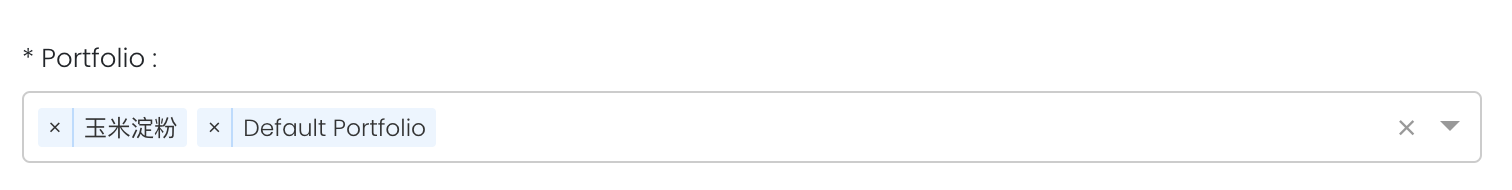

Portfolio Return (%) Table

Return to Overview

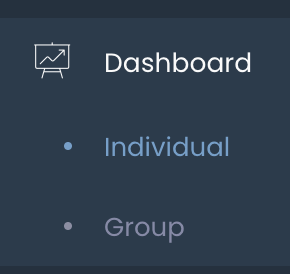

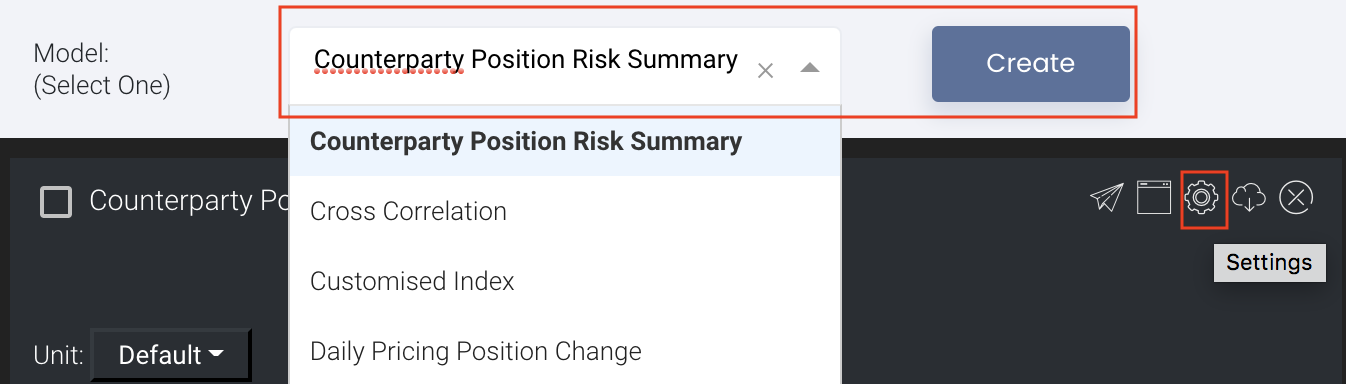

To access the quantitative model/report, click on 'Dashboard' from the navigation sidebar on the left. Select the model/report from the drop-down list and click 'Create'. Click on the 'Settings' button (gear icon) at the top right corner of the model to set up your model/report.

About

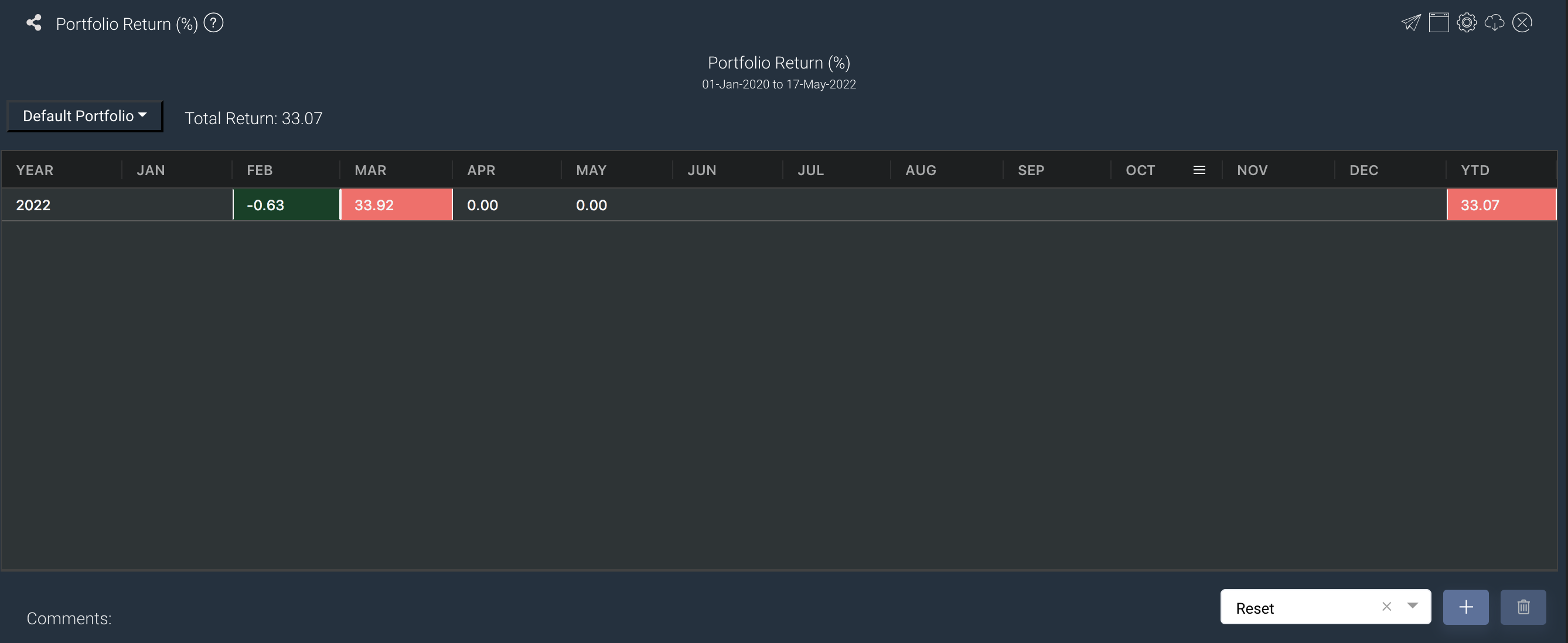

The Portfolio Return table allows the user to view the monthly returns of the portfolio categorised according to years, expressed in percentage form. It allows users to track their portfolio's monthly returns and evaluate their portfolio performance and strategy or fund performance. The system will automatically calculate the portfolio's rate of return based on the user's data input, allowing users to view the portfolio returns efficiently at a glance. The report shows the rate of return (as a percentage) by month and year. The last column shows the rate of return of funds for each year. If there is only data available for certain months eg January to May only, the system will automatically calculate the rate of return from January to May. If the returns are positive values, they will be shown in red. If the returns are negative values, they will be shown in green.

Before the portfolio returns can be calculated in the app, you will first need to ensure the following data is input into the system for the calculations to be performed:

1. Profit & Loss (P/L): P/L can be generated from the paper trade and physical trades data (including expenses and income, commission and other costs), in which you may need to upload/input your data into the Paper Trade and Physical Trades page, and in General Ledger (for expenses and income). Please be reminded to input the portfolio name in General Ledger for the expenses and income items before saving for them to be tagged to the portfolio.

2. Funds: You may need to input the fund items into General Ledger.

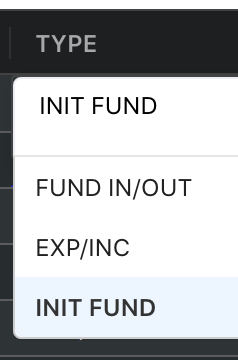

INIT FUND: Initial funds

FUND IN/OUT: Fund in and out items

Please be reminded to input the portfolio name in General Ledger for the fund items before saving for them to be tagged to the portfolio.

Navigation

To access the quantitative model/report, click on 'Dashboard' from the navigation sidebar on the left.

Select the model/report from the drop-down list and click 'Create'. Click on the 'Settings' button (gear icon) at the top right corner of the model to set up your model/report.

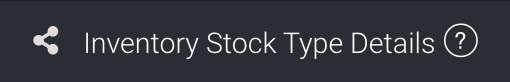

Sharing Model/Report/Dashboard

To share the model with your group members, click on the "Share" button next to the Title of the model followed by the email address of the group members you want to share it with. Once submitted, the model will appear in the Dashboard>Group Dashboard of the selected group members.

This is different from sharing individual or entire Dashboard models/reports, which allows any user who may or may not be users of MAF Cloud to access the individual model/entire dashboard via the shared web link (link will expire in 8 hours). In Group Dashboard, only group members can access the shared models/reports.

Guide

| Name | Image/Description |

|---|---|

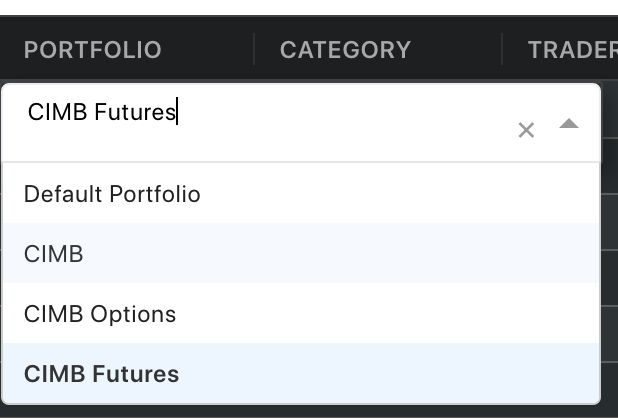

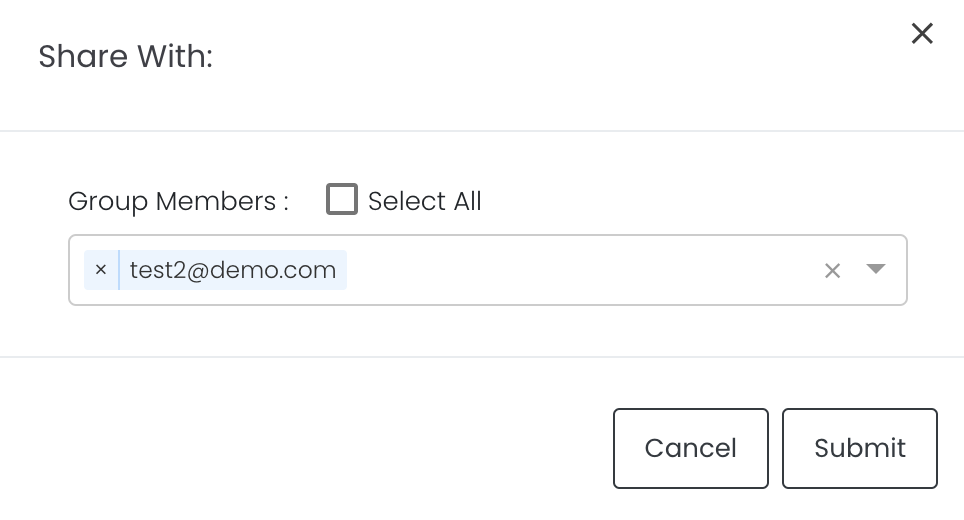

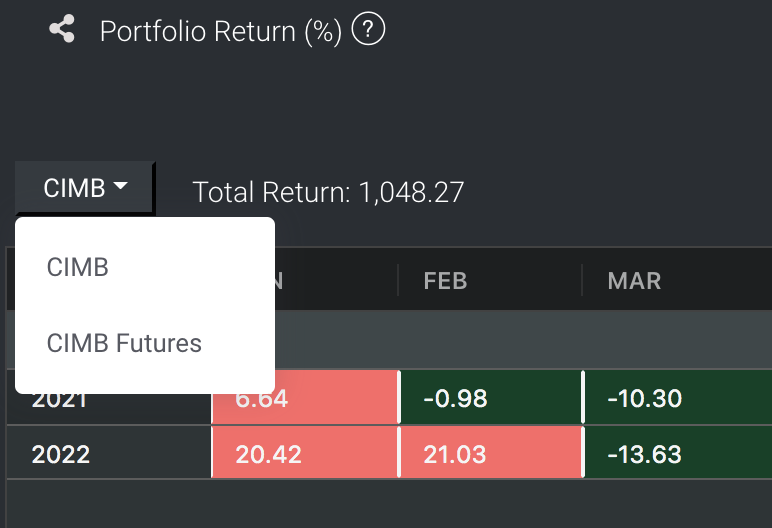

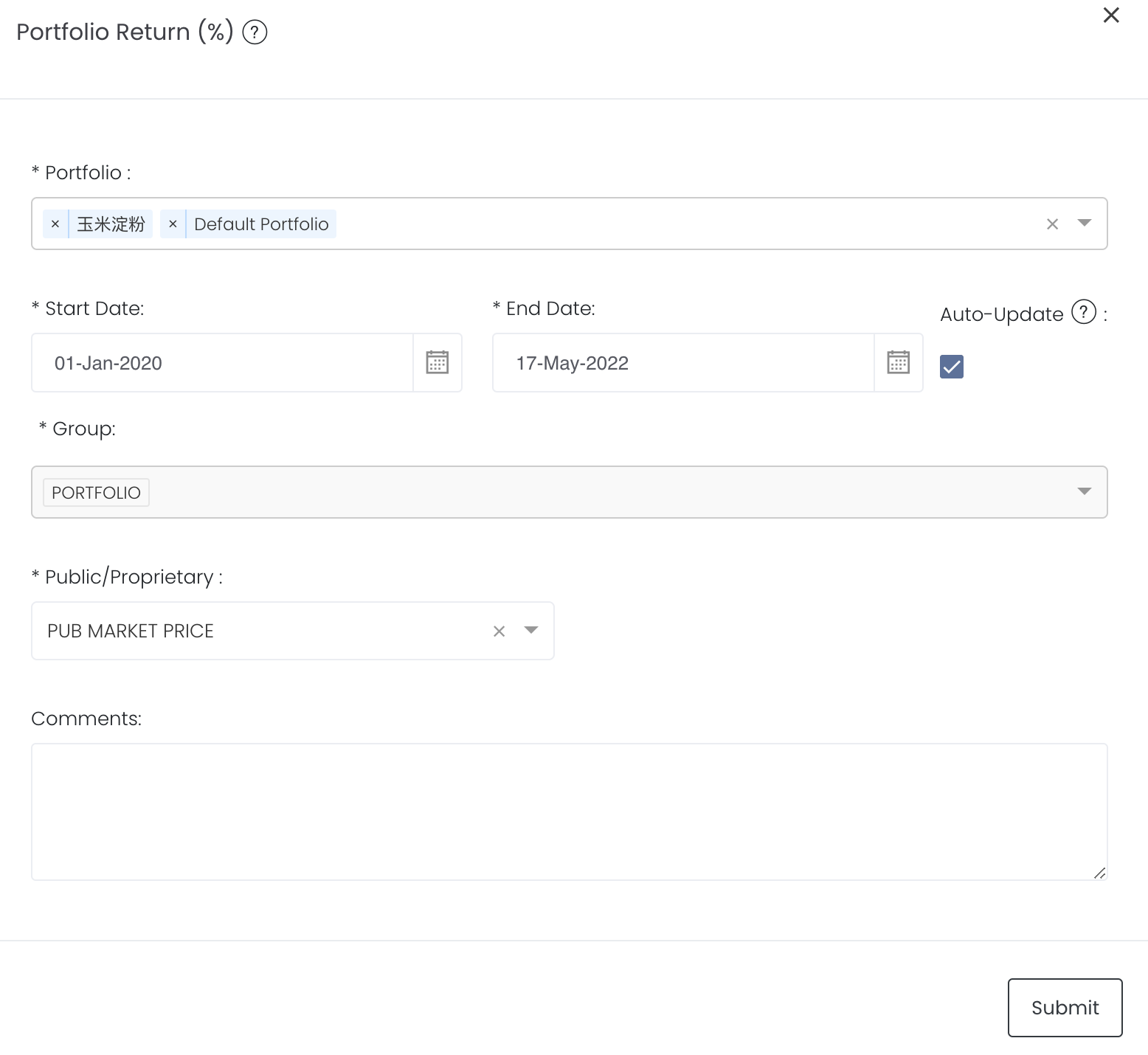

| Portfolio | Select a/multiple portfolio(s) of interest. If multiple portfolios are selected and submitted, you may select the portfolio from the dropdown list in the app on the top left corner to view its returns over the months/years. |

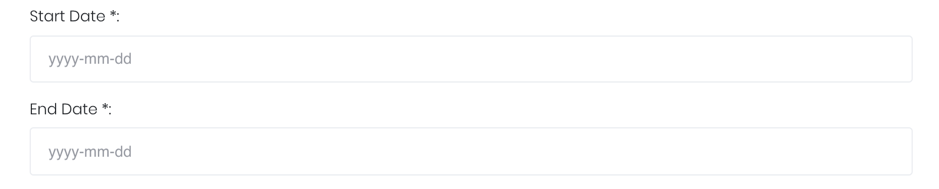

| Duration | Select the start and end date. |

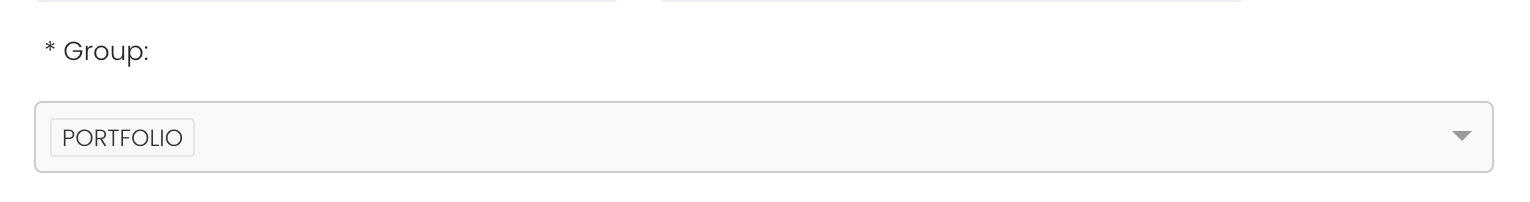

| Group | The group category will be Portfolio by default. No selection is required. |

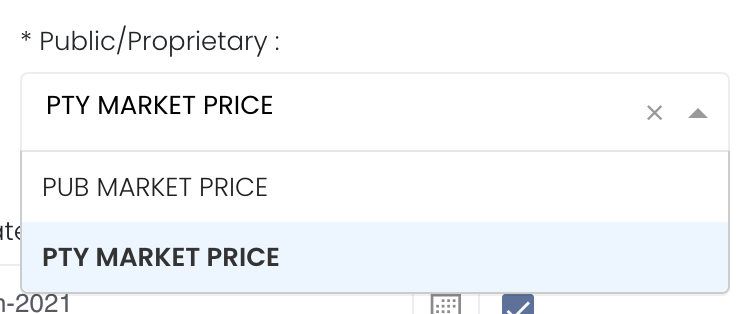

Select public market data or proprietary market data to determine the market data prices used to calculate the P/L or positions accordingly. Please note that if the proprietary (private) market data for certain dates are not input here eg 1 May to 10 May price is input but not 9 May, when you select private data when viewing the portfolio and using the models in Dashboard (eg for trades with trade date on 9 May but private data is not available), the system will use the latest date's settlement price (10 May) to perform the calculations. | |

| Comments | The inserted comments will be displayed at the bottom of the application. This can be useful for documentation purposes or for settings description. |

Input

| Name | Description | Type | Example |

|---|---|---|---|

| Portfolio | Portfolio selected | Portfolio | ABC |

| Start Date | Start of product time-series. | Date (YYYY-MM-DD) | 2015-06-01 |

| End Date | End of product time-series. | Date (YYYY-MM-DD) | 2019-06-14 |

| Comments | Useful for documentation purposes or for settings description. | Text | - |

Output

Name | Description | Type |

|---|---|---|

| Table | Performance returns in percentage (%) form | Plot |

| Select Portfolio to display returns | If multiple portfolios are selected and submitted in the settings, you may select the portfolio from the dropdown list in the app to view its returns over the months/years. If the returns are positive values, they will be shown in red. If the returns are negative values, they will be shown in green. | - |

MAF System Calculation Logic:

In order to reduce the complexity of system calculations, the system will calculate the total of any incoming and outgoing funds (fund in/out) for the month and add to the initial fund in the current month, and place them on the first day of the current month. The initial fund on the first day of each month will be the total incoming and outgoing funds for the month plus the original initial fund on the first day of the month. If there are no transactions, they will also be placed on the first day of the month.

Portfolio Returns Calculation Logic:

Total P/L = Unrealised P/L + Realised P/L + expenses & income + commission + other costs

Fund In/Out: Incoming/Outgoing funds

Initial Fund: Initial fund at the start of the month (may include previous month end month P/L if applicable)

Portfolio Returns (%) = Total P/L at the End of the Month/(Initial Fund + Fund In/Out)*100% or ((Initial Fund + Fund In/Out + Total P/L)/(Initial Fund + Fund In/Out))-1)*100%

Example:

The initial fund of each month (the first day of the month) is determined by adding the initial fund of the month and any fund in/out during the month. For example, if there is fund in on 15/4/22, and fund out on 18/4/22, the system will add the fund in and out and place the total on the first day of the month (1/4/22) as the initial fund. The initial fund on 1/4/22 will be determined by adding the original initial fund (remaining funds at the end of Mar) along with any fund in/out during the month.

However, as this logic is not calculated on a daily basis, there may be a slight discrepancy in the portfolio return calculation.

Discrepancy Example:

System Calculation: Initial fund is 100k, fund out on 15/4/22, so this will be added to the initial fund on 1/4/22, which will be 100k-50k=50k. If the P/L at end of the month (30/4/22) is 70k, then the portfolio returns will be (70k-50k)/50k=40%.

Original Calculation: The original calculation is different as when there is a fund out on 15/4/22, the P/L for the day should be calculated, so the P/L should deduct the initial fund to determine the portfolio returns from 1/4/22 to 15/4/22. So the calculations for 15/4/22 to 30/4/22 should be performed separately to accurately determine the portfolio returns for the month. Once aggregated, the portfolio returns for the month of April will be determined.

So this original calculation will take into account the fund in/out on the first half and second half of the month, whereas the system will aggregate all the initial fund and fund in/out into the first day to calculate the returns, resulting in the slight discrepancy.

Example

Functionality

Please refer to Table Settings for table functionalities.

Definition of Terms

Please refer to List of Definitions: Trades.

Click to access: