Hedge Ratio

Return to Overview

About

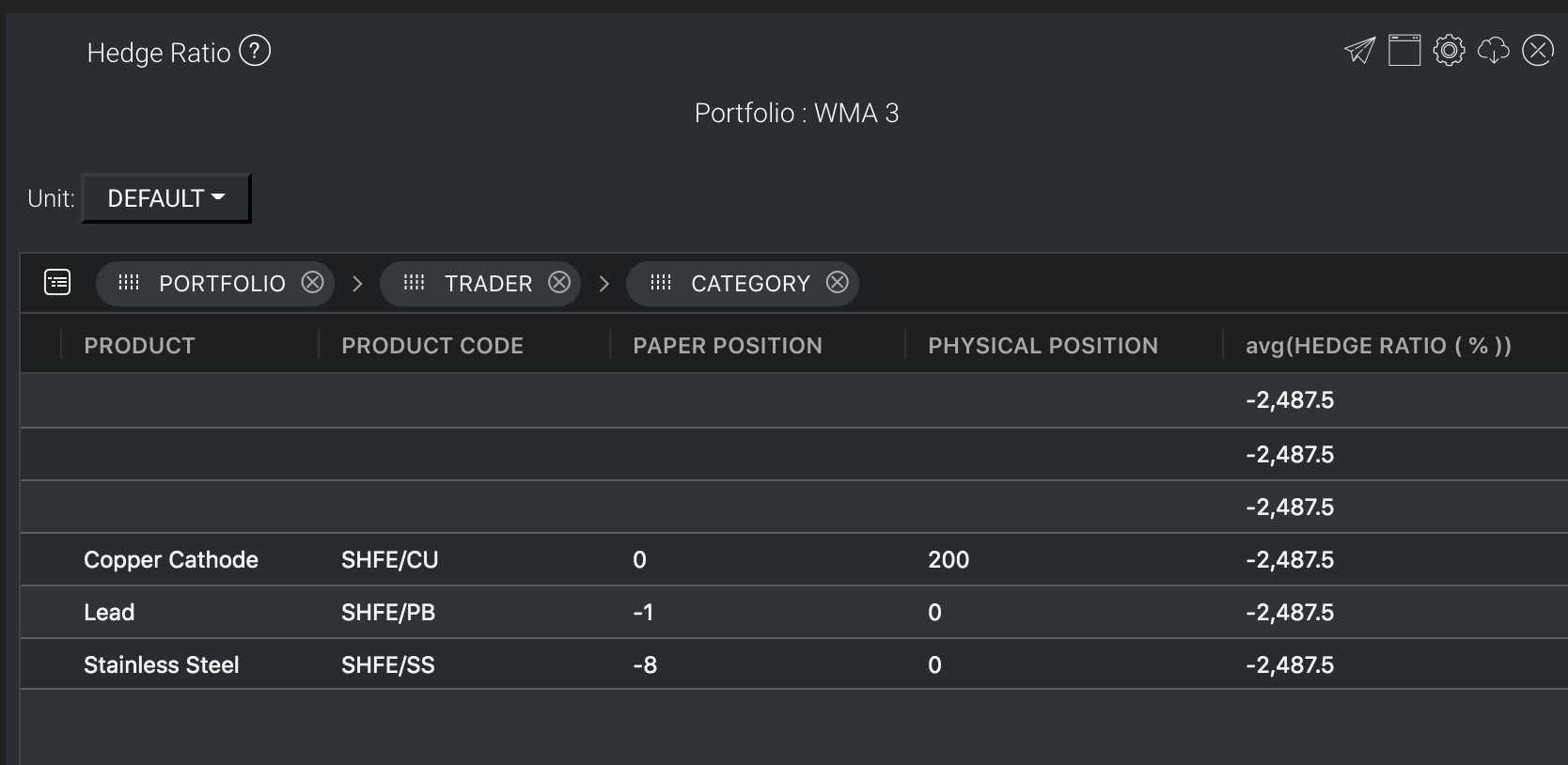

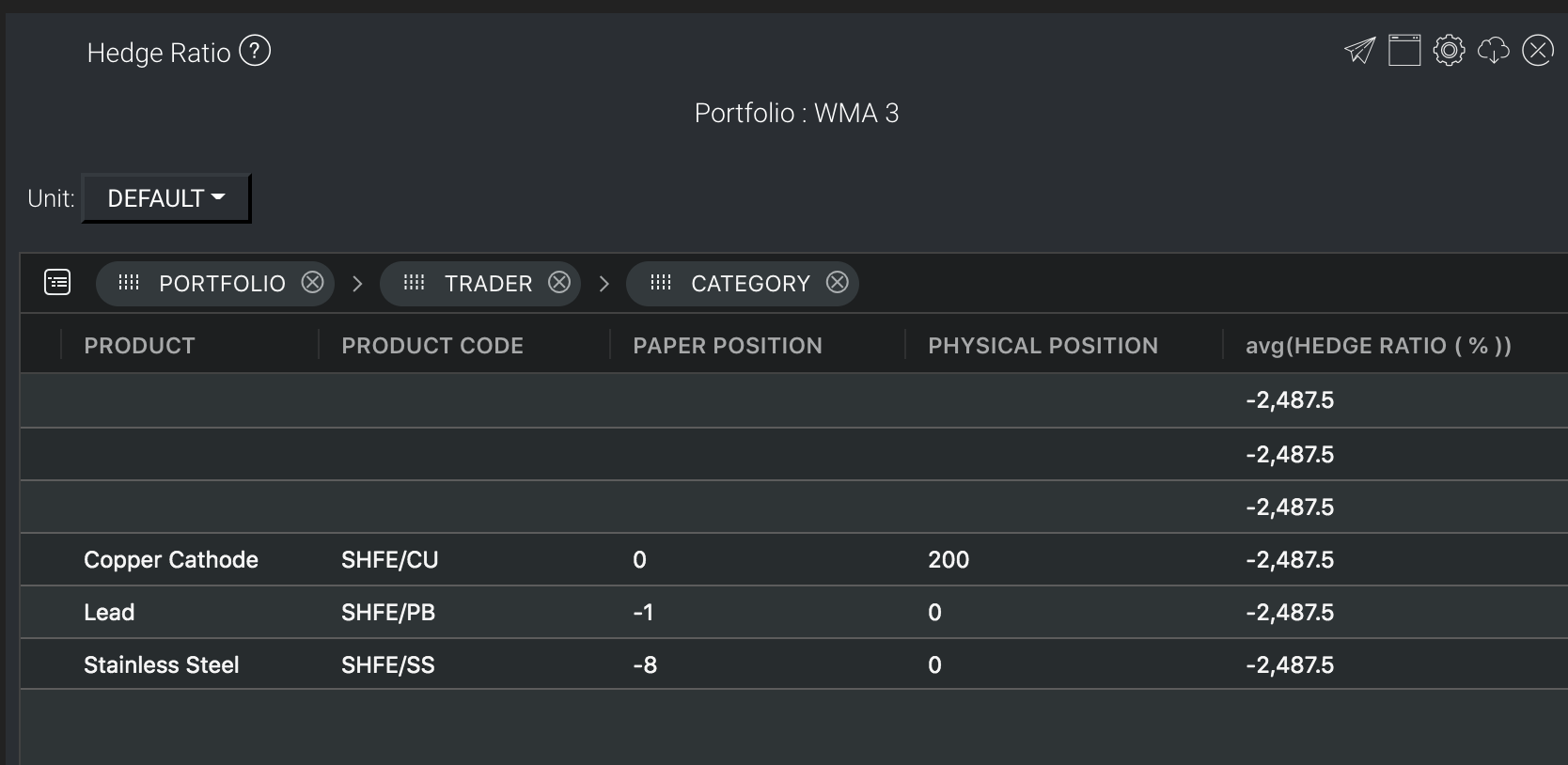

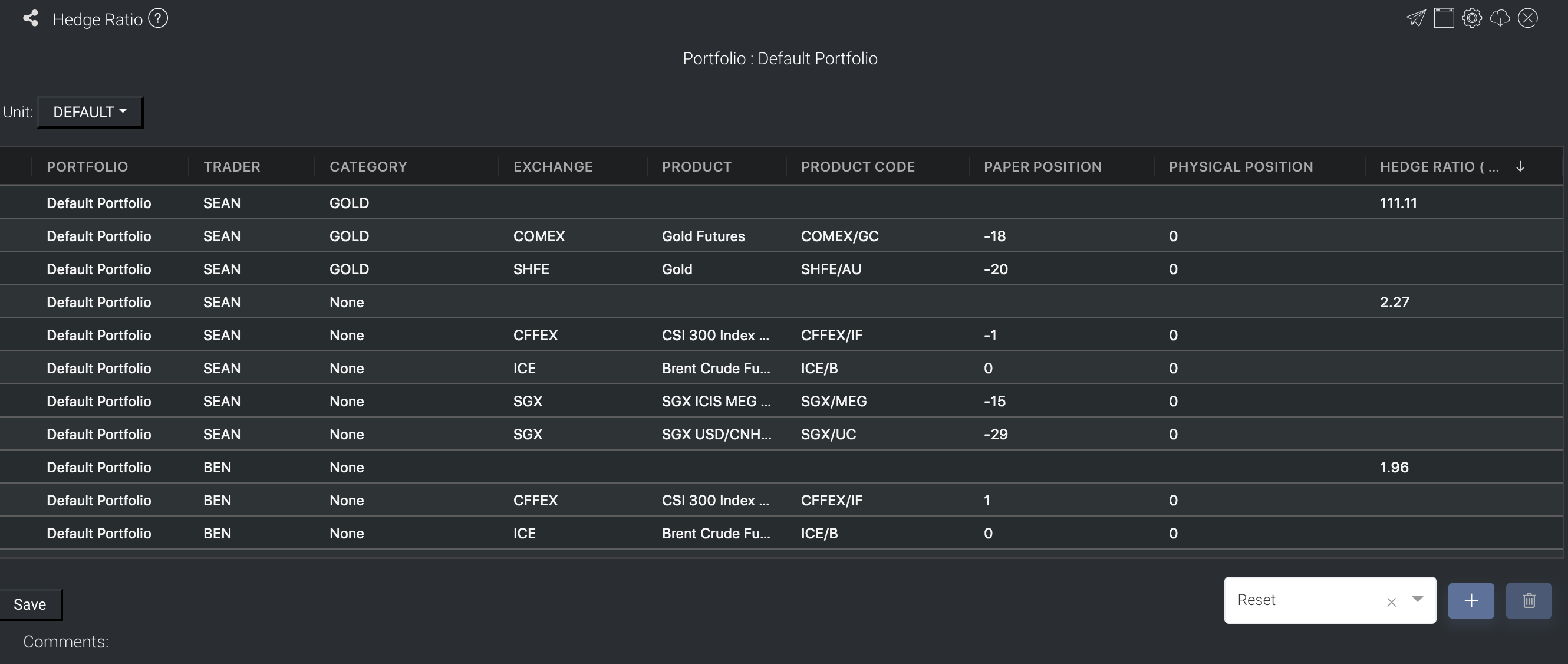

The Hedge Ratio model provides an overview of all paper and physical trades positions and their hedge ratio, categorised according to portfolio, trader and category (by default). You may adjust the grouping according to your needs. Definition of Hedge Ratio can be found here. All your paper and physical trades positions in the selected portfolio will be displayed in the model and used to calculate the hedge ratio.

The rows are the various categories of assets in the portfolio while the columns indicate product information such as trader, category, paper position and physical position. The table acts like a pivot table and can be categorised and organised by groups according to your needs. You can click here to learn how to customise the table by arranging and filtering the columns based on your preference, and saving the table layout(s) as a template.

Navigation

To access the quantitative model/report, click on 'Dashboard' from the navigation sidebar on the left.

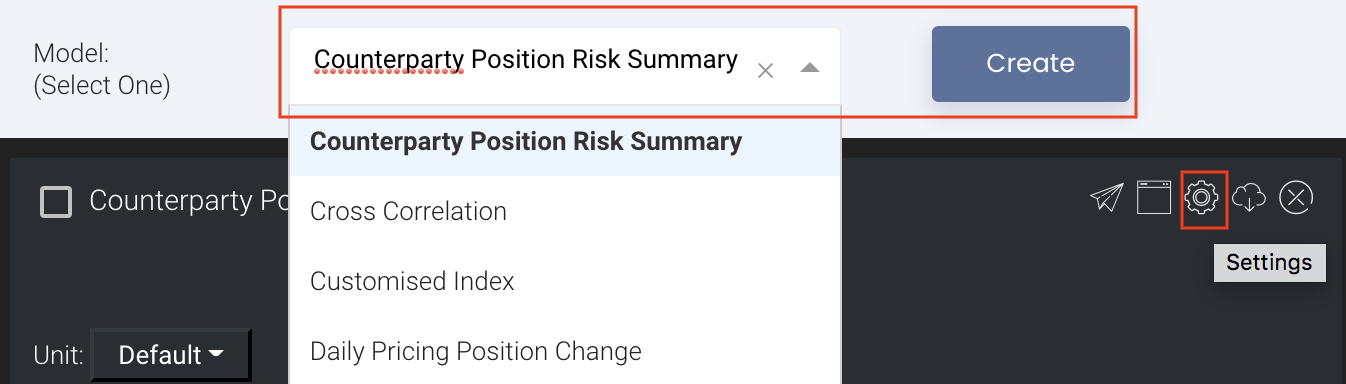

Select the model/report from the drop-down list and click 'Create'. Click on the 'Settings' button (gear icon) at the top right corner of the model to set up your model/report.

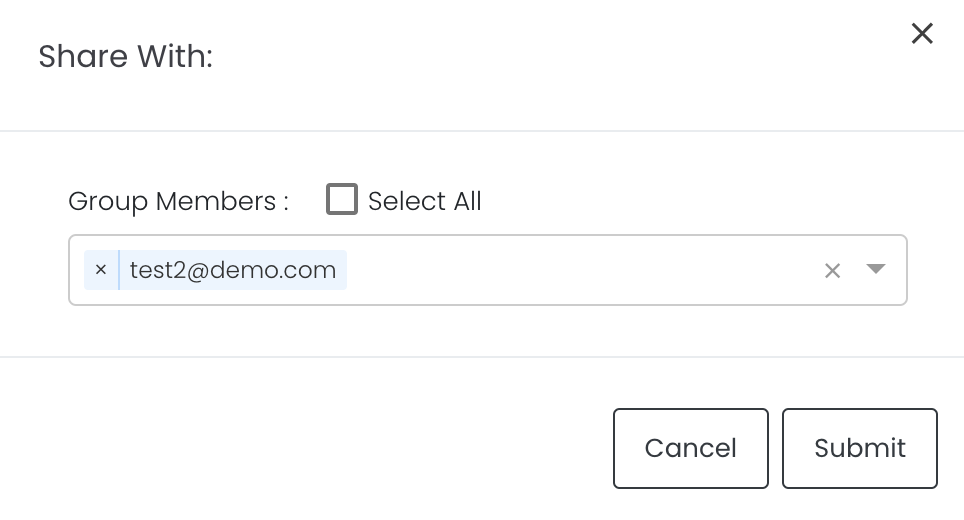

Sharing Model/Report/Dashboard

To share the model with your group members, click on the "Share" button next to the Title of the model followed by the email address of the group members you want to share it with. Once submitted, the model will appear in the Dashboard>Group Dashboard of the selected group members.

This is different from sharing individual or entire Dashboard models/reports, which allows any user who may or may not be users of MAF Cloud to access the individual model/entire dashboard via the shared web link (link will expire in 8 hours). In Group Dashboard, only group members can access the shared models/reports.

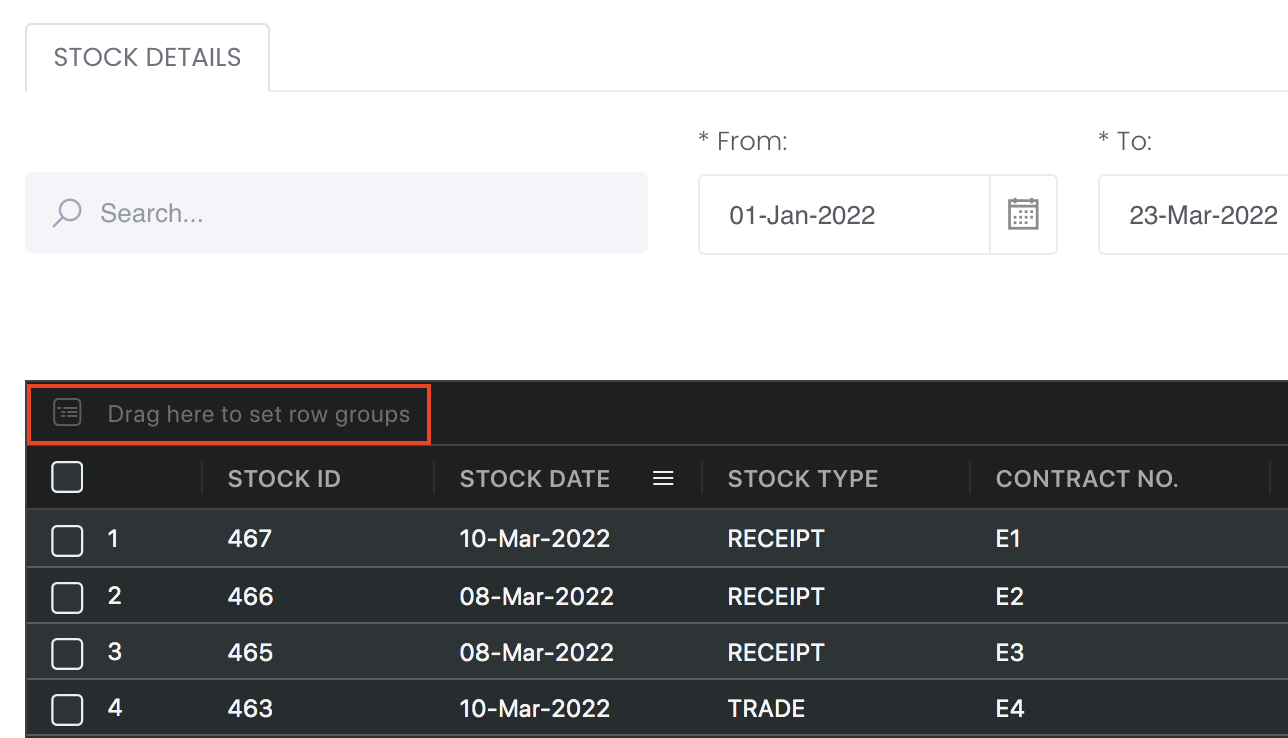

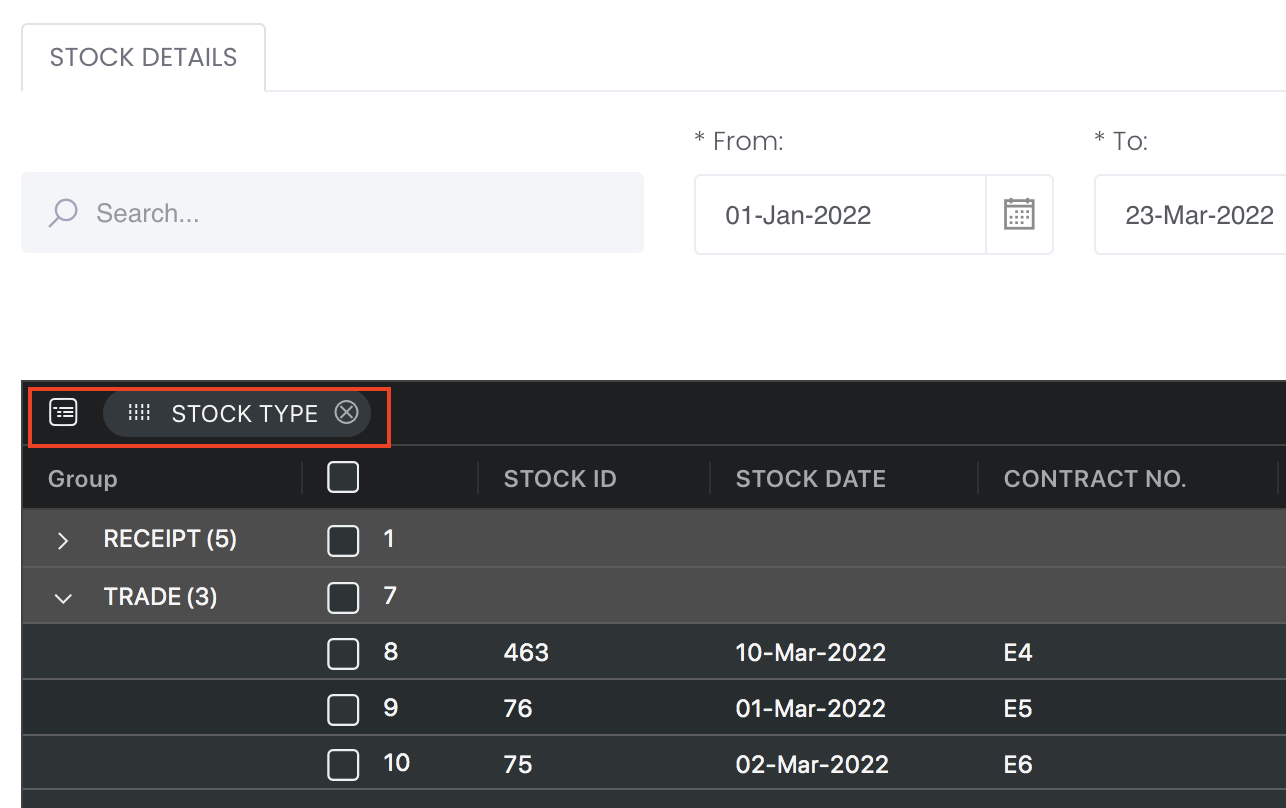

Group Rows

You may also group the rows (liken to the pivot table function in Microsoft Excel) to view the grouped data by dragging any column headers into the “row groups” section as highlighted:

Note:

- The Hedge Ratio model only shows outstanding/existing positions. For example, if the paper trade’s Valuation Date is over, the trade will not appear in the model. If ESTIMATED PRICE or ACTUAL PRICE is input, the contract will not show in the model as well.

- Product coefficient is 1 by default and is applied to both paper and physical trades.

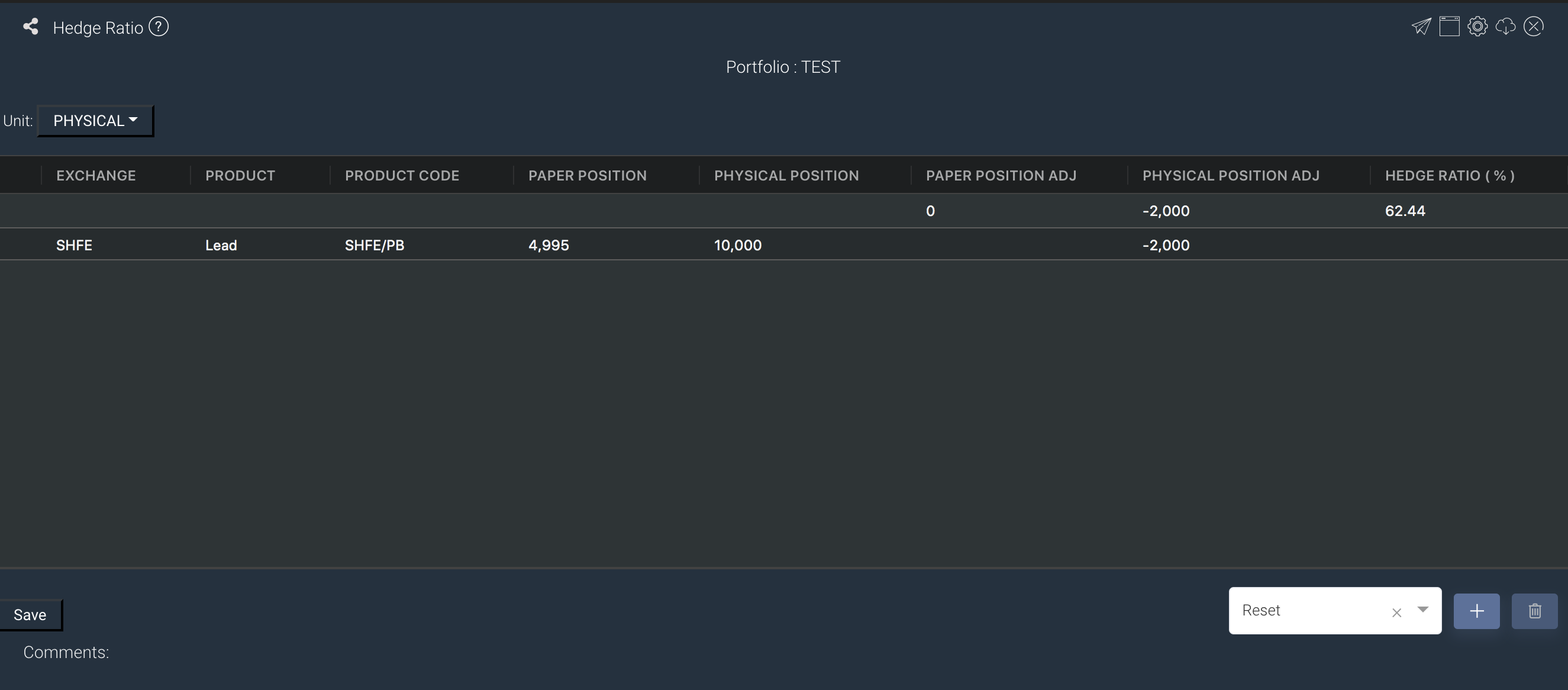

Hedge Ratio Paper and Physical Position Adjustment:

- You can input the position adjustment value (positive/negative sign) in both Paper and Physical Position Adjustment columns which will be added to the respective paper or physical trades positions to form the total positions. Click on SAVE button to save the value. Hedge Ratio will be calculated accordingly.

For example, if physical position is 700, Physical Position Adj is -200, total physical position will be 500. Physical Position Adj will be summed up in group master row. Then the adjusted positions will be used to calculate the hedge ratio

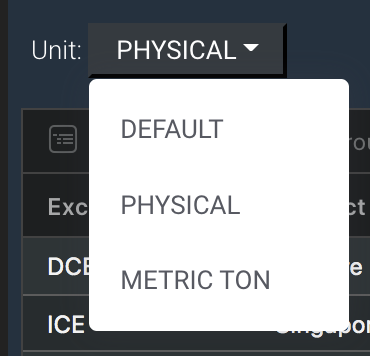

- Please note that in order to use this function, you need to change the UNIT at the side to PHYSICAL or METRIC TON.

Calculations for Hedge Ratio:

Default

- Calculation for Hedge Ratio = Sum (all paper positions with exchanges in China) / sum (rest of the positions) * 100 %

Exchanges in China: [SHFE, DCE, ZCE, HXCCE, CFFEX, INE, COTC]

- Calculation for Hedge Ratio should apply to coefficient: e.g., PAPER POSITION is 100, but coefficient set by the user is 0.9, then it should be "0.9 * 100 + others".

Customised

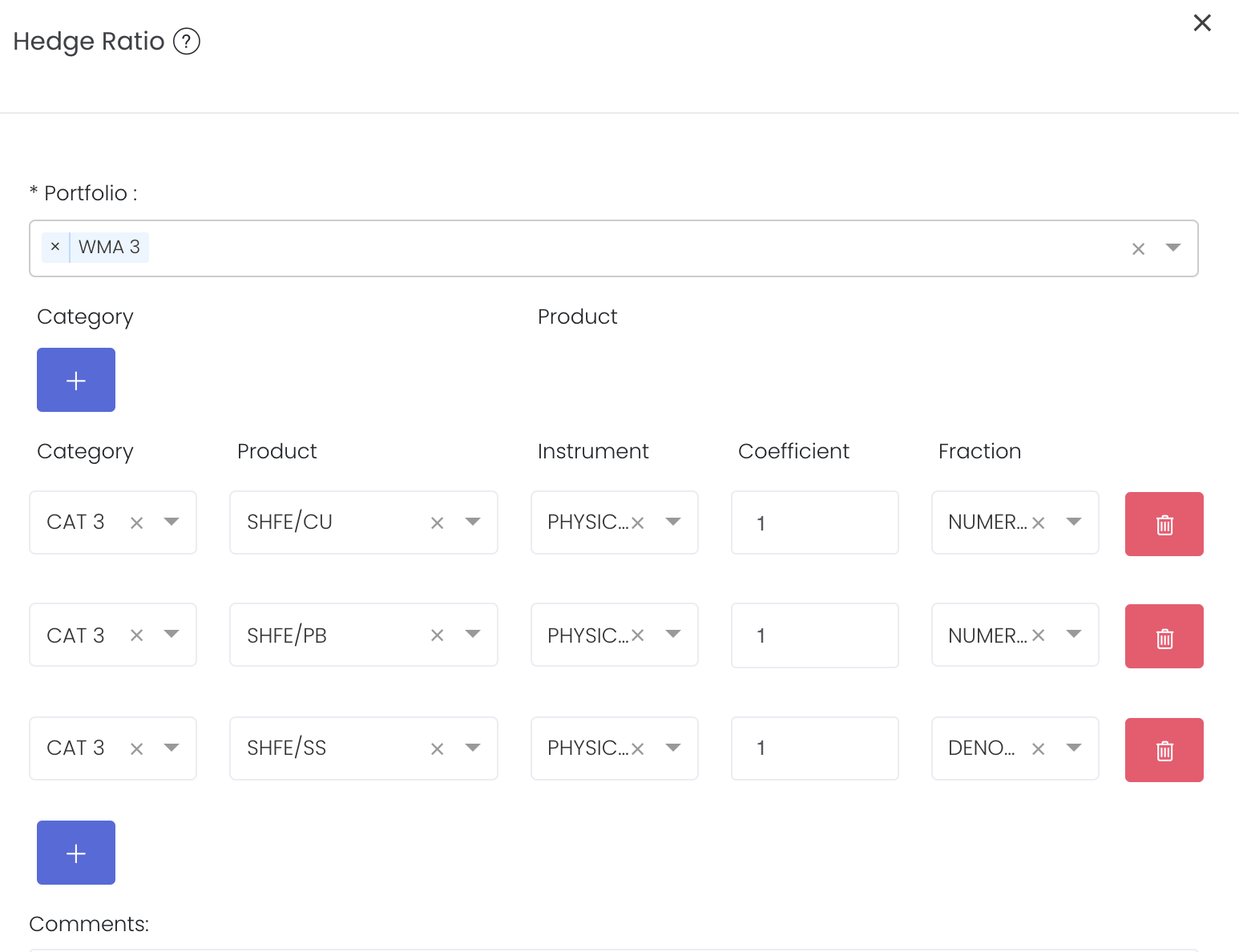

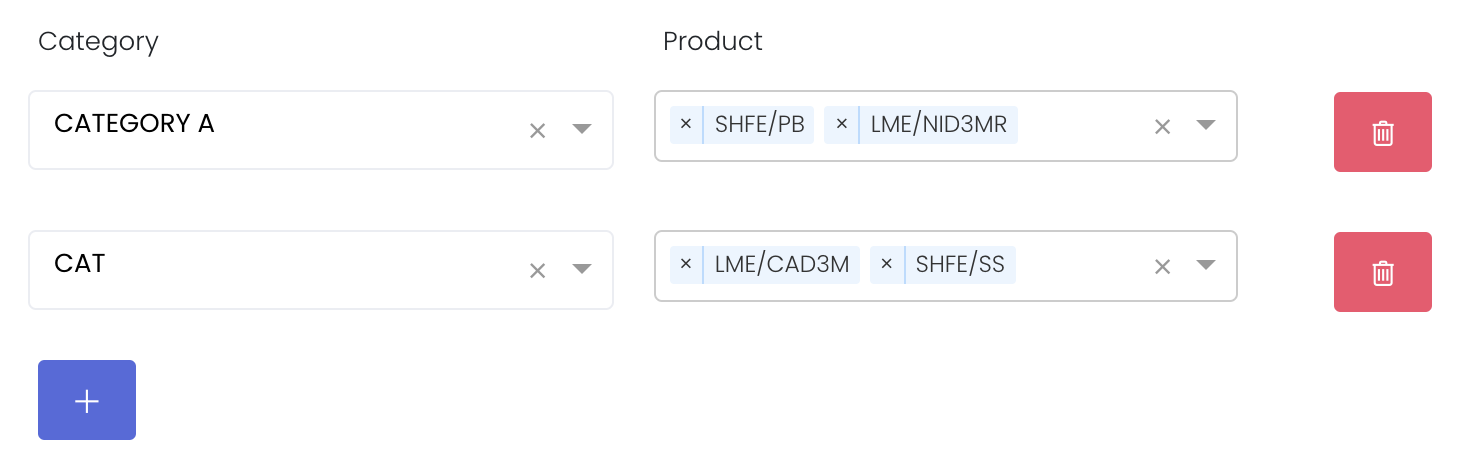

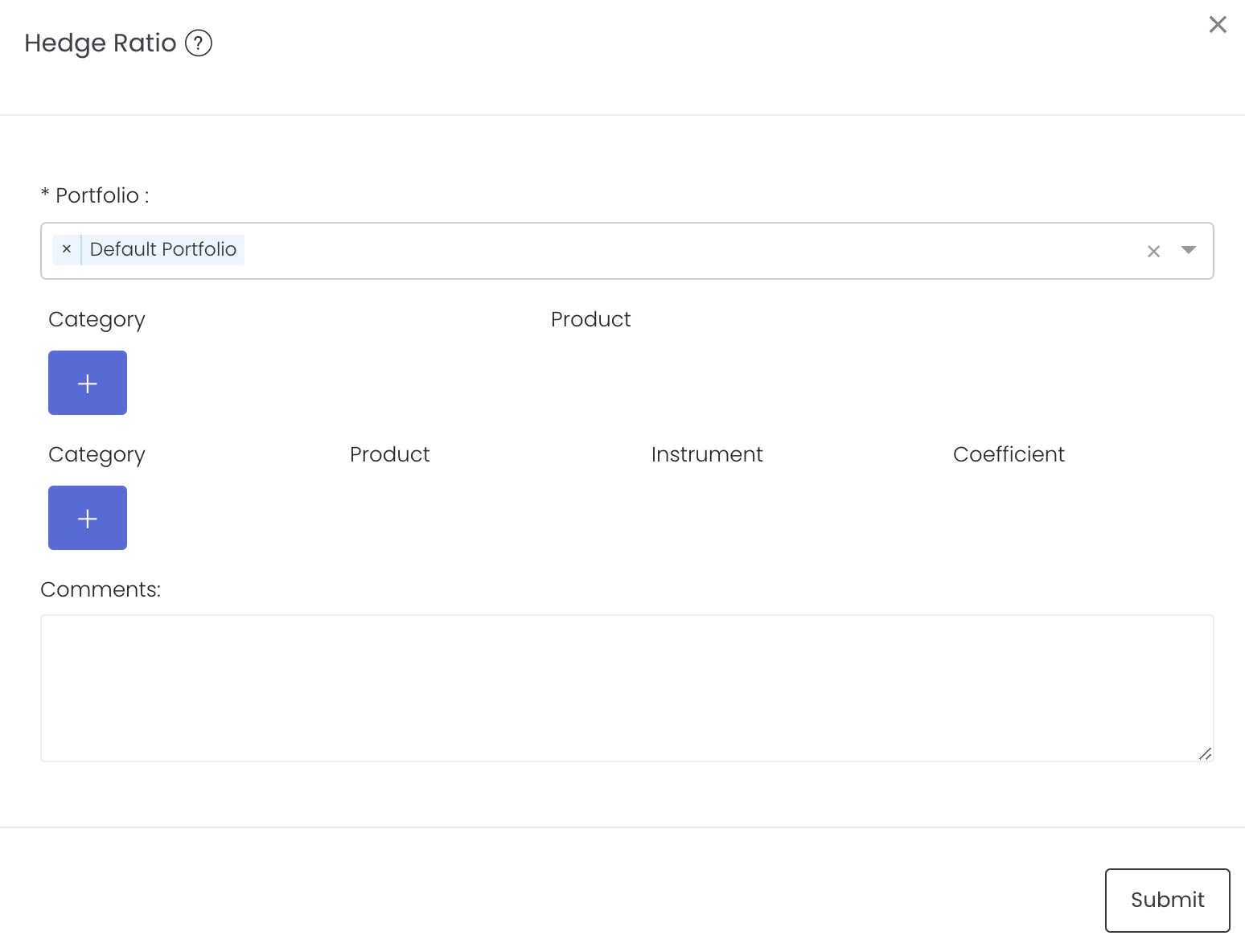

If the above default calculations do not apply to you, you may choose to customise the calculations by placing different products on the numerator or denominator according to your needs. If you did not set up this setting, hedge ratio's calculation will use the above default method.

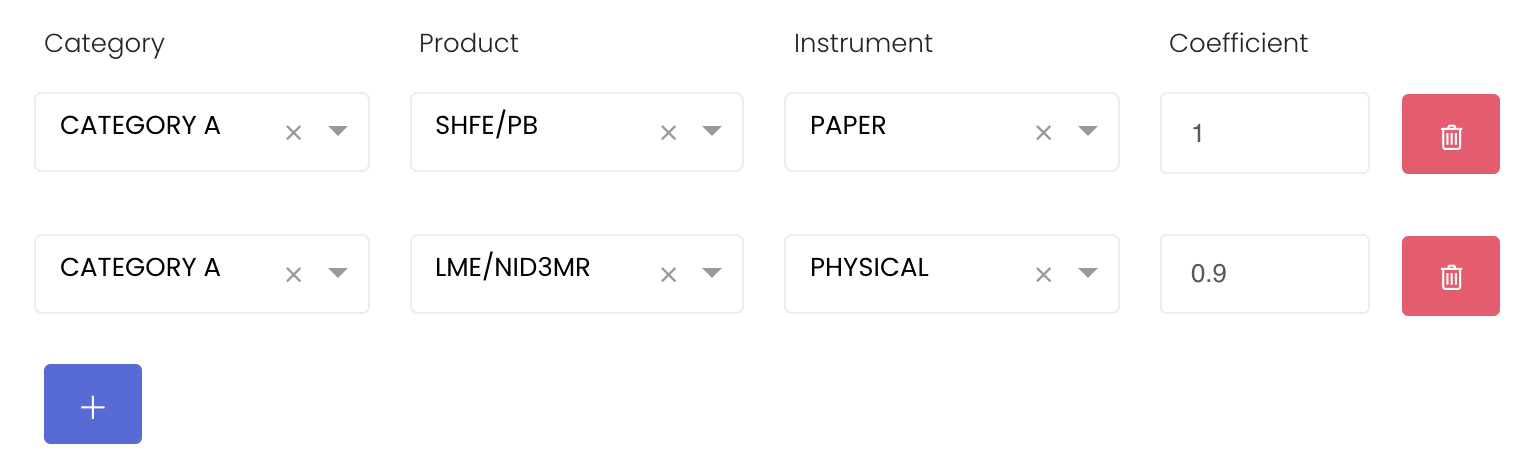

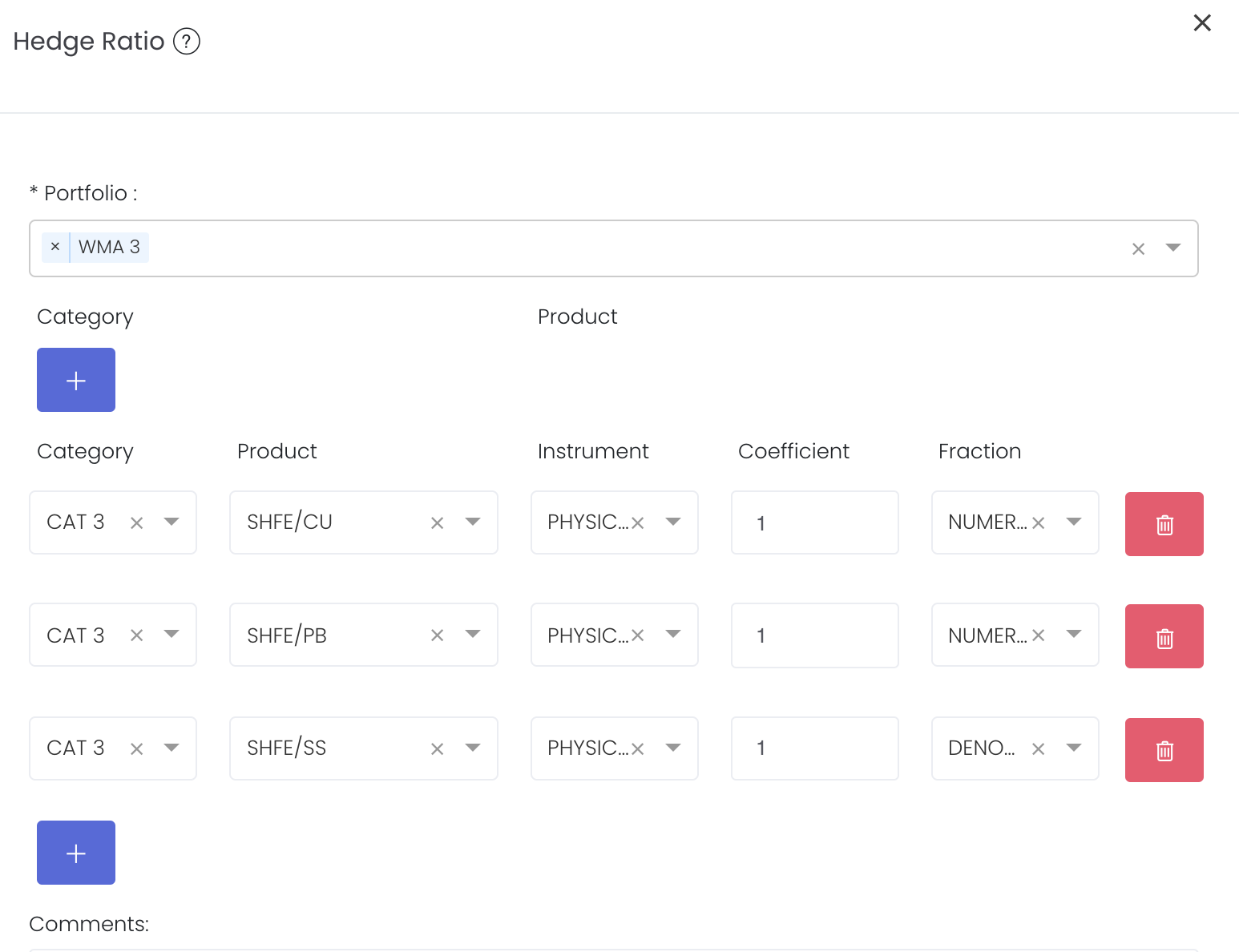

For example, if I want SHFE/CU and SHFE/PB to be on the numerator, I can select the Category, Product, Instrument, Coefficient, and select NUMERATOR for the Fraction; and put DENOMINATOR for SHFE/SS.

Click on "Submit" and the hedge ratio will be calculated according to your customisations = (SHFE/CU+SHFE/PB)/SHFE/SS * 100 = (-1+200)/(-8)*100 = -2487.5

Trades will be categorised according to the Path: TRADER>CATEGORY>PORTFOLIO>STRATEGY by default. The Hedge Ratio will be calculated for each path.

CURRENT LOGIC:

- If the contract is not sold yet, P/L will remain as unrealised P/L, even when TITLE TRANSFER DATE is input. So once contract is sold, it will be closed and P/L will be realised P/L

- To close a contract, ACTUAL PRICE and TITLE TRANSFER DATE must be input

- Only contracts with the same CATEGORY can close each other

- For contracts under the same CATEGORY, sales contract must have TITLE TRANSFER DATE and ACTUAL PRICE to close purchase contract; purchase contract will be closed on a FIFO basis; CLOSE DATE of the closed contract will be the same as the sales contract's TITLE TRANSFER DATE

- HEDGE RATIO, POSITION MATRIX and PHYSICAL TRADE INVENTORY model will only show outstanding positions. If ESTIMATED PRICE or ACTUAL PRICE is input, the contract will not show in the model

Tick 'Excl T Plus' (Exclude T Plus)

The "EXCL T PLUS" tick box determines if T plus trades (T+1) should be included in the portfolio calculation.

So if the tick box is checked, the system will filter out T+1 trades based on the End Date, so the P/L and positions of the portfolio will be calculated accordingly.

If the tick box is not checked, the system will include T+1 trades into the portfolio calculations.

For example, End Date is yesterday 07 Dec 2021, one of the trades (trade date is 07 Dec 2021) is T+1. If "EXCL T PLUS" tick box is checked, the system will filter out this trade and do recalculation for the P/L and positions in the portfolio.

Purpose:

In China futures markets, night trading session is considered next day trade (if user trades at 07 Dec 2021 in night session, the trade date is 08 Dec 2021, so the trade is only shown in 08 dec 2021 statement). However, in some exchanges, e.g, CME, there is no such arrangement. It will be considered 07 Dec 2021 trade date and shown in 07 Dec 2021 statement.

There will be a case when the user wants to standardise the date when they trade spread trading (e.g., BUY SHANGHAI COPPER and Sell COMEX COPPER in night session). In broker statements, SHANGHAI COPPER is shown in 08 Dec 2021 and COMEX COPPER is shown in 07 Dec 2021. So once you tick "EXCL T PLUS", and End Date is 07 Dec 2021, then COMEX COPPER trade will be filtered out and portfolio P/L and positions will be recalculated.

Guide

Name | Images/Description |

|---|---|

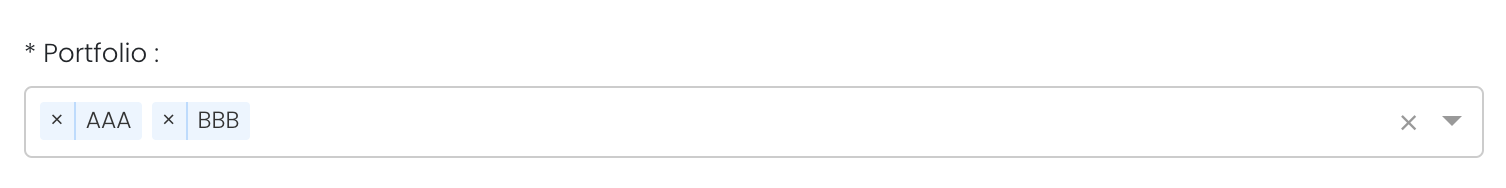

Portfolio | Select a portfolio of interest. You may select multiple portfolios to be displayed in the model. |

| Excl T Plus | Tick: Exclude all trades with "T PLUS" (eg T+1) and portfolio P/L and positions will be recalculated Untick: Include all trades with "T PLUS" (eg T+1) and portfolio P/L and positions will be recalculated |

Filter | Remove Product Filter If you do not want certain products to be displayed in the model, you can filter them out.

To remove the filter, click on the red bin button on the right. All products will be displayed as per default. Note: that you will only be required to do this once and the setting will be saved in that model. Coefficient Setting Coefficient is 1 by default and applies to both paper and physical trades. If you want to set specific coefficient for each product, you can use this setting. Otherwise, you can keep this empty. Click on the blue "+" button and select the category and product from the dropdown list. Select the instrument and input the coefficient. Once done, click 'Submit' and the Hedge Ratio model will be updated according to your settings. Fraction Setting Calculations for Hedge Ratio: Default

Customised You may choose to place different products on the numerator or denominator according to your needs. If you did not set up this setting, hedge ratio's calculation will use the above default method. For example, if I want SHFE/CU and SHFE/PB to be on the numerator, I can select the Category, Product, Instrument, Coefficient, and select NUMERATOR for the Fraction; and put DENOMINATOR for SHFE/SS. Click on "Submit" and the hedge ratio will be calculated accordingly = (SHFE/CU+SHFE/PB)/SHFE/SS * 100 = (-1+200)/(-8)*100 = -2487.5 |

Comments | The inserted comments will be displayed at the bottom of the application. This can be useful for documentation purposes or for settings description. |

Input

Name | Description | Type | Example |

|---|---|---|---|

| Portfolio | Portfolio selected | Portfolio (Selection) | ABC |

| Category | Category of product | Text | Copper |

| Product | Name of product | Text | LME/NID3MR |

Instrument | Physical or Paper Trade | Text | Physical or Paper Trade |

| Coefficient | Coefficient of product for hedge ratio | Number | 1 |

| Comments | Useful for documentation purposes or for settings description. | Text | - |

Output

Description | Type | |

|---|---|---|

Product/Strategy Information | The trades are automatically categorised into their respective groups to provide a comprehensive overview of paper position, physical position and hedge ratio.

You can reorganise your data by dragging-and-dropping the columns at the top of the table to 'set row groups'. | Text |

| Unit Selection | Units are displayed as Lots by default. To change the units, select from the dropdown list. DEFAULT: Units displayed in lots PHYSICAL: Units displayed according to the physical trade's units (eg Metric Tons) | Text |

Example

Functionality

Please refer to Table Settings for table functionalities.

Definition of Terms

Please refer to List of Definitions: Trades.

Click to access: