Portfolio Total P/L by Instrument Contract

Return to Overview

About

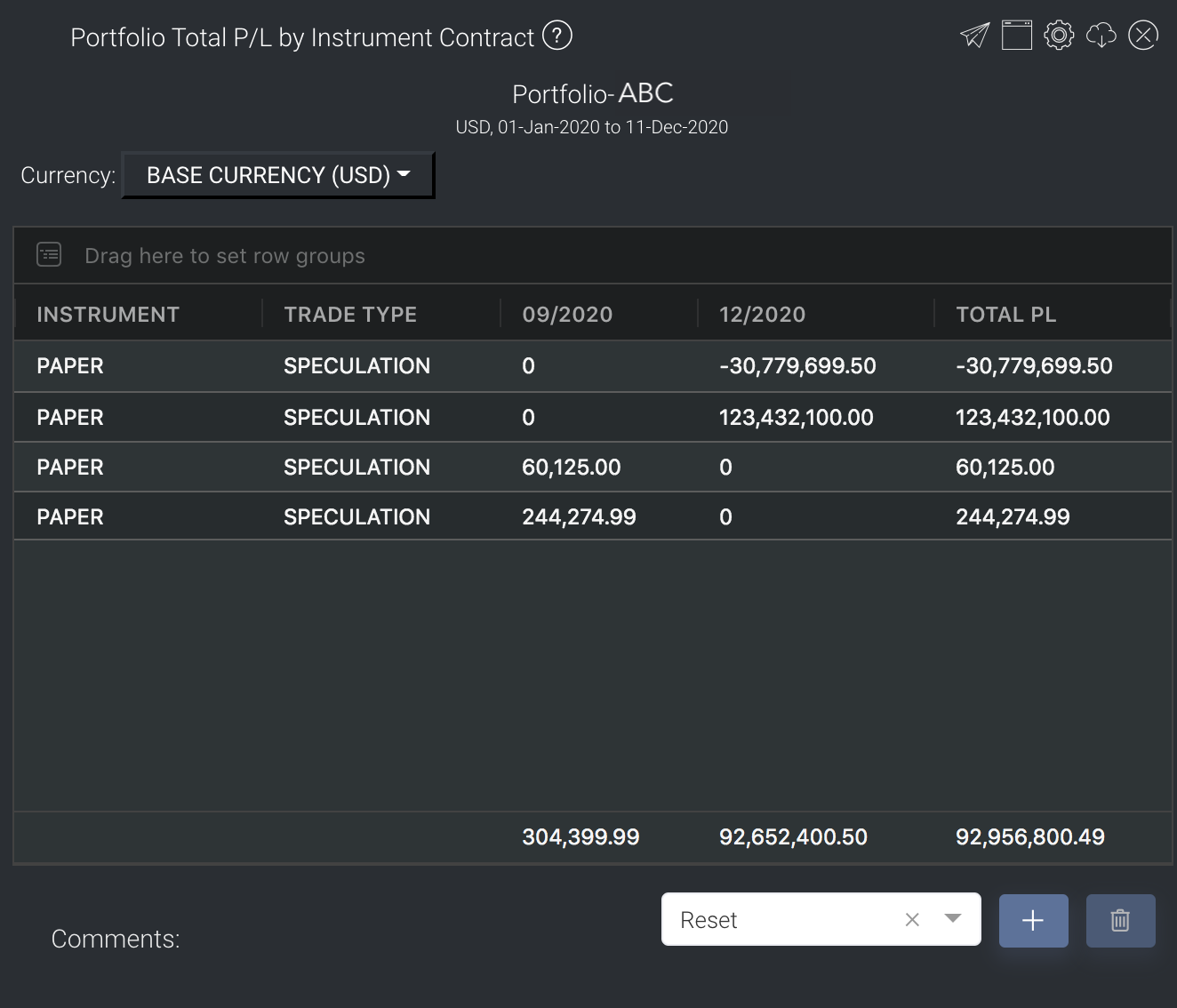

The Portfolio Total P/L by Instrument Contract Matrix allows you to view, at a glance, the composition of assets within a portfolio and their financial positions (total P/L), according to their contract month and year - this includes both open and closed positions.

The rows are the various products in the portfolio while the columns indicate product information such as exchange, instrument, P/L based on contract month & contract year and total P/L. The table acts like a pivot table and can be categorised and organised by groups according to your needs.

You can click here to learn how to customise the table by arranging and filtering the columns based on your preference, and saving the table layout(s) as a template.

Also see Futures Contracts Codes for more information on exchange and month codes, if required.

Navigation

To access the quantitative model/report, click on 'Dashboard' from the navigation sidebar on the left.

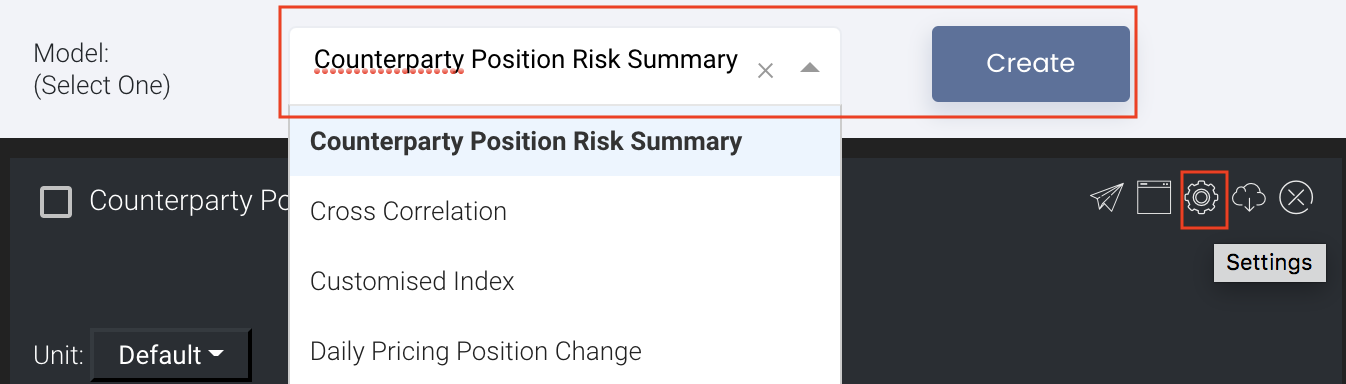

Select the model/report from the drop-down list and click 'Create'. Click on the 'Settings' button (gear icon) at the top right corner of the model to set up your model/report.

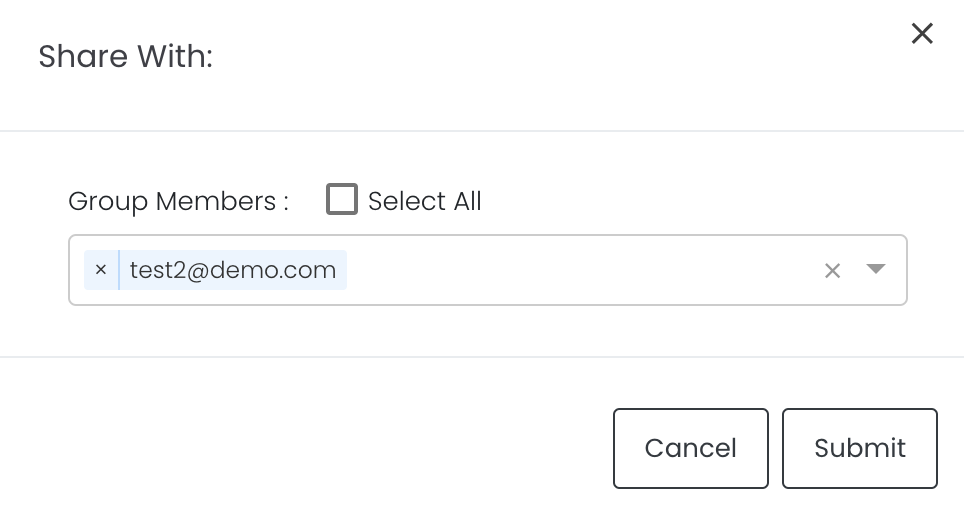

Sharing Model/Report/Dashboard

To share the model with your group members, click on the "Share" button next to the Title of the model followed by the email address of the group members you want to share it with. Once submitted, the model will appear in the Dashboard>Group Dashboard of the selected group members.

This is different from sharing individual or entire Dashboard models/reports, which allows any user who may or may not be users of MAF Cloud to access the individual model/entire dashboard via the shared web link (link will expire in 8 hours). In Group Dashboard, only group members can access the shared models/reports.

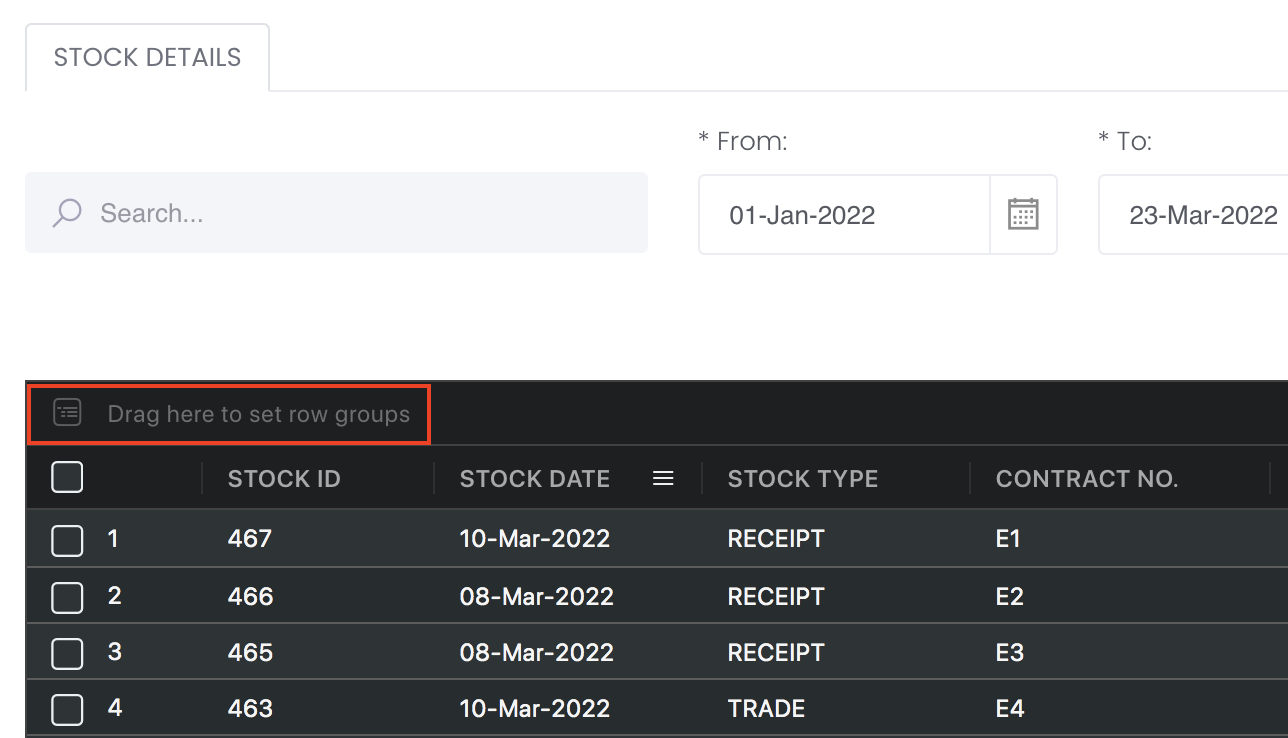

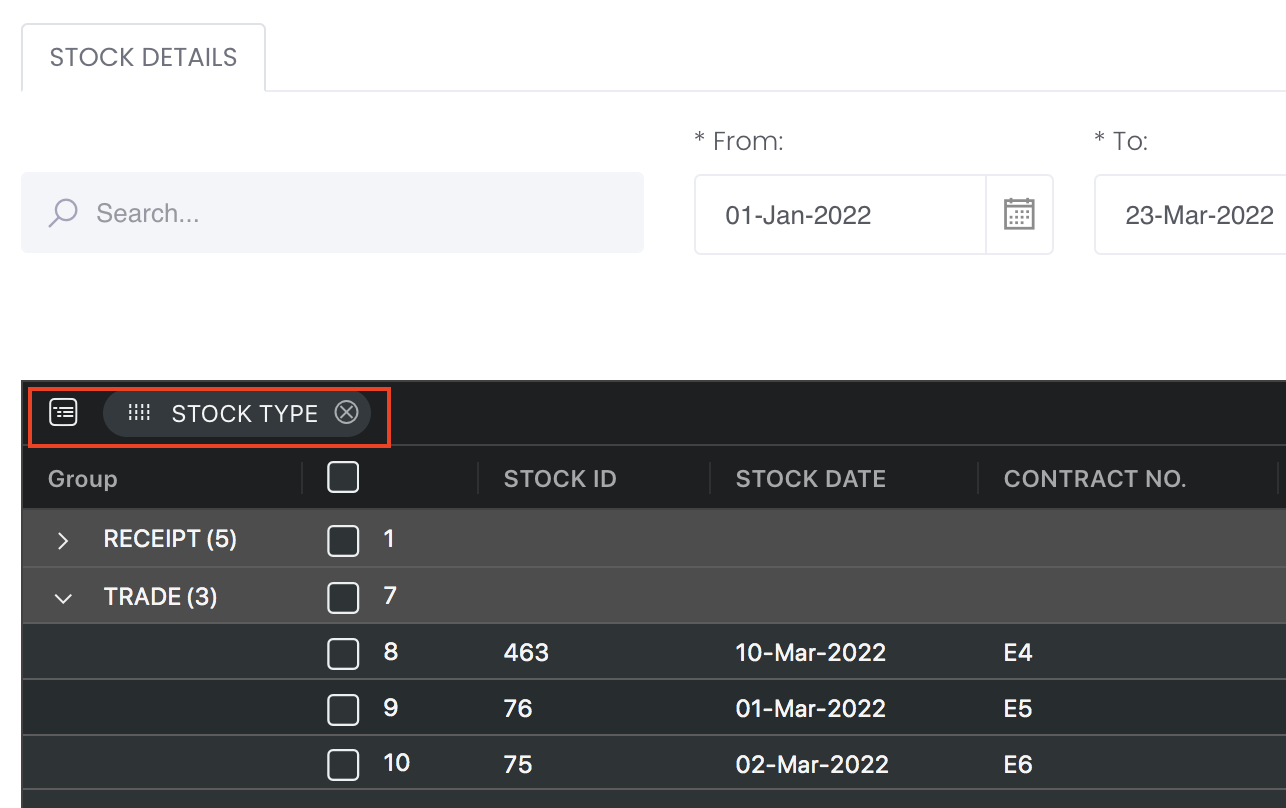

Group Rows

You may also group the rows (liken to the pivot table function in Microsoft Excel) to view the grouped data by dragging any column headers into the “row groups” section as highlighted:

Guide

Name | Images/Description |

|---|---|

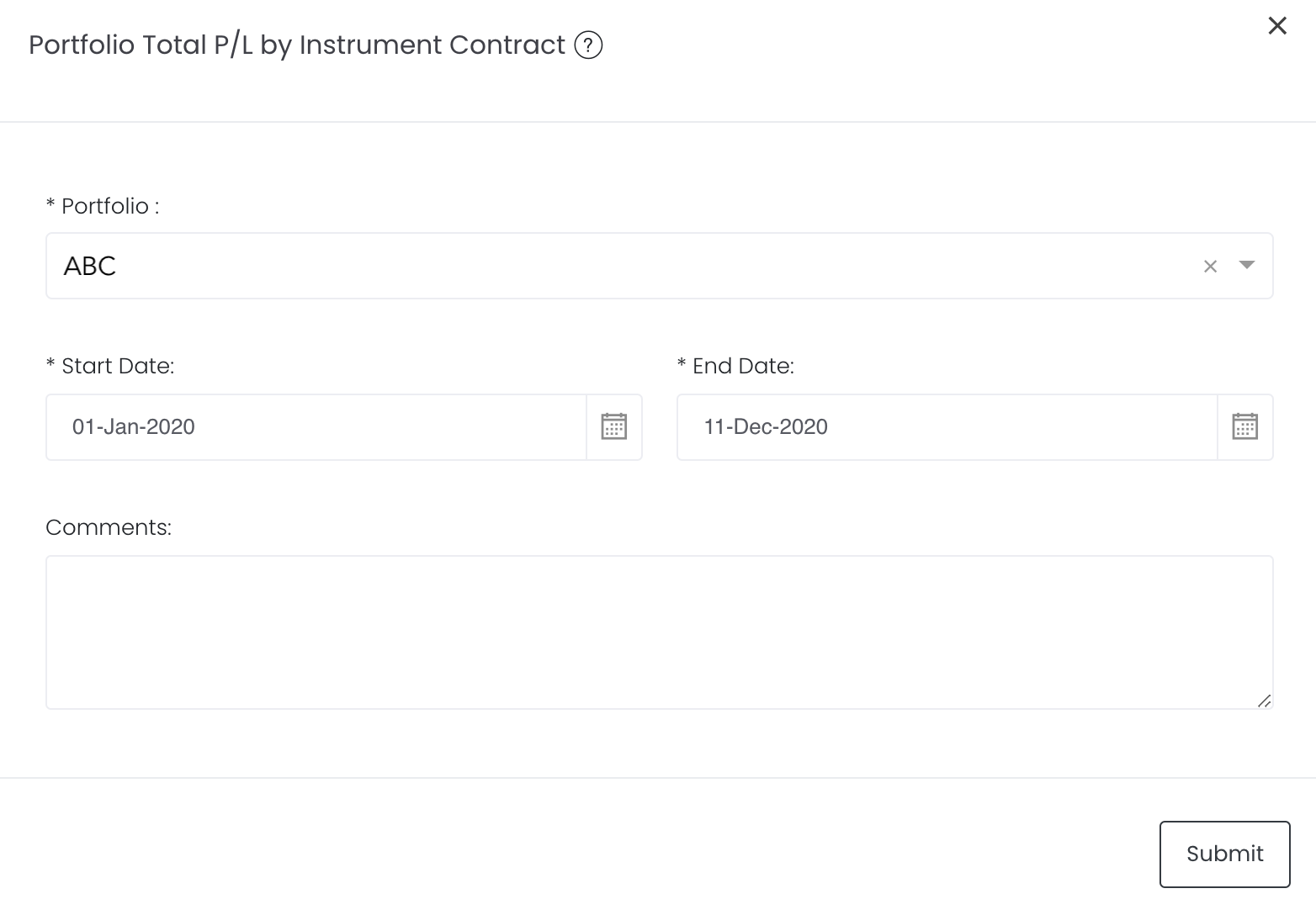

Portfolio | Select a portfolio of interest. |

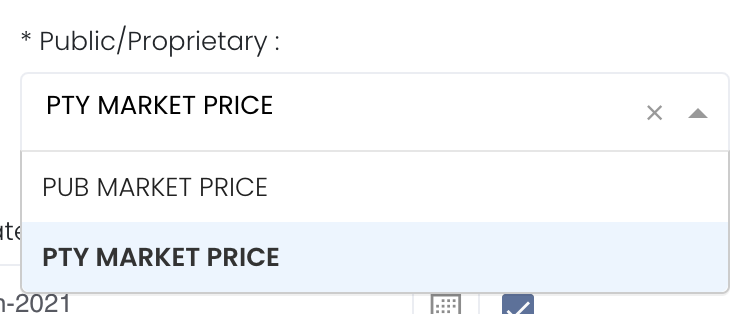

Select public market data or proprietary market data to determine the market data prices used to calculate the P/L or positions accordingly. Please note that if the proprietary (private) market data for certain dates are not input here eg 1 May to 10 May price is input but not 9 May, when you select private data when viewing the portfolio and using the models in Dashboard (eg for trades with trade date on 9 May but private data is not available), the system will use the latest date's settlement price (10 May) to perform the calculations. | |

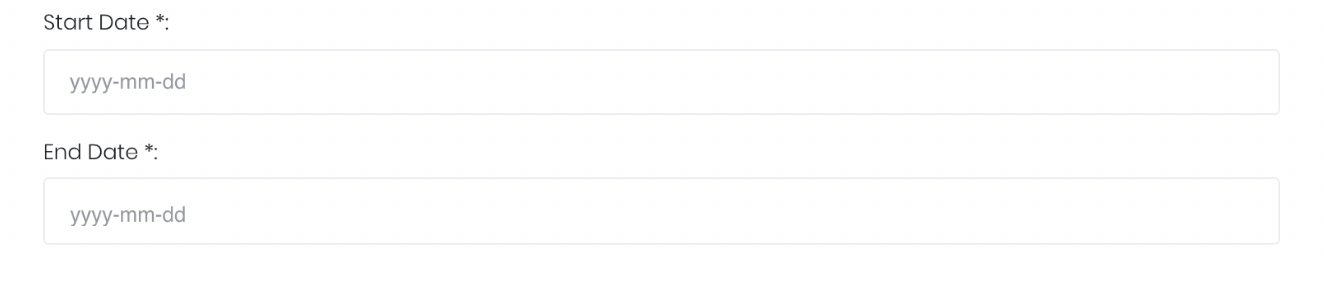

Duration | Select the start and end date to determine the range of period and cut-off date for the calculations of P/L. Start Date will be the start of the year (eg 1 Jan 2020) by default. End Date will be today's date by default. You are free to edit the dates as necessary. |

Comments | The inserted comments will be displayed at the bottom of the application. This can be useful for documentation purposes or for settings description. |

Input

Name | Description | Type | Example |

|---|---|---|---|

| Portfolio | Portfolio selected. | Portfolio (Selection) | ABC |

| Start Date | Start of product time-series. | Date (YYYY-MM-DD) | 2015-06-01 |

| End Date | End of product time-series. | Date (YYYY-MM-DD) | 2019-06-14 |

| Auto Update | Tick: Resets the dates to default once you leave the ‘Dashboard’ page. Untick: Dates according to your settings remain unchanged once you leave the ‘Dashboard’ page. | Checkbox | - |

| Comments | Useful for documentation purposes or for settings description. | Text | - |

Output

Description | Type | |

|---|---|---|

Product/Strategy Information | The details of product(s) are indicated in the columns: product code, exchange, product name, instrument, trade type, currency, exchange rate, P/L based on contract month & contract year of product, and total P/L. You can reorganise your data by dragging-and-dropping the columns at the top of the table to 'set row groups'. | Text |

| Currency | Select from the 'Currency' drop-down list: BASE CURRENCY (USD): P/L will be auto-converted from the original currency (based on the exchange rate displayed in the 'ORIGINAL CURRENCY' table) into USD. ORIGINAL CURRENCY: P/L will be displayed in the original currency (eg CNY). |

Example

Functionality

- Currency Selection: Users may choose the currency (base or original) in which the positions are to be displayed.

Please refer to Table Settings for table functionalities.

Definition of Terms

Please refer to List of Definitions: Trades.

Click to access: