View Portfolio Details

You will be able to view all the details related to your portfolio, such as portfolio information, open/closed positions and trades in this page (additional information about your portfolio, as well as the details of individual positions and trades within your portfolio).

The market data are automatically integrated from various exchange sources and are updated daily to provide the latest figures. All paper and physical trades in each portfolio will be reflected in either the 'Open Positions' or 'Closed Positions', as well as 'Trades'.

To access, click 'Portfolio' from the navigation sidebar on the left, and click 'View Portfolio'.

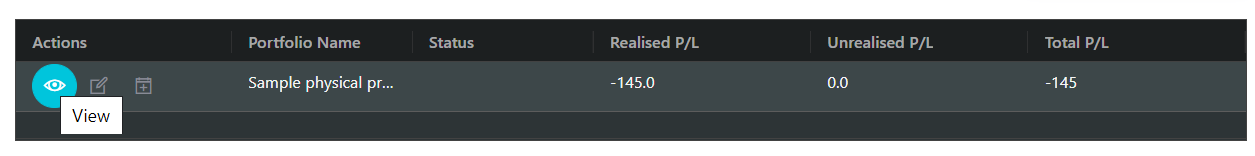

Click 'View' (represented by an 'eye' icon) under 'Actions' of your desired portfolio and you will be directed to a 'View Portfolio Details' page.

TABLE OF CONTENTS:

Portfolio Information

Please refer to List of Definitions: Portfolio Details for more details.

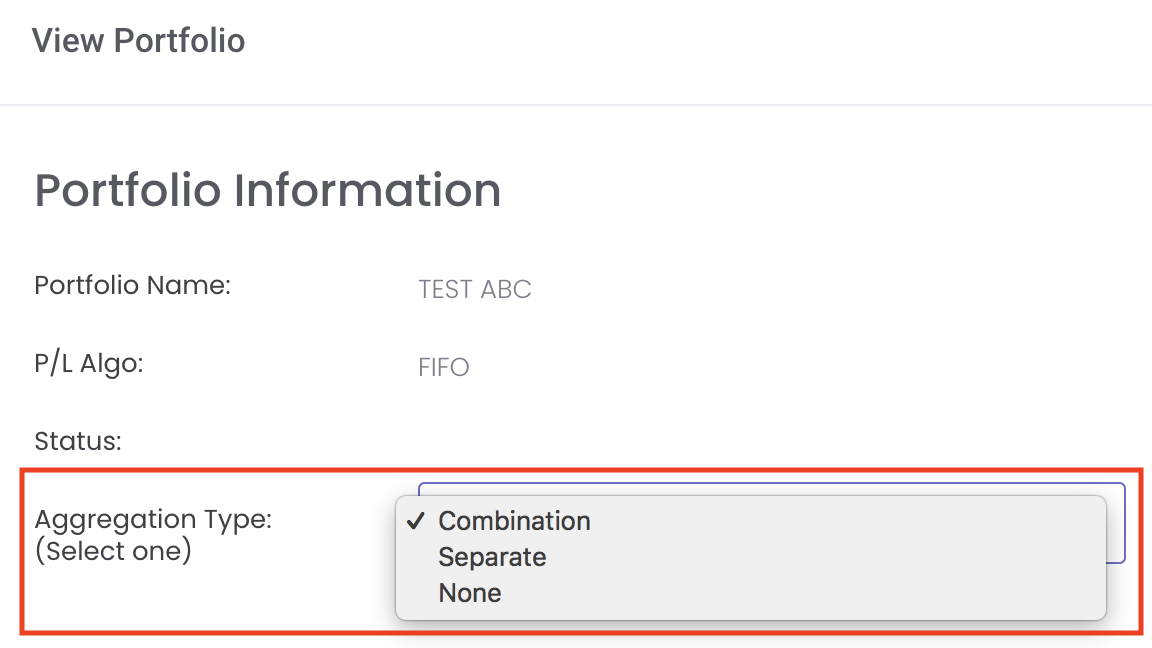

Aggregation Type

- Combination - If this aggregation type is selected, the system will categorise and combine all the trades with the same following details to the position:

- Contract ('Exchange', 'Product Name', 'Contract Code')

- Trade Type ('Benchmark', 'Potential', 'Premium')

- Separate - This is the default setting. If this aggregation type is selected, the system will categorise and combine all the trades with the same following details to the position:

- Contract ('Exchange', 'Product Name', 'Contract Code')

- Trade Type ('Benchmark', 'Potential', 'Premium')

- Account ('Account' is case-insensitive and is one of the elements for grouping trades to position. You can fill in the 'Account' column when creating or editing your paper trades.)

- None - If this aggregation type is selected, the trades will not be categorised and combined, and will be displayed individually.

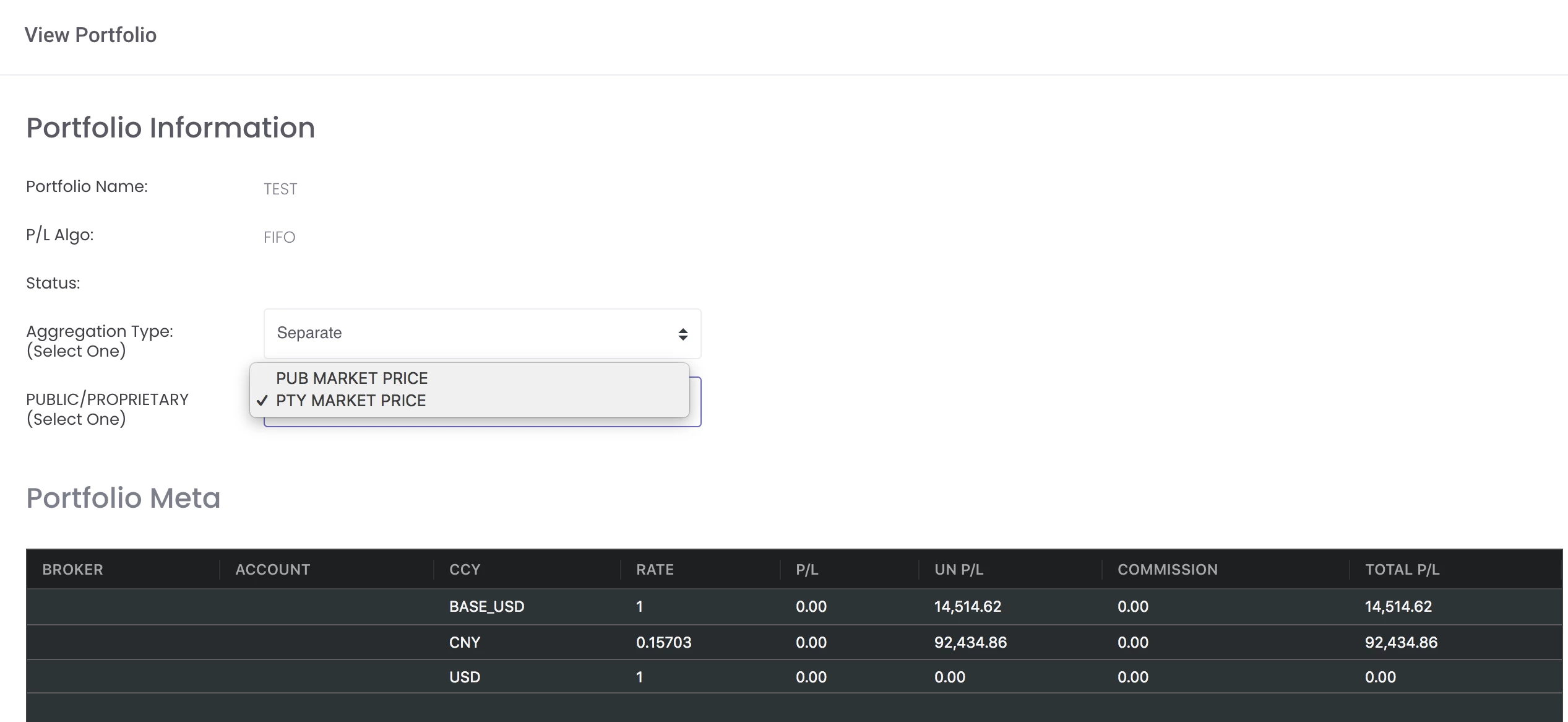

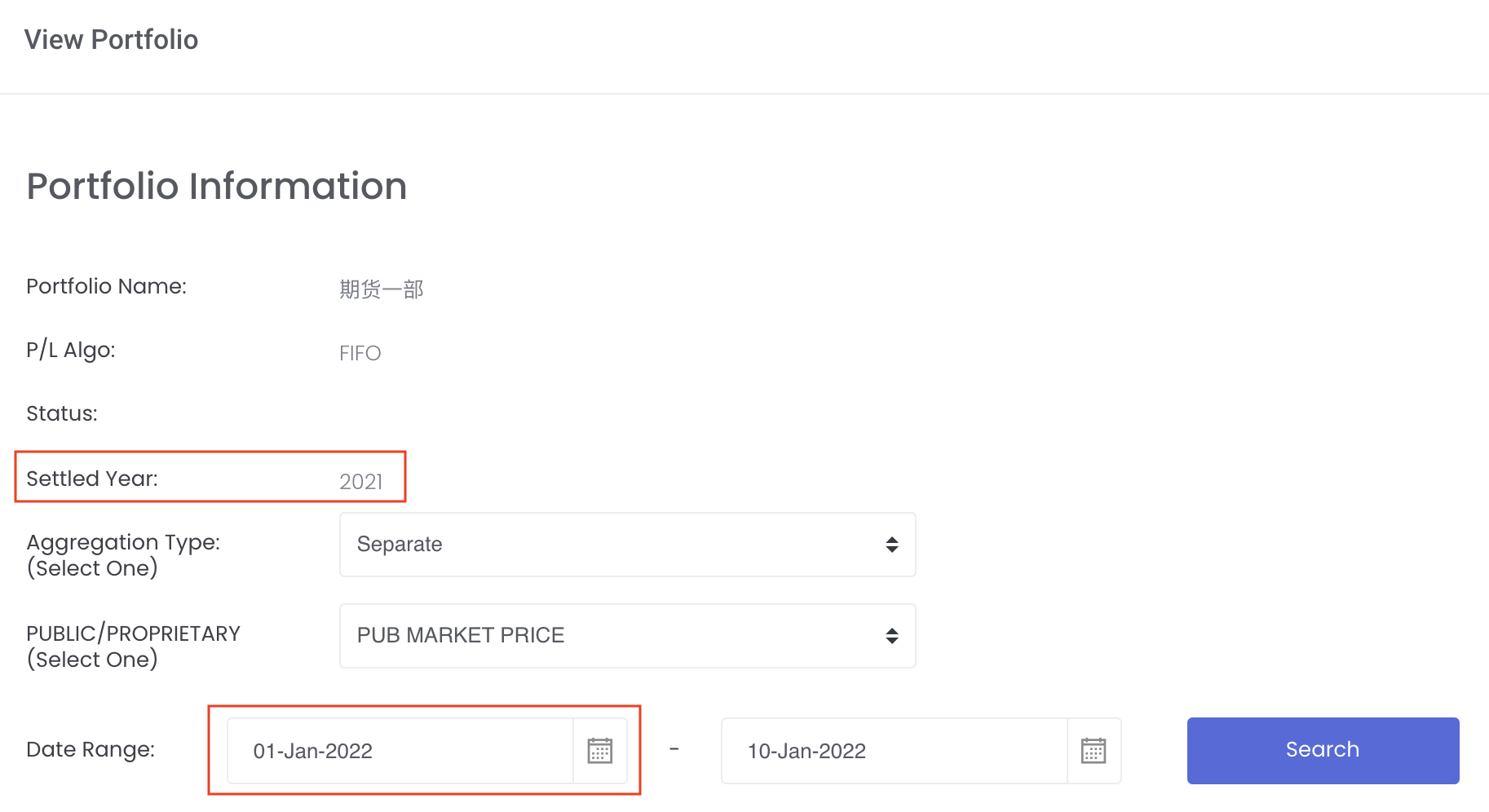

Select Proprietary Market Data or Public Market Data

You may opt to view your portfolio P/L calculations using your proprietary market data prices (private data uploaded) or public market data prices (prices obtained from various Exchanges sources) by selecting from the drop-down list accordingly. This function is also available in certain models in Dashboard; namely, Group P/L Model, Portfolio P/L Details Model, Counterparty Position Risk Summary and Portfolio Total P/L by Instrument Contract.

Please note that if the proprietary (private) market data for certain dates are not input here eg 1 May to 10 May price is input but not 9 May, when you select private data when viewing the portfolio and using the models in Dashboard (eg for trades with trade date on 9 May but private data is not available), the system will use the latest date's settlement price (10 May) to perform the calculations.

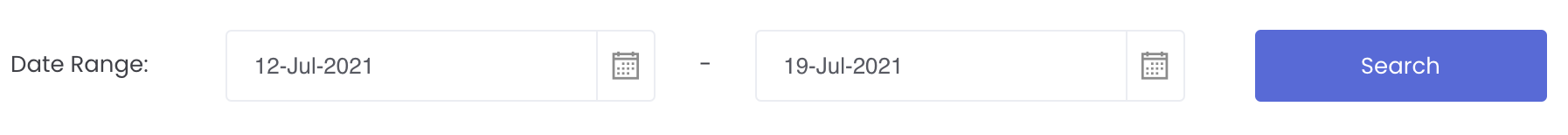

Date Range

Select the date range to display the trades in the all the tables; namely, OPEN POSITIONS, CLOSED POSITIONS and TRADES table accordingly. The end date will be automatically updated as today's date and start date will be 1 week before by default. Fill in your desired date and click 'Search' to display your trades accordingly. So if certain trades are not displayed, you may need to adjust the date range to view them accordingly.

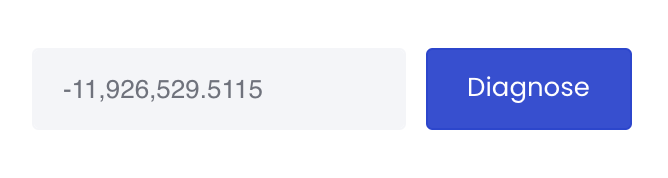

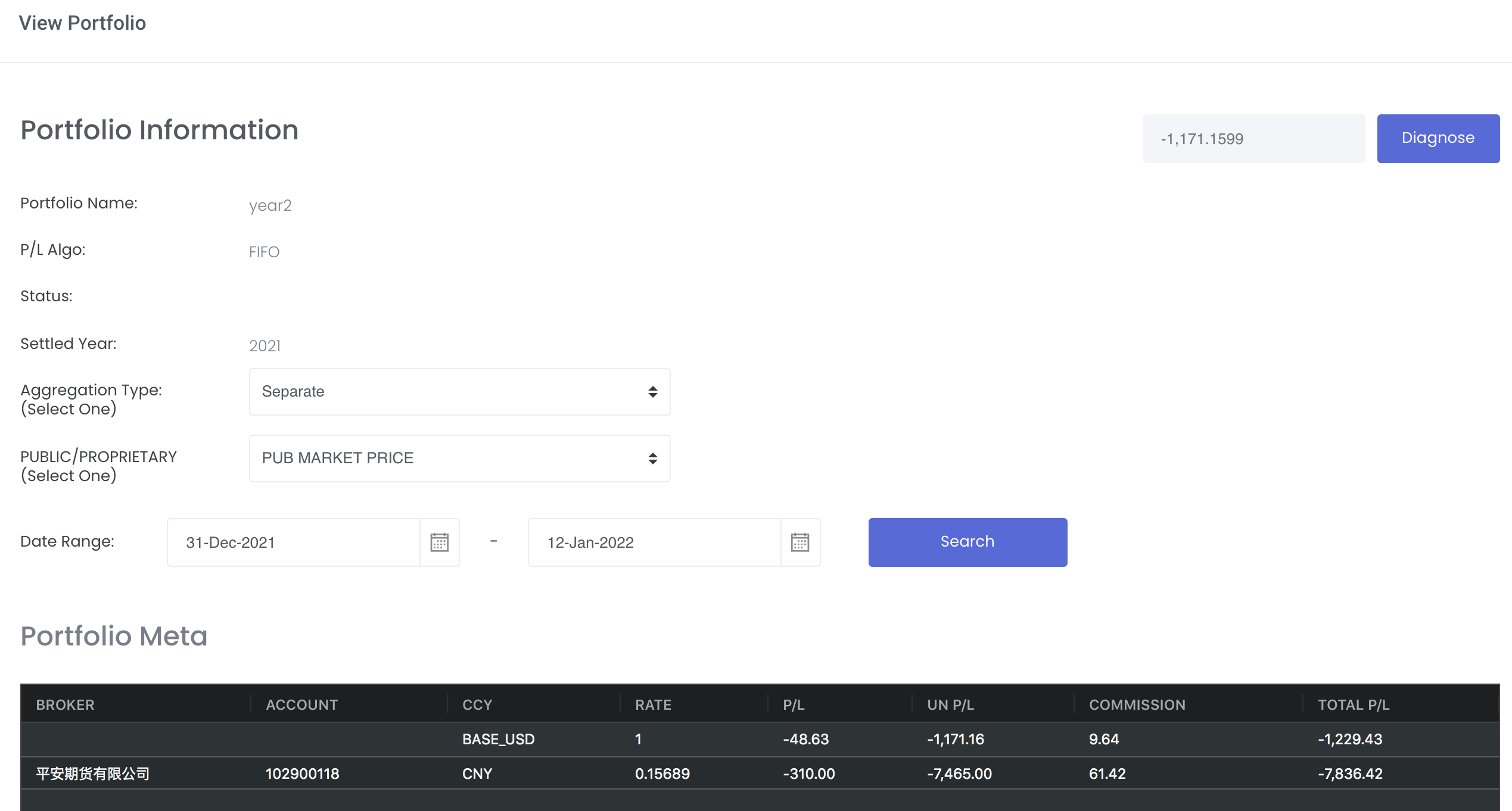

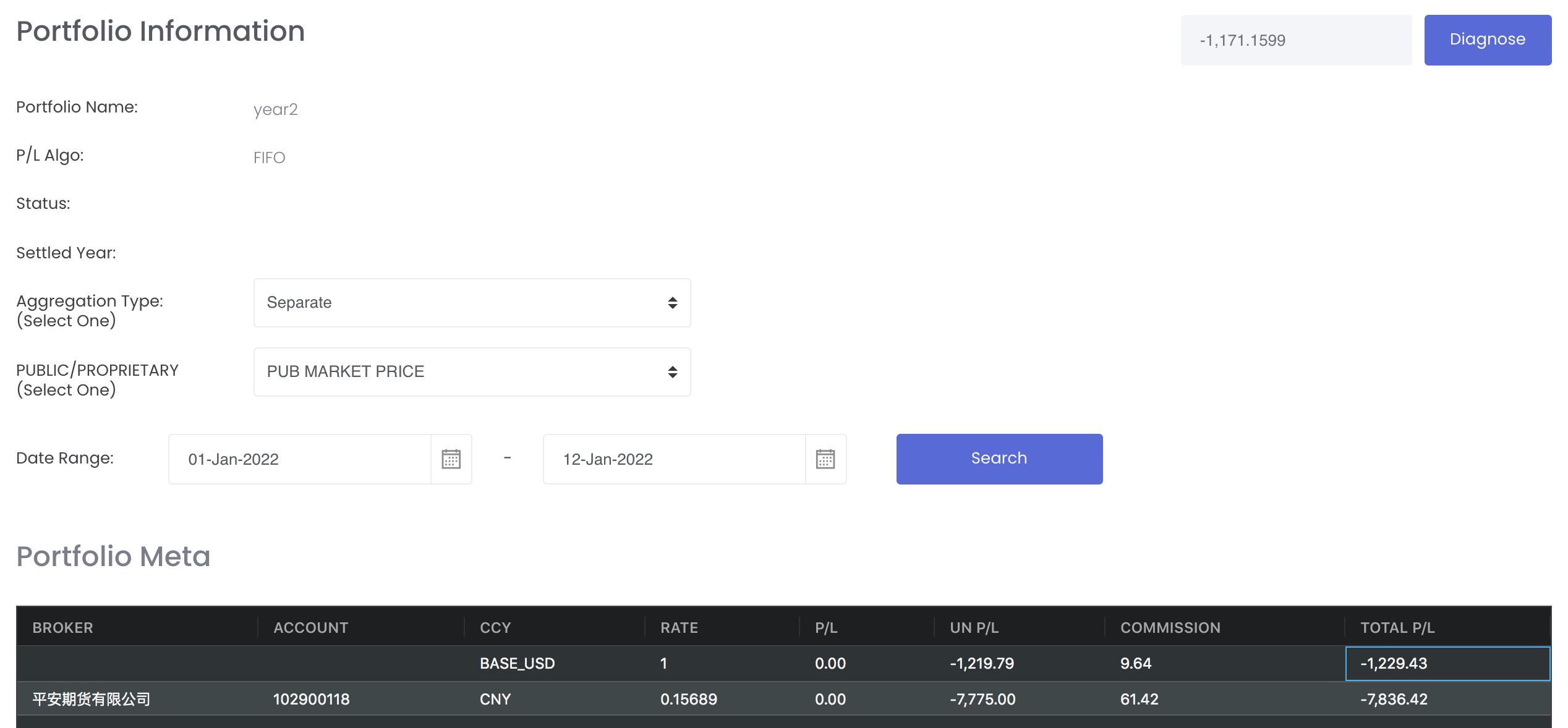

Check Total P/L

You can click on the "Diagnose" button at the top right corner of the page and the total P/L will be generated (system will calculate using a different method), allowing you to confirm that the total P/L in the portfolio is updated or still require recalculation to obtain the correct figure.

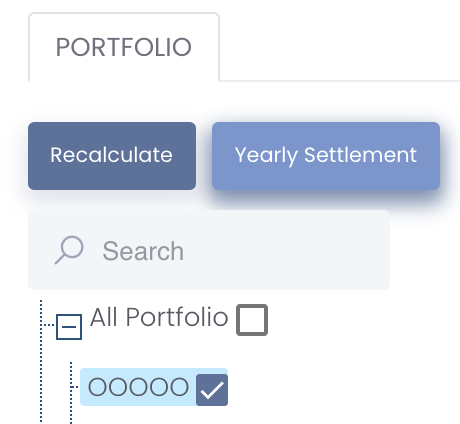

To recalculate the portfolios, you can tick the portfolio(s) and click 'Recalculate'.

Please note that Portfolio recalculation: If any value in WMT, DMT, FE % and MOIS% is changed in math formula, system will recalculate P/L

check:

Are there spec variables in math formula?

Are those spec variables in the math formula value changed?

if both check yes, then MAF will recalculate P/L. If no formula pricing mode or no math formula, check 1 and 2 are not valid, then wont recalculate P/L

Start Date: Select the earliest trade date to recalculate trades from.

If empty, the system will use the earliest possible trade date to perform recalculations.

Alternatively, you may perform recalculations manually by:

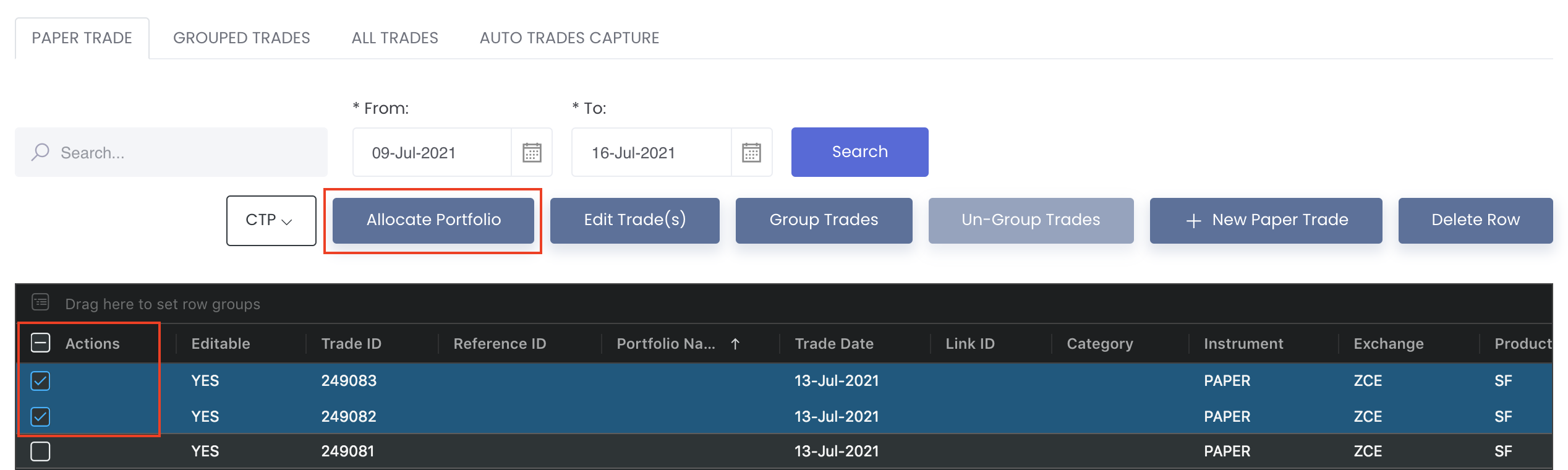

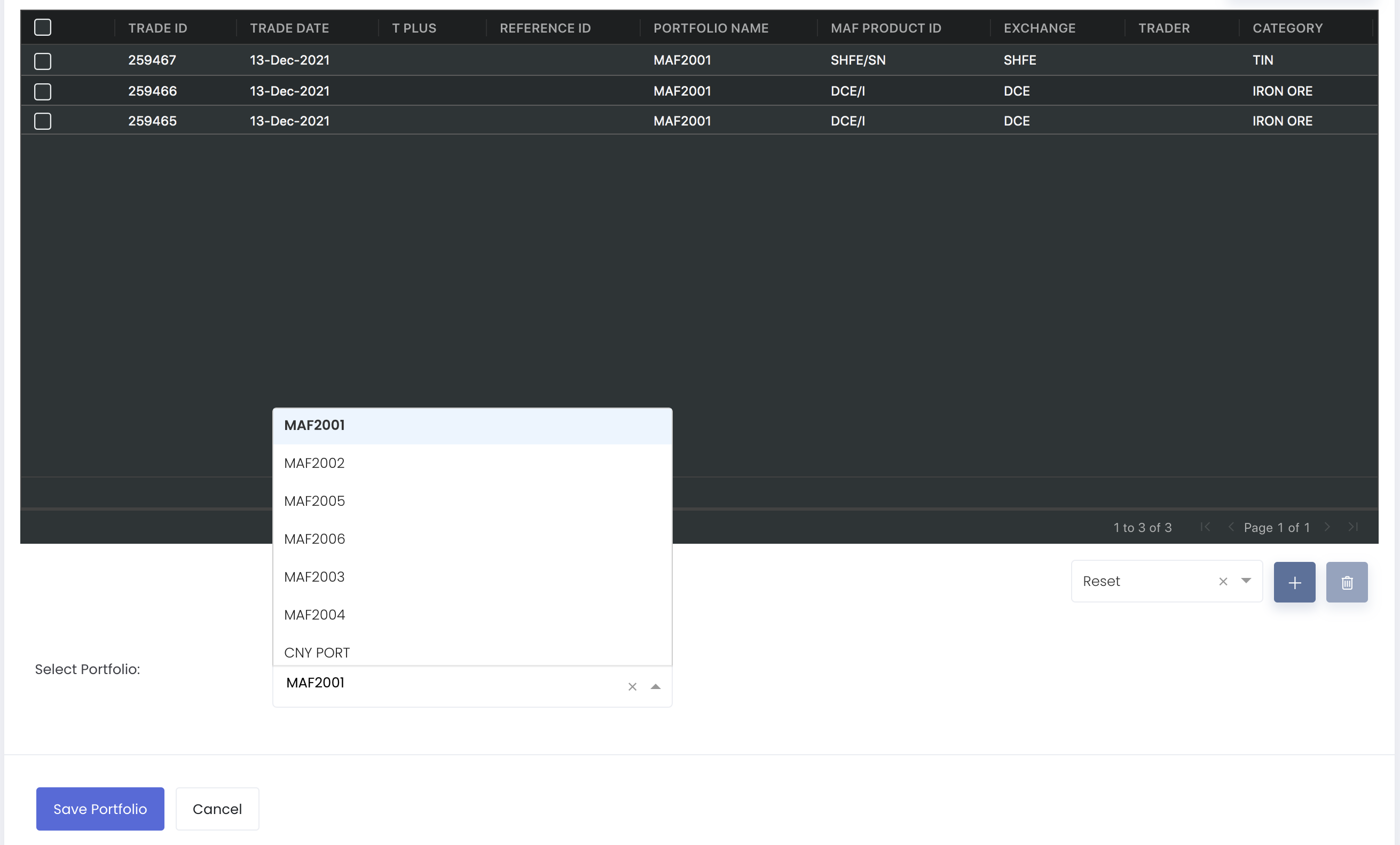

1. Deselect all the trades from your existing portfolio and save:

In Paper Trades page:

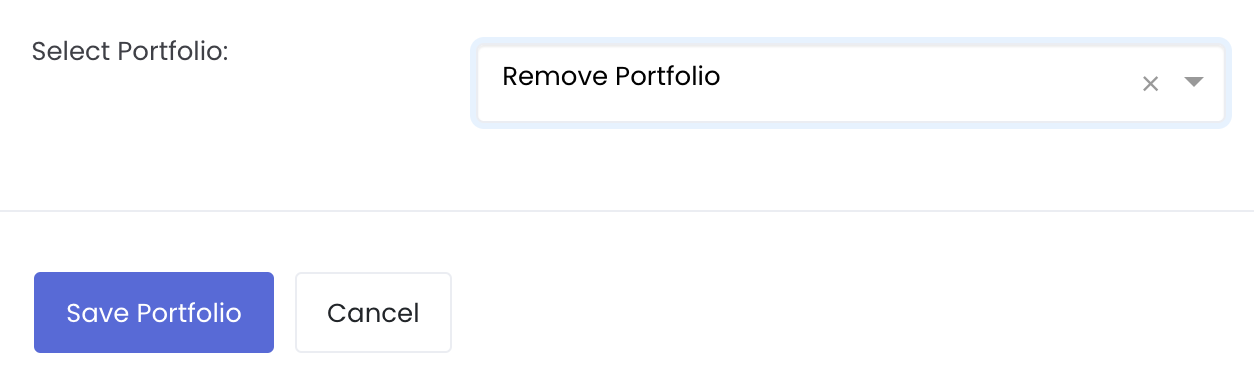

- Tick the checkbox(es) of your trades in the Managing Paper Trades page and click on "Reallocate Portfolio" to be redirected to a new page.

- Select "Remove Portfolio" from the drop-down list ('Select Portfolio') at the bottom of the page. Click 'Save Portfolio' once done.

2. Re-add all the trades into the existing portfolio and save

In Paper Trades page:

- Tick the checkbox(es) of your trades in the Managing Paper Trades page and click on "Reallocate Portfolio" to be redirected to a new page.

- Select the portfolio name (to allocate all the trades into) from the drop-down list ('Select Portfolio'). Click 'Save Portfolio' once done.

The system may take a few seconds to perform the recalculations for existing portfolios. After refreshing the page, the updated changes of the 'Aggregation Type' function will be reflected.

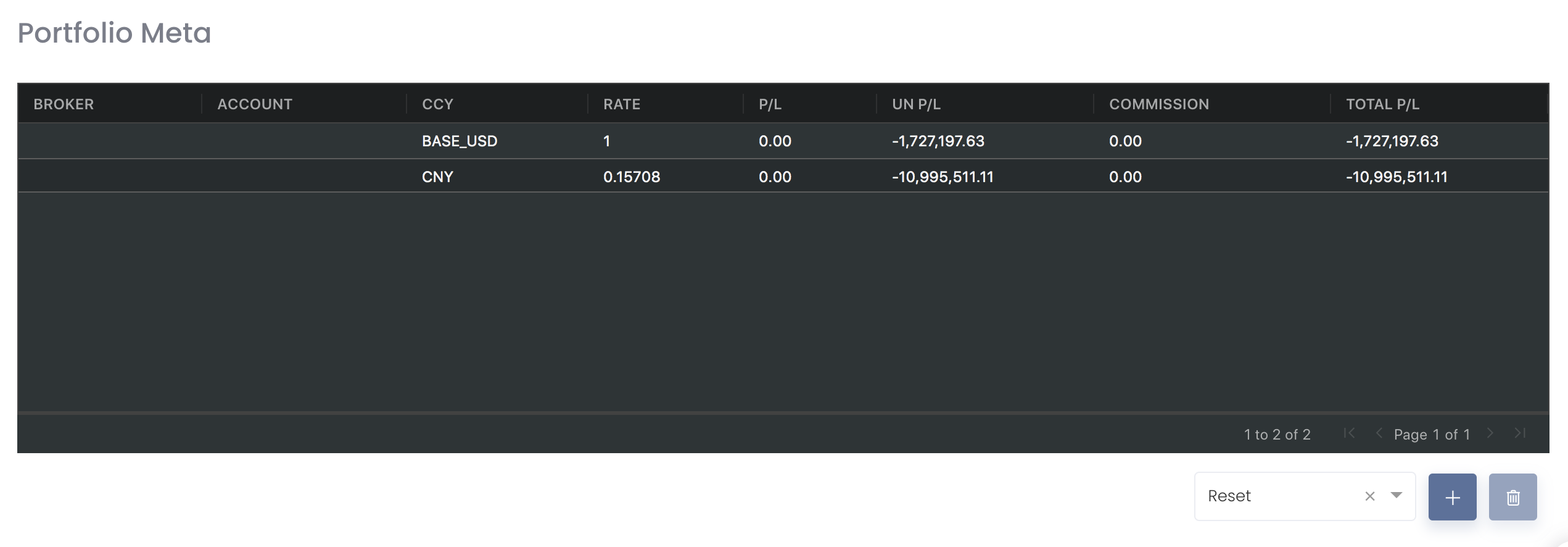

Portfolio Meta

The table displays the realised P/L, unrealised P/L and total P/L in different currencies. The P/L for all of your positions will be automatically calculated in the table according to the currency used and 'Exchange Rate' for the day, giving you a good overview of your P/L in different currencies.

'Broker' and 'Account' columns will be displayed if you select the 'Separate' aggregation type mentioned above.

The first row represents the P/L of all of your positions (in USD or other currencies), converted to the base currency (USD), based on the 'Exchange Rate' for the day.

Subsequent rows represent the P/L of all of your positions in other currencies, based on the 'Exchange Rate' for the day.

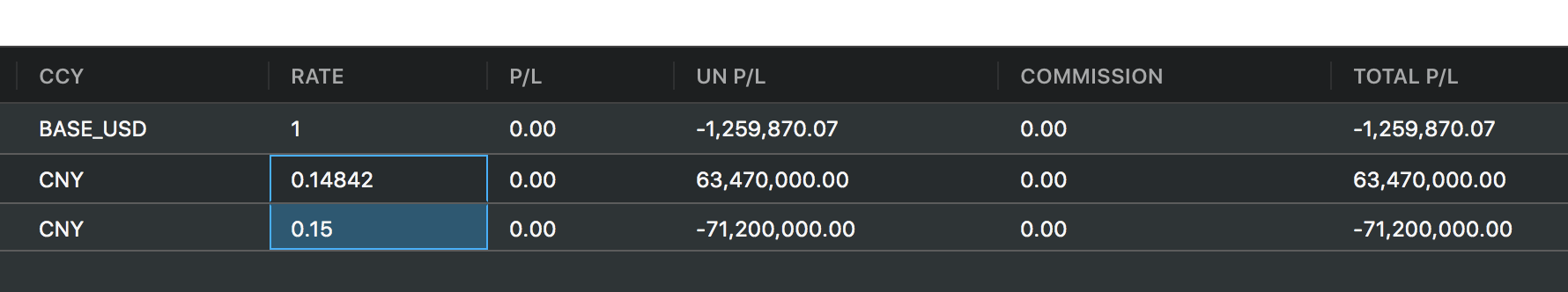

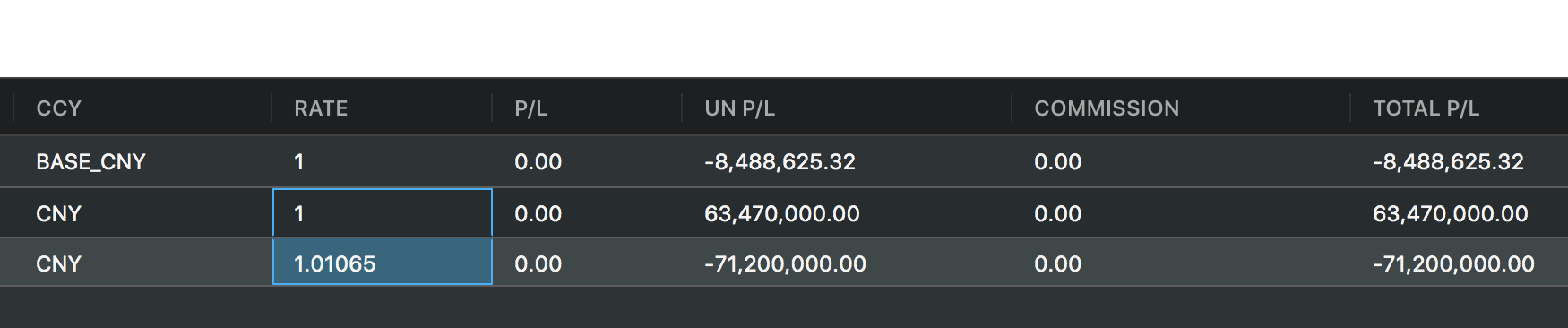

Special Cases: Exchange Rate Adjustment for P/L calculations:

Even if settlement currency is same as pricing currency for physical trade, we need to consider exchange rate For example, physical trade uses import and export trade mode deal currency is USD pricing currency is CNY, there is an exchange rate for this physical trade. e.g., USDCNY = 6.0 however, deal parent portfolio is CNY current logic:

new logic when loading deal parent portfolio, BE will

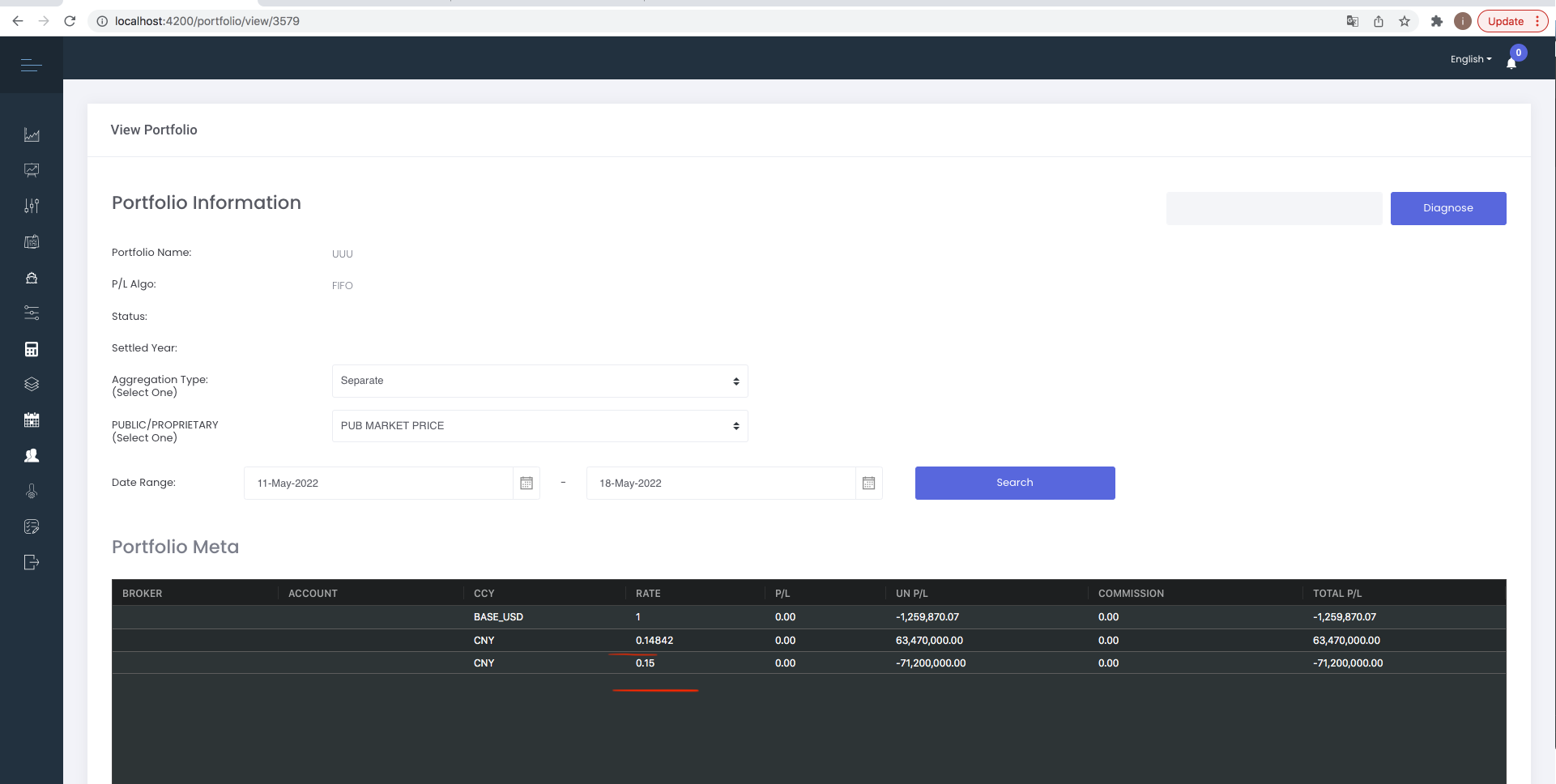

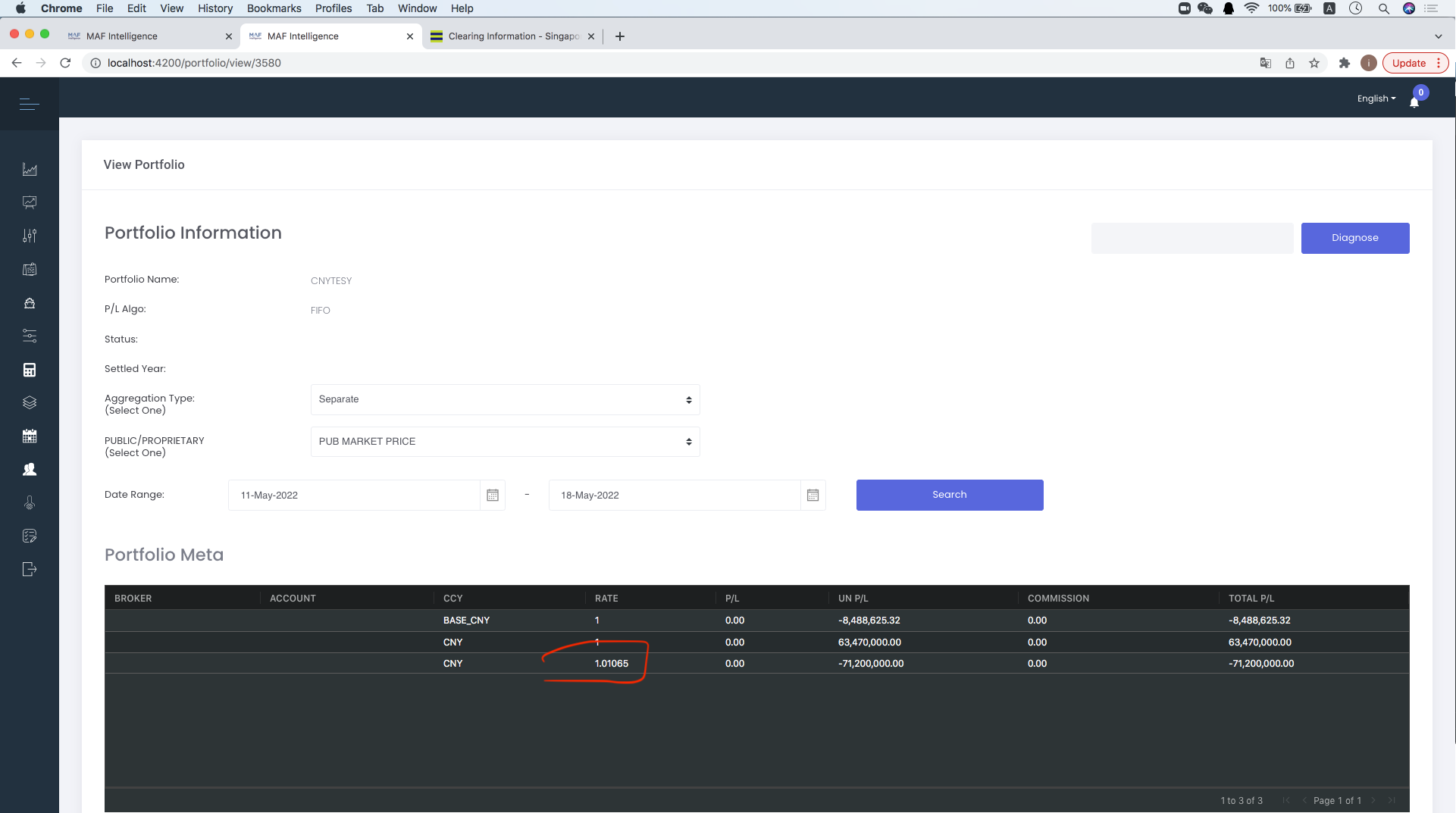

sample case: in deal UUU, there is a physical trade: deal ccy is USD, physical trade pricing ccy is CNY, and there is a exchange rate in trade execution page which is 0.15 so you can see in UUU portfolio, sett ccy is USD, there are two exchange rate for benchmark and MTM pricing

|

In summary: there are 3 types of currency:

If deal ccy and settlement currency are different, exchange rate can be input in phy trade execution or system will use its own exchange rate to calculate P/L. If portfolio ccy is different from deal ccy, system will use system exchange rate or exchange rate set in proprietary market data to calculate P/L. |

But for example, if physical trade uses Import/Export Trade Mode, deal ccy is USD, settlement ccy is CNY, so there is an exchange rate of e.g., USDCNY = 6.0. But portfolio currency is CNY. So now we need to consider if there are 2 trades (buy/sell), both deal ccy is USD; sell contract with settlement ccy as CNY (so no exchange rate; also because MTM pricing cannot allow input of exchange rate so exchange rate will be system default 0.14842) and buy contract with settlement ccy as CNY so need to self input exchange rate (0.15). So by putting this deal (1 buy 1 sell trade) into a portfolio with portfolio ccy CNY, the system will need to do auto conversion to calculate the P/L for both buy and sell contracts using the same exchange rate (0.14842).

|

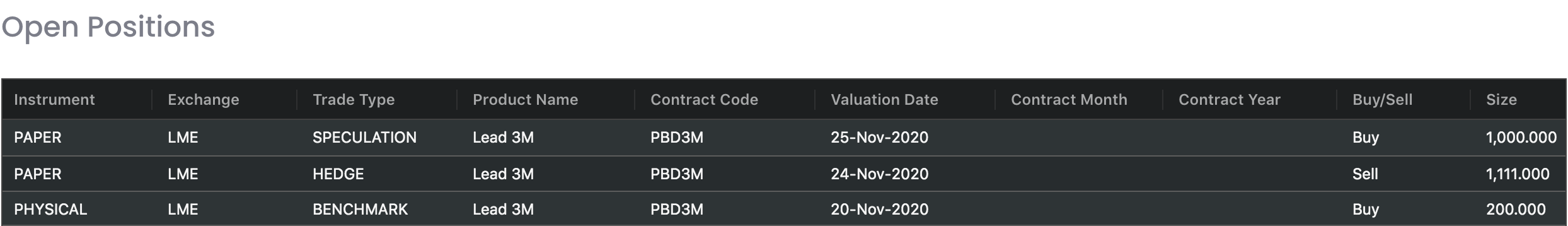

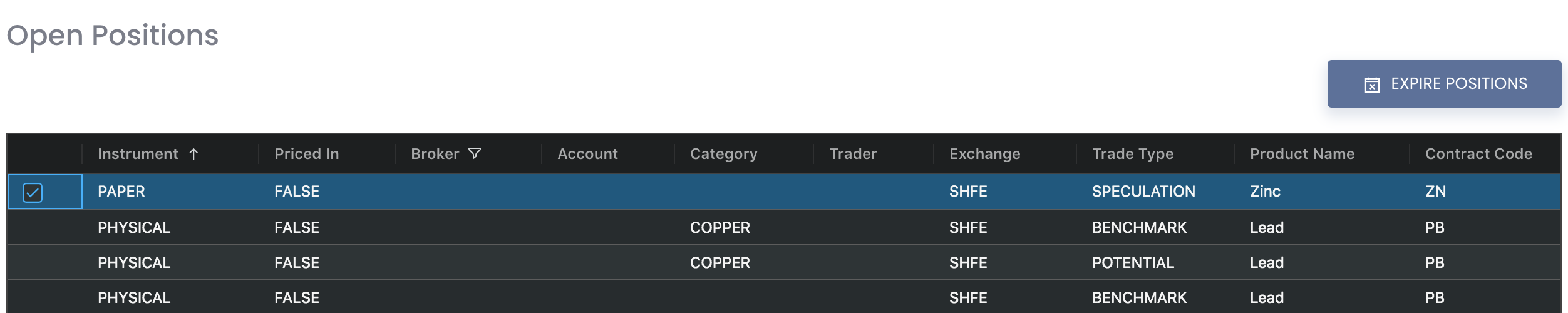

Open Positions

The 'Open Positions' table consists of all the open positions in the portfolio (ie. position is 1-sided: only 'buy' or 'sell'). You will be able to monitor the outstanding paper and physical trades which are not closed/completed here. To determine the 'Unrealised P/L' value, UNPL = (Settlement Price - Purchase Price) * Contract Size * Size, where 'Purchase Price' = 'Average Price' in system.

When a trade position has been created or closed, its corresponding portfolio will be automatically updated and this table will reflect the latest changes, allowing you to monitor your positions immediately and accurately.

If 'Actual Price' is empty, the system will use 'Estimated Price' in the portfolio calculations. If 'Actual Price' is input, the system will use 'Actual Price' in the portfolio calculations.

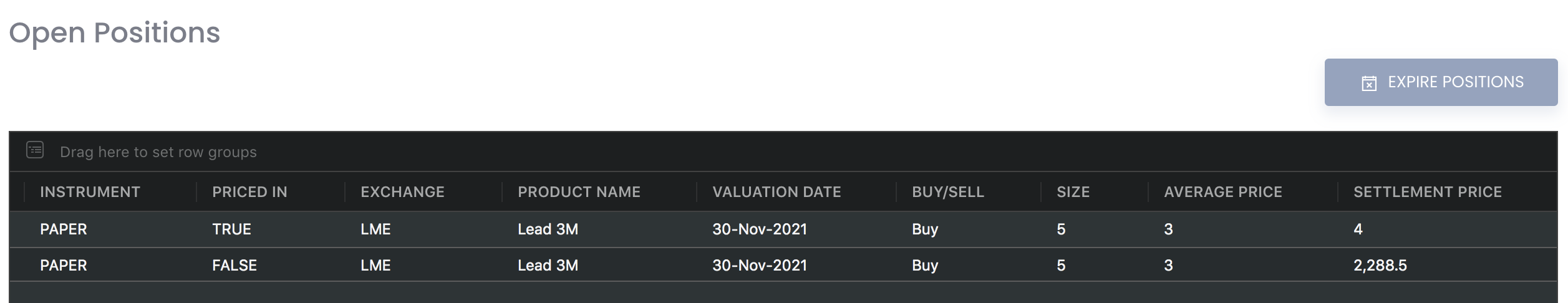

'PRICED IN' column will show 'TRUE' and provide a clear indication if 'Estimated Price' or 'Actual Price' in trade execution page has been input, and show 'FALSE' if 'Estimated Price' or 'Actual Price' in trade execution page has NOT been input.

Please note that once 'Title Transfer Date' and 'Estimated Price' have been input in the trade execution page for both purchase and sale trades, the trade will remain in Open Positions table as unrealised P/L. But once 'Title Transfer Date' and 'Actual Price' have been input in the trade execution page, the trade will move from Open Positions table to Closed Positions table. Otherwise, the trade will remain in Open Positions table as unrealised P/L.

- If ACTUAL PRICE has been input but 'Title Transfer Date' is still empty, it will be considered as an OPEN POSITION (trade will appear in OPEN POSITION table) and PRICED IN will be TRUE.

- If ACTUAL PRICE has not been input but 'Title Transfer Date' is filled/not filled, it will be considered as an OPEN POSITION (trade will appear in OPEN POSITION table) and PRICED IN will be FALSE.

- If ACTUAL PRICE has been input and 'Title Transfer Date' is filled, it will be considered closed and the trade will appear in the CLOSED POSITION table and PRICED IN will be TRUE.

- If ESTIMATED PRICE has been input but ACTUAL PRICE is not input, and 'Title Transfer Date' is filled/not filled, it will be considered as an OPEN POSITION (trade will appear in OPEN POSITION table) and PRICED IN will be TRUE.

- In short, the trade will only be considered CLOSED if the ACTUAL PRICE and TITLE TRANSFER DATE are filled. Otherwise, the trade will remain in the OPEN POSITION table as unrealised P/L.

- However, if the purchase and sale trades do not have the same Category, they will not close each other and will thus remain as open positions. If the actual quantity differs slightly, the positions will be closed accordingly.

Please also note that once you have updated the 'Actual Quantity' and 'Actual Price' in the trade execution of a trade, the trade will move from 'Open Positions' table to 'Closed Positions' table to reflect that the trade has been completed/closed on that quantity and price. For forwards contract, if the 'Valuation Date' of a trade has expired (any date before today's date), the trade will automatically be reflected in the 'Closed Positions' table based on the settlement price on the 'Valuation Date', unless the 'Actual Quantity' and 'Actual Price' are input in the trade execution page.

Inputting 'Title Transfer Date' will replace 'Trade Date' in PORTFOLIO page (under TRADES table). If 'Title Transfer Date' is removed, the original 'Trade Date' will be displayed. 'Title Transfer Date' cannot be after Today's Date.

Trades with different CATEGORY and TRADER names will not be combined/closed off.

If the pricing mode of the physical trade position is not FIXED (which means it is either WMA, FLOAT/AVE or SPOT), the unit will be in LOTS. If the pricing mode is FIXED, the unit will be in the original units eg metric tons, barrels etc.

For paper trades, if product is lead, average price = 1, and size = 1, and settlement price = 15060. P/L = (15060 - 1)*5 = 75295

For options contract, forward options can be expired based on their value date, same as forward contract. So once it expired, it will become closed position. So in Counterparty Position Risk Summary app, it will only show open positions.

PVT column is added to Portfolio (Open Position table) and P/L Details model:

Shows PUB = trade is calculated using public data

Shows PROP = trade is calculated using proprietary/private data

Shows empty = Priced_In = true : trade has price (estimated/actual price) so column will be empty/blank

So to check if you have uploaded the correct proprietary (PVT) data, you can check the Settlement Date by sorting (click on the header name to sort). If the Settlement Date is not yesterday's date, it means that the data is not updated yet.

Positions displayed will change according to the 'Aggregation Type' selected under 'Portfolio Information'.

Note: "BENCHMARK" refers to the benchmark pricing you set and "POTENTIAL" refers to the mark-to-market pricing you set when creating physical trades.

Note: For Float/WMA/Spot pricing mode, 'Size' in this table will be converted to "Lots" = Contract Quantity (found in physical trade's pricing page)/Product Size (found in product data table)

For example, if contract quantity is 500, and product size is 25 (Aluminium 3M), 'Size' = 500/25 = 20

Tax Rate: If you key in the tax rate in the create physical trades page, your P/L will be calculated excluding the tax rate. If you leave this field empty, your P/L will be calculated including the tax rate.

P/L = Contract Value / (1+tax rate %)

Note: For LME position, if the position is closed but prompt data (VALUATION DATE) is still not meet yet, it will be treated as an OPEN POSITION (display in the OPEN POSITIONS table) but PRICED IN column will be TRUE.

For paper trades, if the trade has not been closed (eg sell 2, buy 1 so left with 1 qty), the closed quantity will appear in CLOSED POSITION table and the remaining open quantity will appear in OPEN POSITION table.

For example, buy sell LME Lead 3M contract, input trade date as 22 Nov, value date as 30 Nov; buy 10 lot at $3, sell 5 lots at $4. In portfolio, it will be displayed like this: first row will be the net buy and sales of 5 lots at $3 and $4. The remaining lots will be shown in the 2nd row.

Please refer to List of Definitions: Portfolio Details for more details.

If the purchase and sale contracts have slightly differing Actual Quantity, the system will auto-close the trades, so the trades will be shown in the Closed Positions table instead.

Close Expired Positions

The system will check and auto-expire positions (with last settlement date more than 2 weeks from today) using the settlement price and last settlement date or trade date, whichever is later, on a daily basis.

Otherwise, you can close expired positions (paper trades only) manually in this page, by ticking the checkbox(es) of the trade(s) and clicking on 'EXPIRE POSITIONS' at the top right corner above the table, and a pop-up window will appear, reflecting the default trade date or settlement date (whichever is later) and expiration price. You may edit the date and price accordingly and click "Expire" to proceed. Once confirmed, the expiration price will appear in the EXP PRICE column in the paper trades table and portfolio (trades table) for your reference, which will be used to calculate your P/L.

It could take a few seconds for the system to close the expired positions and you may be required to refresh the page to view the latest updates. We will add a notification to update you with the status in the near future.

FYI, the same products will use the same expiration price (for example, if you create a gold futures today and expire at settlement price $1, and create the same product the next day and expire at $2, the expiration price for all the gold futures will be $2).

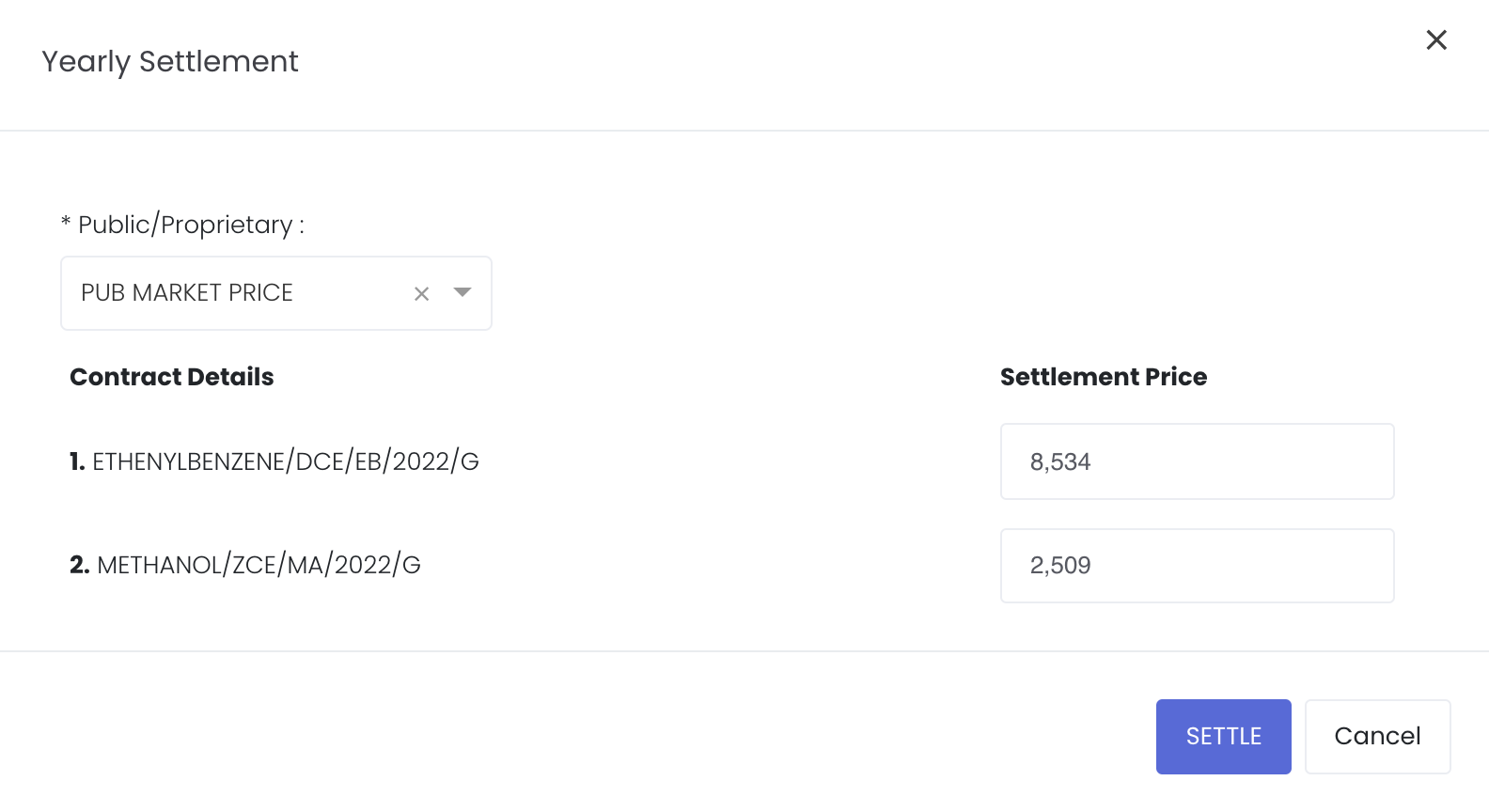

Yearly Settlement Positions

Portfolio calculations will have a year end cut off option now so you can choose to exclude P/L calculations for previous years in the new/current year. For instance, you can opt for the P/L of your trades in 2021 to be excluded in the P/L calculations for 2022 to start afresh.

You can go to Portfolio>View Portfolio, tick the portfolio and click on Yearly Settlement and confirm the necessary details to settle/close off all positions (this portfolio will be known as the portfolio with settled year). When the portfolio is settled, the system will realise all trades with trade date on or before 31/12/21 and change all open positions to closed positions, and realised P/L will be calculated accordingly. Then it will bring over the same open positions (trade date becomes 01/01/2022) to 2022. So once eg 2021 trades are closed off/settled, you can proceed to the View Portfolio Details page of the portfolio.

For portfolio with settled year, the Settled Year will be displayed under the Portfolio Information section. The P/L calculations will depend on the Start Date (first date of Date Range). So once 2021 trades are closed off/settled, you can proceed to View Portfolio Details of the portfolio. Start Date will be used to determine the P/L calculations cut off for this function. If you select Start Date before 01/01/2022, the system will add all P/L and commission for 2021 (until 31/12/2021) and add into the new year P/L (which means all accumulated P/L in 2021 will be added into calculations for 2022 if the Start Date is before 01/01/2022 aka total P/L will include realised P/L and commission for 31/12/2021 and P/L for 2022). If Start Date is on or after 01/01/2022, the portfolio P/L will not include any P/L from 2021 and will only include P/L from 01/01/2022 onwards (will exclude realised p/l and commission for 31/12/2021 and only show P/L for 2022). If you don't settle the portfolio, all the trades in the portfolio will remain and calculated as per normal.

To identify paper trades that have been settled, you can go to View Paper Trades page and settled paper trades will show MAF YSI under SYSTEM NO. column.

For Diagnose button, it will only calculate total P/L for the current/new year (after settled year) eg 2022. To check, settled and unsettled P/L should be the same except the date range

Relevant Dashboard models will reflect Yearly Settlement related figures accordingly:

Futures Account

Portfolio P/L Details

Group P/L

FX Exposure

Portfolio Performance Chart

Scenario

Settled portfolio's P/L should be exactly the same as that of the unsettled portfolio, if the date range is adjusted correctly. Here an example of the same portfolio for trades with Trade Date 31-Dec-2021, to check that the total P/L are the same regardless of settled or unsettled, you can follow the steps below:

For settled portfolio, change the Date Range start date to "31-Dec-2021" and keep the end date as today's date. This portfolio will include the closed trades in 31-Dec-2021 and trades in 2022.

For unsettled portfolio, change the Date Range start date to "01-Jan-2022" and keep the end date as today's date. This portfolio will include all trades in 2022 as well as the 31-Dec-2021 trades which are not closed yet as this portfolio is unsettled.

For settled portfolio, if you want to exclude the trades for 31-Dec-2021, you have to adjust the start date to 01-Jan-2022 instead.

The Diagnose button will only calculate trades in 2022 (01-Jan-2022 to today's date).

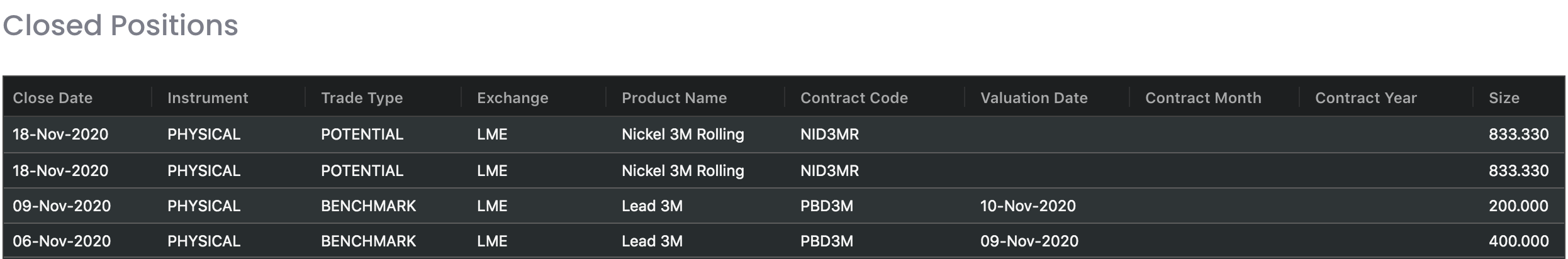

Closed Positions

The 'Closed Positions' table consists of all the closed positions in the portfolio (ie. original position was closed by an opposing position). You will be able to monitor the closed/completed paper and physical trades here. To determine the 'Unrealised P/L' value, UNPL = (Sold Price - Settlement Price) * Contract Size * Size, where 'Sold Price' = 'Average Price' in system.

When a trade position has been closed, its corresponding portfolio will be automatically updated and this table will reflect the latest changes, allowing you to monitor your positions immediately and accurately.

If 'Actual Price' is empty, the system will use 'Estimated Price' in the portfolio calculations. If 'Actual Price' is input, the system will use 'Actual Price' in the portfolio calculations.

Please note that once 'Title Transfer Date' and 'Estimated Price' have been input in the trade execution page, the trade will remain in Open Positions table as unrealised P/L. But once 'Title Transfer Date' and 'Actual Price' have been input in the trade execution page, the trade will move from Open Positions table to Closed Positions table. Otherwise, the trade will remain in Open Positions table as unrealised P/L.

- If ACTUAL PRICE has been input but 'Title Transfer Date' is still empty, it will be considered as an OPEN POSITION (trade will appear in OPEN POSITION table) and PRICED IN will be TRUE.

- If ACTUAL PRICE has not been input but 'Title Transfer Date' is filled/not filled, it will be considered as an OPEN POSITION (trade will appear in OPEN POSITION table) and PRICED IN will be FALSE.

- If ACTUAL PRICE has been input and 'Title Transfer Date' is filled, it will be considered closed and the trade will appear in the CLOSED POSITION table and PRICED IN will be TRUE.

- If ESTIMATED PRICE has been input but ACTUAL PRICE is not input, and 'Title Transfer Date' is filled/not filled, it will be considered as an OPEN POSITION (trade will appear in OPEN POSITION table) and PRICED IN will be TRUE.

- In short, the trade will only be considered CLOSED if the ACTUAL PRICE and TITLE TRANSFER DATE are filled. Otherwise, the trade will remain in the OPEN POSITION table as unrealised P/L.

Please also note that once you have updated the 'Actual Quantity' and 'Actual Price' in the trade execution of a trade, the trade will move from 'Open Positions' table to 'Closed Positions' table to reflect that the trade has been completed/closed on that quantity and price. For forwards contract, if the 'Valuation Date' of a trade has expired (any date before today's date), the trade will automatically be reflected in the 'Closed Positions' table based on the settlement price on the 'Valuation Date', unless the 'Actual Quantity' and 'Actual Price' are input in the trade execution page.

Inputting 'Title Transfer Date' will replace 'Trade Date' in PORTFOLIO page (under TRADES table). If 'Title Transfer Date' is removed, the original 'Trade Date' will be displayed. 'Title Transfer Date' cannot be after Today's Date.

Trades with different TRADER names will not be combined/closed off.

If the pricing mode of the physical trade position is not FIXED (which means it is either WMA, FLOAT/AVE or SPOT), the unit will be in LOTS. If the pricing mode is FIXED, the unit will be in the original units eg metric tons, barrels etc.

For paper trades, if product is lead, average price = 1, and size = 1, and settlement price = 15060. P/L = (15060 - 1)*5 = 75295

Positions displayed will change according to the 'Aggregation Type' selected under 'Portfolio Information'.

Note: "BENCHMARK" refers to the benchmark pricing you set and "POTENTIAL" refers to the mark-to-market pricing you set when creating physical trades.

Note: For Float/WMA/Spot pricing mode, 'Size' in this table will be converted to "Lots" = Contract Quantity (found in physical trade's pricing page)/Product Size (found in product data table)

For example, if contract quantity is 500, and product size is 25 (Aluminium 3M), 'Size' = 500/25 = 20

Note: If 'Valuation Date' is before today's date, the 'Close Date' will be 1 day before, indicating the position has been closed using settlement price on the 'Close Date'.

Tax Rate: If you key in the tax rate in the create physical trades page, your P/L will be calculated excluding the tax rate. If you leave this field empty, your P/L will be calculated including the tax rate.

P/L = Contract Value / (1+tax rate %)

Please refer to List of Definitions: Portfolio Details for more details.

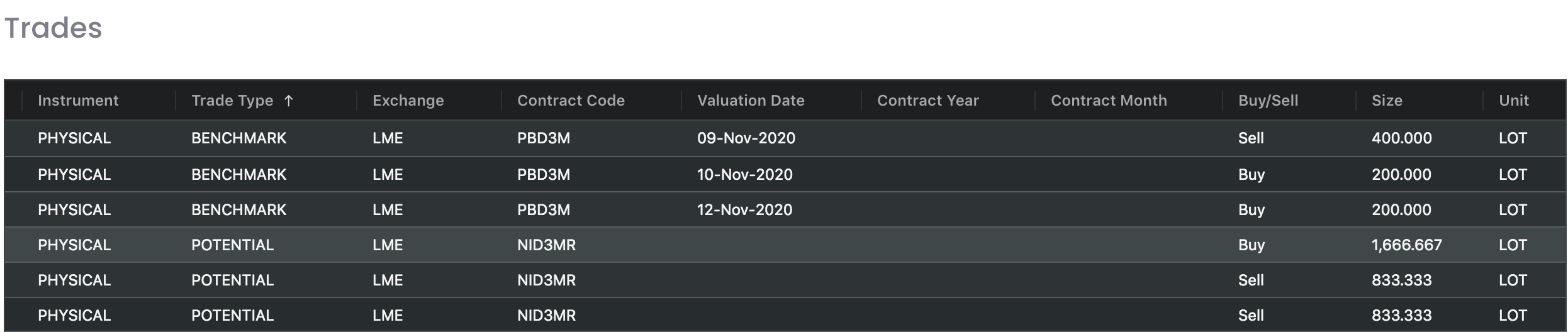

Trades

The 'Trades' table is a summary of all the paper and physical trades in the portfolio (with their trade IDs etc for reference). Their overall positions have been accounted for in 'Positions' above.

Date Range

Select the date range to display the trades in the TRADES table accordingly. The end date will be automatically updated as today's date and start date will be 1 week before by default. Fill in your desired date and click 'Search' to display your trades accordingly.

Note: "BENCHMARK" refers to the benchmark pricing you set and "POTENTIAL" refers to the mark-to-market pricing you set when creating physical trades.

Note: For 'Trade Type' = "BENCHMARK", if your trade is 'PURCHASE', 'Buy/Sell' will be displayed as 'Sell' and if your trade is 'SALE', 'Buy/Sell' will be displayed as 'Buy'.

Note: For Float/WMA/Spot pricing mode, 'Size' in this table will be converted to "Lots" = Contract Quantity (found in physical trade's pricing page)/Product Size (found in product data table)

For example, if contract quantity is 500, and product size is 25 (Aluminium 3M), 'Size' = 500/25 = 20

Tax Rate: If you key in the tax rate in the create physical trades page, your P/L will be calculated excluding the tax rate. If you leave this field empty, your P/L will be calculated including the tax rate.

P/L = Contract Value / (1+tax rate %)

Please refer to List of Definitions: Trades for more information.

Functionality

Please refer to Table Settings for table functionalities.

Definition of Terms

Please refer to List of Definitions: Portfolio Details.

Click to access: