List of Definitions: Trades

eThis page provides a list of definitions, for any table items related to 'Trades' that you may encounter in MAF Cloud. You can use Ctrl + F and key in keyword to find the definitions.

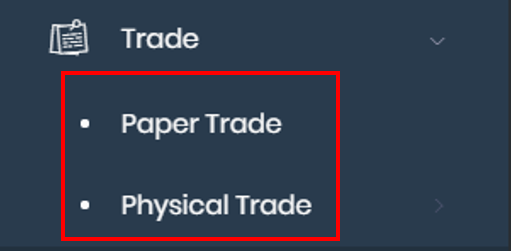

Paper & Physical Trades Main Page

Under 'Trade' in the navigation sidebar on the left, click 'Paper Trade' or 'Physical Trade'.

This table is also applicable to 'Trades' shown in Viewing Portfolio Details.

PAPER TRADES

PAPER TRADES & ALL TRADES TAB

Type | Description | Example |

|---|---|---|

| Trade ID | Unique ID tagged to each trade, auto-generated by system | 123 |

| Portfolio Name | Portfolio the trade is allocated to, if any | - |

Trade Date | Date on which trade was created | |

| Link ID | If the trade was created from a Grouping procedure, it will have a Link ID for that Group (Please refer to Managing Paper Trades for more information). | 25 |

| Category | Category of product | Copper |

| Instrument | Type of financial instrument | Paper |

Exchange | Exchange which the product is traded in | ICEUS |

| Product Code | Product code of the product | - |

Product Name | Name of product | Sugar |

| MAF Product ID | Exchange and Contract Code (separated by "/") | ICEUS/KC |

Buy/Sell | Buying or selling | Buy |

Size | Number of units (eg. lots) of product traded | 2 |

| Trade Type |

| Hedge |

Valuation Date | Date of maturity (for "Forward" trade contracts) | 2019-04-30 |

Contract Month | Month of contract (for "Futures" product type) | July |

Contract Year | Year of contract (for "Futures" product type) | 2019 |

Price | Price at which the trade was made | 97.9 |

| Trade Value | Trade amount (price * quantity) | 10,000 |

| Currency | Currency of the trade | USD |

Account | Account of trade contract | J000996A |

| Trader | Name of trader | Trader 1 |

Broker | Name of broker | CIMB |

Link Physical Trade | If the paper trade is related to one of the user's physical trades (eg. if the paper trade is a hedge for a physical trade), he/she may choose to link them by inserting the physical trade's ID here for easier reference. | t5437 |

System No. | Trade number auto-generated by system | - |

| Remarks | Any additional comments | - |

| Commission | Commission paid by user to the broker | 12.3 |

| Commission Currency | Currency in which commission is paid | USD |

AUTO TRADES CAPTURE TAB

| Type | Description | Example |

|---|---|---|

| Broker | Name of broker | CIMB |

| Account | Name of account with Broker | 123456 |

| Portfolio Name | Name of portfolio (in MAF Cloud) to capture and store the paper trades data from the email via STP (select from drop-down list) | ABC |

| Portfolio ID | Unique Portfolio ID tagged to each portfolio, auto-generated by system | 450 |

| Password | Password to open the excel spreadsheet in your email, if any | abc123 |

PHYSICAL TRADES

TRADES TAB

CREATE & VIEW PHYSICAL TRADES

| Type | Description | Example |

|---|---|---|

General Information | ||

| Trade ID | Unique Trade ID tagged to each trade, auto-generated by system | 528 |

| Deal ID | Unique Deal ID tagged to each portfolio, auto-generated by system | 390 |

| Deal No. | Deal number of the trade | MAF2001 |

| Contract No. | Contract number of the trade | 545 |

| Contract Type | Spot: Buying or selling a commodity for immediate settlement on the spot date, which is normally two business days after the trade date Term: Buying or selling a commodity for settlement at a specified time in the future. | Spot |

| Trader | Name of trader | Max |

| Counterparty Ref No. | Counterparty reference number | REF-2001 |

| Term Contract Details | ||

| Term Contract No. | Contract number for the term trade. Once you input "TERM NO." in 'Term Details' table, you can select your 'Term Contract No.' from the drop-down list. | 520 |

| Term Contract ID | Each trade has a unique Term Contract ID, auto generated by system once you selected the Term Contract No. | 392 |

| Entity of Contract | Company name (whom the contract belongs to) | Samsung |

| Purchase/Sale | Purchase: Buy Sale: Sell | Purchase |

| Party at the other side of the trade | Sony | |

| Product | Type of product that is being traded | Aluminium |

| Specification | Specify the brand, type, etc | 3003 |

| Unit | Unit of trade | Kilogram |

| Total Qty | Total quantity available | 5000 |

| Traded Qty | Quantity that was traded | 4500 |

| Trade Details | ||

| Trade Date | Date of trade, today's date is the default value | |

| Entity of Contract | Company name (whom the contract belongs to) | Shell |

| Purchase/Sale | Purchase: Buy Sale: Sell | |

| Counterparty | Party at the other side of the trade | Sony |

| Trade No. | Contract number for the trade | 437 |

| Product | Type of product that is traded | Petroleum |

| Specification | Specify the brand, type, etc | Gasoline |

| Quantity + Tolerance | Quantity that is being traded and the tolerance for it (+/- value) | 100, 1% |

| Range | Range of the quantity, given the percentage of tolerance | 99 - 101 |

| Unit | Unit of trade | Kilogram |

| Option | ||

| Pricing Description | Any other additional pricing information | - |

| Unit Conversion | Option to convert from one unit to another | Metric ton to kilogram |

| Conversion Factor | A multiplier to convert from one unit to another | 1000 |

| To Unit | The desired unit you wish for the original unit to be converted to | Kilogram |

| Converted Unit | Updated converted amount of the desired unit | 1,000,000 |

| Payment Details | ||

| Settlement Currency | Currency used to settle the trade | USD |

| Credit Term | Terms which indicate when payment is due for sales made on account (or credit) | 2/10 net 30 |

| Payment Term | Terms of payment | TT |

| Days | 3 | |

| Other Details | ||

| Incoterm | Pre-defined commercial terms that define the responsibilities of buyers and sellers for the sale of goods in international transactions | CIF |

| Port/Country | Country/port at which trade is taking place | Nanjing/China |

| Laycan Period | Earliest and latest time of laycan period at which laytime can commence, beyond which the charterer can opt to cancel the charter | 1 Nov to 2 Nov 2020 |

| Shipping Month/Year | Shipping month and year | Jan-2021 |

| Laytime (Hours) | Time given for the vessel to load/unload | 14 |

| Ext | Extended hours, if any | 6 |

| Demurrage | Payable charge if the owner of the ship fails to load/unload within given time frame | USD 75 |

| GT&C | ||

| Law/Arb | ||

| Inspection | ||

| Q+Q | ||

| Remarks | Any additional comments | - |

| Benchmark Index(es) | Use financial instrument(s) as an index to benchmark the pricing of your trades | - |

| Premium/Discount | Set a premium or discount to your benchmark index/MTM | - |

| MTM | Use financial instrument(s) as an index to mark-to-market the pricing of your trades | - |

| Quantity | Quantity of your trade, auto-filled in when you input 'Quantity + Tolerance' in previous page | 2000 |

| Outstanding Quantity | Outstanding quantity of trade which are un-settled (either no title transfer date or title transfer date is after today’s date) | 90 |

| Converted Quantity | New converted quantity after applying 'Unit Conversion' tool | 2,000,000 |

| Pricing Type: Fix | Price: Fixed price of your trade Currency: Currency of your trade, auto-filled in when you input 'Settlement Currency' in previous page Unit: Unit of your trade, auto-filled in when you input 'Unit' in previous page | $1,000 USD Metric Ton |

| Pricing Type: Float/Average | Pricing Period: Pricing Period of your trade Financial Instrument(s): Financial instrument/product (forward products) you use to benchmark/MTM your trade Contract Term: Valuation Date only for forward products Quantity: Quantity of your trade(s), which should add up to the total 'Quantity' at the top left of the page |

- Lead 3M 5,000 |

| Pricing Type: WMA | Month: Contract month of your trade Year: Contract year of your trade Last Trading Day: Last trading day of your trade Financial Instrument(s): Financial instrument/product (futures products) you use to benchmark/MTM your trade Contract Term: Month & Year only for futures products Quantity: Quantity of your trade(s), which should add up to the total 'Quantity' at the top left of the page | Jan 2020 31 Nov 2020 Zinc 1, 2020 3,000 |

| Pricing Type: Spot | Financial Instrument: Financial instrument/product ("3M Rolling" products) you use to benchmark/MTM your trade Quantity: Quantity of your trade(s), which should add up to the total 'Quantity' at the top left of the page | Lead 3M Rolling 4,000 |

PHYSICAL TRADES EXECUTION TABLE

| Type | Description | Example |

|---|---|---|

| Actions | Provides more physical trade execution of the trade

| |

| Execution ID | Unique Execution ID tagged to each portfolio, auto-generated by system | 382 |

| Execution No. | Execution number of the physical trade execution | 285 |

| Trade ID | Unique Trade ID tagged to each portfolio, auto-generated by system | 382 |

| Contract No. | Contract number of the trade | MAF2001-P |

| Counterparty Ref No. | Counterparty reference number | REF-2001 |

| Counterparty | Party at the other side of the trade | BP |

| Product | Type of product that is being traded | Oil |

| Specification | Specify the brand, type, etc | SPEC |

| Delivery Term | Inco term + Port/Country | FOB Singapore |

| Credit Term | Terms which indicate when payment is due for sales made on account (or credit) | Credit Term |

| Status | Status of the execution | In progress |

| Storage | Name of storage | Storage A |

| Vessel/Voyage | Name of the vessel | Oceania |

| BL No. | Bill of lading number | BL2020-01 |

| Laycan Start | Earliest time of laycan period | |

| Laycan End | End time of laycan period at which laytime can commence, beyond which the charterer can opt to cancel the charter | |

| LoadPort | Name of port of loading | Shanghai |

| LoadPort Agent | Oversees and coordinates all aspects of the port | COX |

| LoadPort Surveyor | Person who inspects the vessel | Ken |

| LoadPort ETA/NOR | Estimated time of arrival at port | 10am |

| LoadPort ETB/All Fast | Estimated time of berthing |

10:30am |

| LoadPort ETC/COL/COD | Estimated time of completion |

8am |

| ETD | Estimated time of delivery | 12-Jan-2014 00:00 |

| Disport | Name of port of discharge | |

| Disport Agent | ||

| Disport Surveyor | ||

| Disport ETA/NOR | 15-Jan-2014 00:00 | |

| Disport ETB/All Fast | 16-Jan-2014 00:00 | |

| Disport ETC/COD | 12-Feb-2014 00:00 | |

| BL Date | Bill of lading date | |

| Title Transfer Date | Date when title of goods are transferred | |

| Payment Date | Date at which payment will be made | |

| DP/LC Sub Date | Document against Payment or Letter of Credit submission date | 31 Dec 2020 |

| Pricing Start | Start date of pricing | |

| Pricing End | End date of pricing | |

| Estimated Price | Price at which actual price is not confirmed yet. System will use Estimated Price to perform calculations in portfolio if Actual Price is not input yet. If Actual Price has been input, Actual price will auto replace Estimated Price in performing calculations | $988 |

| Premium | Premium at which trade is traded at. | $1 |

| Actual Price | Price at which the actual quantity was traded for. | $1,000 |

| Provisional Quantity | Quantity that was agreed upon initially but actual quantity is not finalised yet | 5,000 |

| Provisional Price | Price at which was agreed upon initially but actual price is not finalised yet | $1,000 |

| Provisional Value | Price at which was agreed upon initially but actual trade value is not finalised yet (Provisional Quantity * Provisional Price) | $5,000,000 |

| Gross Quantity | Gross quantity that was traded | 2,000 |

| Actual Quantity | Actual quantity that was traded | 2,001.87 |

| Price Unit | Price per unit (Metric Ton) | USD/Metric Ton |

| Converted Actual Quantity | New converted actual quantity after applying 'Unit Conversion' tool | 1 Metric Ton to 1,000 Kilogram |

| Final Price | Sum of actual prices of all 'Pricing Blocks', including 'Benchmark' and 'Premium/Discount' values | $1,000 |

| Final Value | Final trade value (Final Price * Actual Quantity) | $2,001,000.87 |

| Exchange Rate | Exchange rate at which trade was traded for | 0.1566 |

| Custom Tax Rate | Custom tax rate include in trade | 10% |

| Demurrage Rate | Rate at which the owner of the vessel will be charged for surpassing the laycan period | $75 |

| Demurrage Ref Date | Date at which demurrage rate was confirmed | |

| Full Claim Days | No. of days after Timebar Reference Date that full claim must be made | 5 |

| Full Claim Timebar | Last day to make full payment of claims to claimee | |

| Notification Days | No. of days after Timebar Reference Date that timebar will expire | 5 |

| Notification Timebar | Last day to issue notification/send claim to claimee | |

| Date at which the claim was confirmed | ||

| Number of days for Q&Q claims | 3 | |

| A contract deadline to follow | ||

| Remarks | Any additional comments | - |

DEALS TAB

| Type | Description | Example |

|---|---|---|

| Deal ID | Unique Deal ID tagged to each portfolio, auto-generated by system | 472 |

| Deal No | Deal number of the trade | MAF2001 |

| Product | Type of product that is being traded | Aluminium |

| Specification | Specify the brand, type, etc | 3003 |

| Outstanding Quantity | Outstanding quantity indicates that the trade is un-settled (either no title transfer date or title transfer date is after today’s date) | 10,000 |

| Unit | Unit of trade | Metric Tons |

| Currency | Currency of trade | Yen |

| Realised P/L | Profit & loss value from completed transactions | 5,000 |

| Unrealised P/L | Profit & loss value from relevant but uncompleted transactions | 3,200 |

| Commission | Commission paid to broker | $200 |

| Total P/L | Sum of Realised P/L and Unrealised P/L | $8,200 |

| Created By | User who creates the data | Max |

| Created On | Date/Time when data was created | |

| Last Updated By | User who last updated the data | Lydia |

| Last Updated | Date/Time when data was last updated |

PHYSICAL TRADES LIST

| Type | Description | Example |

|---|---|---|

Trade ID | Unique Trade ID tagged to each portfolio, auto-generated by system | 382 |

| Deal ID | Unique Deal ID tagged to each portfolio, auto-generated by system | 128 |

| Deal No | Deal number of the trade | MAF2001 |

| Contract No | Contract number of the trade | MAF2001-P |

| Contract Type | Spot contracts usually occur immediately while term contracts continue for a longer period of time | SPOT/TERM |

| Trader | Name of trader | James |

| Trade Date | Date the trade was made |

|

| Entity of Contract | Company name (whom the contract belongs to) | Shell |

| Purchase/Sale | Whether the contract was a purchase or sale | Purchase |

| Counterparty | Party at the other side of the trade | BP |

| Product | Type of product that is being traded | Oil |

| Specification | Specify the brand, type, etc | Petroleum |

| Quantity | Quantity of the product that was traded | 100,000 |

| Outstanding Quantity | Outstanding quantity indicates that the trade is un-settled (either no title transfer date or title transfer date is after today’s date) | 10,000 |

| Unit | Unit of the amount traded | Metric Tons |

| Option | ||

| Pricing Description | Any other additional pricing information | - |

| Settlement Currency | Currency that the trade was settled in | USD |

| Credit Term | Terms which indicate when payment is due for sales made on account (or credit) | 2/10 net 30 |

| Payment Term/Days | Terms of payment | TT |

| Incoterm | Pre-defined commercial terms that define the responsibilities of buyers and sellers for the sale of goods in international transactions | CIF |

| Port/Country | Country/port at which trade is taking place | Nanjing/China |

| Laycan Start | Earliest time of laycan period | |

| Laycan End | End time of laycan period at which laytime can commence, beyond which the charterer can opt to cancel the charter | |

| Laytime/Ext | Time given to vessel to load/unload | 12 Hours |

| Created By | User who creates the data | Bob |

| Created on | Date/Time when data was created |

TERM DETAILS TAB

| Type | Description | Example |

|---|---|---|

| Term ID | Unique Term ID tagged to each portfolio, auto-generated by system | 428 |

| Term No | Term number of the trade | MAF2001-P |

| Entity of Contract | Company name (whom the contract belongs to) | Dell |

| Purchase/Sale | Whether the contract was a purchase or sale | Purchase |

| Counterparty | Party at the other side of the trade | Hewlett-Packard |

| Product | Type of product that is being traded | Steel |

| Specification | Specify the brand, type, etc | Carbon |

| Total Quantity | Total quantity to be fulfilled according to the contract | 20,000 |

| Traded Quantity | Quantity fulfilled so far | 17,000 |

| Outstanding Quantity | Outstanding quantity not fulfilled yet ('TOTAL QTY'-'TRADED QTY') | 3,000 |

| Unit | Unit at which the goods are being traded | Metric Tons |

| Incoterm | Pre-defined commercial terms that define the responsibilities of buyers and sellers for the sale of goods in international transactions | CIF |

| Port | Port at which the trade is taking place | Singapore |

| Payment Term | Terms of payment | TT |

| Remarks | Additional information | - |

| Created By | User who creates the data | Anne |

| Created On | Date/Time when data was created | |

| Last Updated By | User who last updated the data | Bob |

| Last Updated On | Date the data was last updated on |

SHIPPING INSTRUCTION

| Type | Description | Example |

|---|---|---|

| SI ID | Unique Term ID tagged to each shipping instruction, auto-generated by system | 11 |

| Date | Date shipping instruction is established | 19-Mar-2020 |

| SI No. | Shipping Instruction Number | PNS2I-011 |

| Contract No. | Contract Number | PB13112 |

| Shipper | Company that ships the goods | PT Prasidha-SAQ |

| Freight | Provides more details on whether the payment mode is Prepaid/Collect/Elsewhere | Collect |

| Freight Payable | Provides more details on how the payment for freight is made | Payable by FMS in Singapore |

| Consignee | Receiver of shipment | Company ABC |

| NotifyParty | Contact person to be notified when the shipment arrives at destination | Company ABC |

| Qty | Total quantity to be shipped | 50,000 |

| Unit | Unit at which the goods are being shipped | Metric Tons |

| Remarks | Any additional comments | |

| Created by | User who creates the data | Max |

| Created on | Date/Time when data was created | 17-Feb-2019 |

| Last Updated by | User who last updated the data | Lydia |

| Last Updated | Date the data was last updated on | 17-Jun-2019 |

INVENTORY TAB

| Type | Description | Example |

|---|---|---|

| Deal ID | Unique Deal ID tagged to each portfolio, auto-generated by system | 763 |

| Deal No | Deal number of trade | MAF2001 |

| Outstanding Quantity | Outstanding/Remaining quantity of the trade, yet to be purchased/sold | 33,400 |

| Unit | Unit of trade | Kilogram |

| Currency | Currency of trade | Yen |

| Realised P/L | Amount of profit/loss that has been converted to cash | +10,000 |

| Unrealised P/L | Potential profit/loss that is on paper but has yet to be converted to cash | +15,000 |

| Commission | Commission paid by user to the broker | 15 |

| Total P/L | Total amount of profit/loss from realised and unrealised profit/loss | 25,000 |

| Created By | User who creates the data | Alex |

| Created On | Date/Time when data was created | |

| Last Updated By | User who last updated the data | Brad |

| Last Updated On | Date the data was last updated on |

STORAGE SETTINGS TAB

| Type | Description | Example |

|---|---|---|

| Storage ID | Unique Storage ID tagged to each portfolio, auto-generated by system | 75 |

| Storage Name | Name of the storage space you will be keeping your inventory in | Storage A |

| Storage Location | Where the storage space is located at | Building A |

| Storage Owner | Who owns the storage space | Samsung |

| Capacity | Amount of storage space that is available | 5,000 |

| Unit | Unit of trade | Kilogram |

| Settlement Currency | Currency used to settle the trade | USD |

| Created By | User who creates the data | Trish |

| Created On | Date/Time when data was created | |

| Last Modified By | User who last updated the data | Alex |

| Last Modified On | Date the data was last updated on |

EXPENSES AND INCOMES

Deal/Trade Level

| Type | Description | Example |

|---|---|---|

| Trade ID | Unique ID tagged to each trade, auto-generated by system | 123 |

| Trade Date | Date on which trade was created | 01-Jan-2021 |

| Ref Type | Identify the type of transaction (PS: Purchase/Sale, EXP/INC: Expense/Income) | PS |

| Deal ID | Unique Deal ID tagged to each portfolio, auto-generated by system | 763 |

| Deal No. | Deal number of trade | MAF2001 |

| Contract No. | Contract number of the trade | 545 |

| Execution No. | Execution number of the physical trade execution | 285 |

| EXP/INC Description | Provides more details about the expense or income transaction | PURCHASE-1 |

| Entity of Contract | Company name (whom the contract belongs to) | Dell |

| Counterparty | Party at the other side of the trade | MAF |

| Category | Category of product | Copper |

| Trader | Name of trader | Mark |

| Credit/Debit | An expense entry will be considered a debit, an income entry will be considered a credit | Debit |

| Traded Quantity | Quantity that was traded | 4500 |

| Unit | Unit of trade | Metric Ton |

| Unit Price | Price per unit | 1.00 |

| Currency/Unit | Currency used to pay per unit | USD/CNY |

| Currency | Currency paid for the trade | USD |

| Amount | Value of the amount | 200.0 |

| Remarks | Any additional comments | |

| Created By | User who creates the data | Max |

| Created On | Date/Time when data was created | 03-Feb-2019 |

| Last Updated By | User who last updated the data | Lydia |

| Last Updated | Date/Time when data was last updated | 17-Jun-2019 |

Portfolio Level

| Type | Description | Example |

|---|---|---|

| Trade Date | Date on which trade was created | 01-Jan-2021 |

| Ref Type | Identify the type of transaction (PS: Purchase/Sale, EXP/INC: Expense/Income) | EXP/INC |

| Ref ID | Reference Number | 193 |

| Portfolio Name | Portfolio the trade is allocated to, if any | |

| EXP/INC Description | Provides more details about the expense or income transaction | DES |

| Entity of Contract | Company name (whom the contract belongs to) | Dell |

| Counterparty | Party at the other side of the trade | Hewlett-Packard |

| Credit/Debit | An expense entry will be considered a debit, an income entry will be considered a credit | Debit |

| Traded Quantity | Quantity that was traded | 4500 |

| Unit | Unit of trade | Metric Ton |

| Unit Price | Price per unit | 1.00 |

| Currency/Unit | Currency used to pay per unit | USD/CNY |

| Currency | Currency paid for the trade | USD |

| Amount | Value of the amount | 200.0 |

| Remarks | Any additional comments | |

| Created By | User who creates the data | Max |

| Created On | Date/Time when data was created | 03-Feb-2019 |

| Last Updated By | User who last updated the data | Lydia |

| Last Updated | Date/Time when data was last updated | 17-Jun-2019 |

*Click here for more information on the Market Data Structure.

PAYMENT RECORDS

Outstanding Payment Records/Settled Payment Records

| Type | Description | Example |

|---|---|---|

| PR ID | Unique ID tagged to each payment record, auto-generated by system | 123 |

| PR Ref No. | Reference Number | 193 |

| PR Title | Title of invoice | Rubber Invoice Sale |

| Contract No. | Contract number of the payment record | ABC-P |

| Issue/Receipt | To issue/receive an invoice from your counterparties | ISSUE |

| PR Des | Description of the invoice | |

| PR Date | Date the invoice is issued | 01-Feb-2018 |

| Due Date | Date when payment is expected | 20-Feb-2019 |

| Self Entity | Company name (whom the invoice belongs to) | Shell |

| Bill To (From) | Counterparty to issue or to receive the invoice | Counterparty ABC |

| Bank A/C | Bank Account of the company (whom the invoice belongs to) | 1111 |

| PR Action | Provides more details on whether the payment is payable or receivable | Payable |

| Balanced Amount | Total invoice amount to be received/paid from/by counterparties. | 1,000.0 |

| Settled Amount | Total amount received/paid from/by counterparties. | 200.0 |

| Oustanding Amount | Total amount not received/paid from/by counterparties | 500.0 |

| CCY | Payment currency | USD |

| Created by | User who creates the data | Max |

| Created on | Date/Time when data was created | 03-Feb-2019 |

| Last Updated by | User who last updated the data | Lydia |

| Last Updated | Date/Time when data was last updated | 17-Jun-2019 |

BULK TRADES UPLOAD

| Type | Description | Example |

|---|---|---|

| Trade Date | Date on which trade was created | 17-07-2021 |

| Deal ID | Unique Deal ID tagged to each portfolio, auto-generated by system | 110 |

| Deal No. | Deal number of the trade | MAF2001 |

| Trader | Name of trader | Serene |

| Trade Mode | Offshore: Domestic China: | Offshore |

| Contract No. | Contract number of the trade | MAF2001-P |

| Execution No. | Execution number of the physical trade execution | 111 |

| Purchase/Sale | Purchase: Buy Sale: Sell | Purchase |

| Entity of Contract | Company name (whom the contract belongs to) | MAF |

| Counterparty | Party at the other side of the trade | MAL |

| Counterparty Ref No. | Counterparty reference number | REF-01 |

| Product | Type of product that is being traded | Copper |

| Spec | Specify the brand, type, etc | 1002 |

| Category | Category of product | Copper |

| Quantity | Quantity that was traded | 1000 |

| Unit | Unit of trade | Metric Ton |

| Deal CCY | Currency of the deal | USD |

| Payment Date | Date at which payment will be made | 17-07-2021 |

| Title Transfer Date | Date when title of goods are transferred | 30-07-2021 |

| Benchmark Pricing | Select financial instrument(s) as an index to benchmark the pricing of your trades | Lead 3M |

| Premium | Set a premium or discount to your benchmark index/MTM | 1 |

| Fixed Price | Fixed/Actual price of the trade | 1000 |

| Fixed Pricing CCY | Currency of the fixed/actual price of the trade | CNY |

| Tax Rate | Tax rate of the fixed/actual price of the trade. Tax rate for WMA/FLOAT/SPOT item will be indicated in the PHYSICAL PRICING SETTING tab instead | 10% |

| MTM Pricing | Select financial instrument(s) as an index to mark-to-market the pricing of your trades | Lead |

| Actual Qty | Actual quantity that was traded | 1000.18 |

| Estimated Price | Price at which actual price is not confirmed yet. System will use Estimated Price to perform calculations in portfolio if Actual Price is not input yet. If Actual Price has been input, Actual price will auto replace Estimated Price in performing calculations | 900 |

| Actual Price | Price at which the actual quantity was traded for. | 1000.22 |

| Exchange Rate | Exchange rate at which trade was traded for | 0.1234 |

| Custom Tax Amount | Custom tax rate include in trade | 10% |

PHYSICAL PRICING SETTING

| Type | Description | Example |

|---|---|---|

| PPS ID | Unique ID tagged to each portfolio, auto-generated by system | 101 |

| Pricing Code | Name/Code of the pricing index as defined by you for bulk uploading of trades. Select this pricing code will auto return/link the associated products for pricing of your benchmark/MTM trade. | LEAD TRADE |

| MAF Product ID | Exchange and Contract Code (separated by "/") | SHFE/SN |

| Pricing Mode | FLOAT/AVERAGE: Select this if you want to use forward financial instrument/products) to benchmark/MTM your trade WMA: Select this if you want to use futures financial instrument/products) to benchmark/MTM your trade SPOT: Financial instrument/product ("3M Rolling" products) you use to benchmark/MTM your trade | LEAD 3M |

| Trade Type | BENCHMARK: Select this to tag the pricing index as a benchmark item POTENTIAL: Select this to tag the pricing index as a MTM item | Benchmark |

| Premium | Set a premium or discount to your benchmark index/MTM | 1 |

| Pricing Start | Start date of pricing | 21-07-2021 |

| Pricing End | End date of pricing | 21-07-2021 |

| Month | Month of contract (for "Futures" product type) | Jan |

| Year | Year of contract (for "Futures" product type) | 2021 |

| Tax Rate | Tax rate included in trade | 10% |

| Created by | User who creates the data | Max |

| Created on | Date/Time when data was created | 03-Feb-2019 |

| Last Updated by | User who last updated the data | Lydia |

| Last Updated | Date/Time when data was last updated | 17-Jun-2019 |

Click to access: