Creating a Strategy Product

Return to Overview

The 'Create Strategy Product' function allows the user to create customised and self-defined strategies in the product database which are combinations of single products or contracts. For example, the user can create a spread position where he/she simultaneously holds long and short positions of different maturity times for the same product.

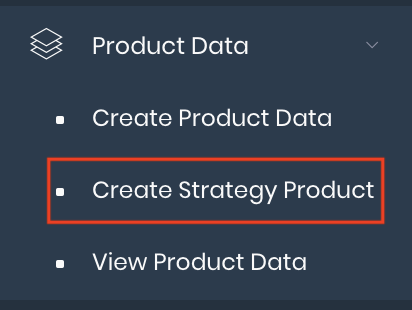

To access, click 'Create Strategy Product' under 'Product Data' in the navigation sidebar on the left.

The Position Matrix will then display the net positions of these customised strategy products, if applied into the model. See 'Using Strategy Products' below for more information.

Creating a Strategy Product

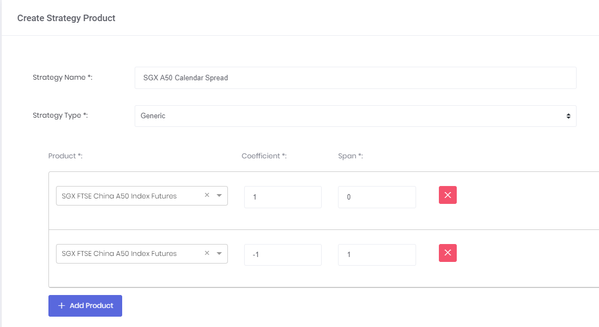

Strategy Name: You can freely choose the strategy's name.

Strategy Type:

- Generic: Any defined strategy type.

- Q/H/F: Quarterly/Half-Year/Full calendar strip strategy.

- Group: The user groups the selected products together to view as a single product.

Product: Name(s) of products included in strategy

Coefficient: A multiplicative number

- Example: -1 means the outright contract has the opposite direction of strategy direction and multiplying coefficient is 1

Span: Time interval of the product's contract (relative to the strategy) in months

- Example: 0 means current month contract (main contract), 1 means the contract is 1 month later than the main contract, and so on

Example of A50 Calendar Spread:

This strategy product is a combination of the following: a long position on a product (SGX FTSE China A50 Index Futures) with maturity on a given (current) month, and an equal short position on the same product with maturity 1 month later. A time-series of this strategy product will show the price differential across a 1-month maturity difference.

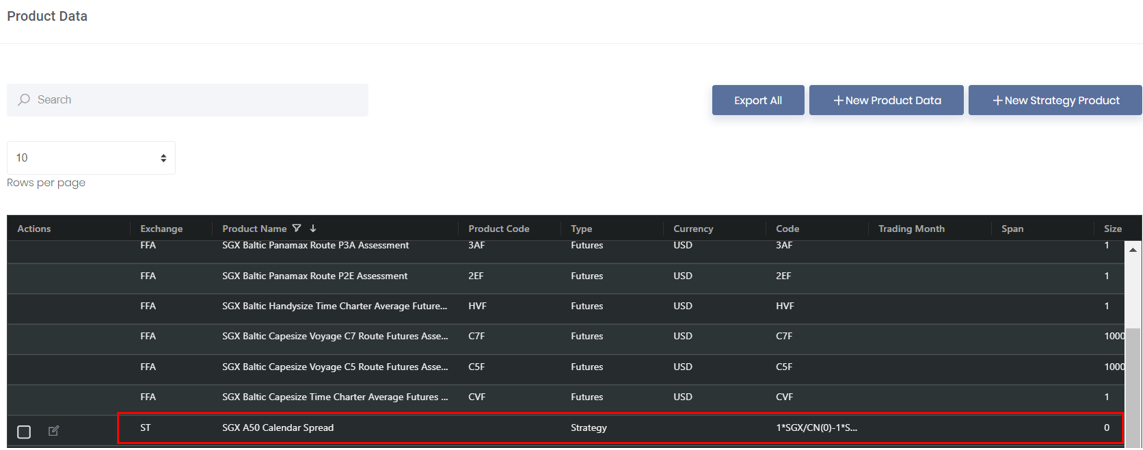

Once the strategy is created, you will be able to find your newly created strategy product in the product database (with its name and formula shown, for easier reference).

Using Strategy Products

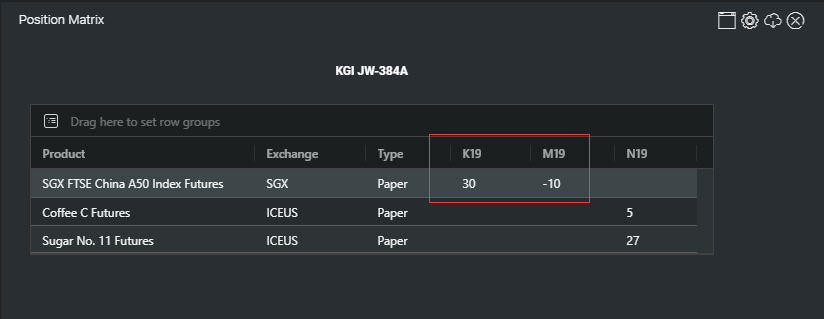

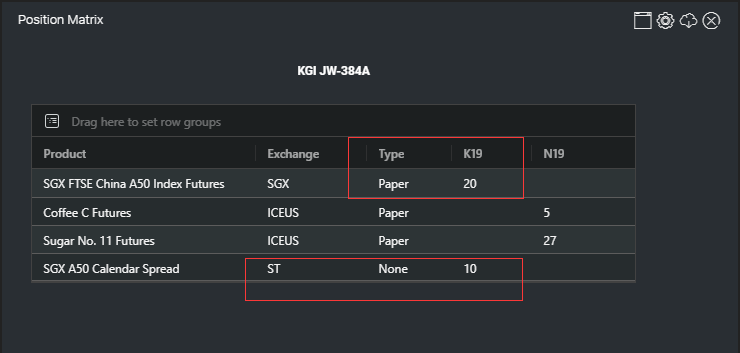

The Strategy Products you have created may be used when you open the 'Position Matrix' and 'Daily Pricing Position Change' models in your 'Dashboard'.

The 'Position Matrix' model summarises the net positions of products held in the selected portfolio, for various maturities. Meanwhile, the 'Daily Pricing Position Change' model calculates the changes in the position(s) in your portfolio, due to daily pricing, for that trading day. The default (without any strategy products chosen) will display the positions of the original contracts. By selecting the strategy product(s) when inputting into the model, the effect(s) of the strategy product(s) selected will be shown.

For example:

Before Strategy

SGX FTSE China A50 Index Futures net positions = 30* K19 - 10* M19

After Strategy

Added Calendar Spread strategy for SGX FTSE China A50 Index Futures (K19 - M19).

It displays the net position of SGX A50 Calendar Spread (K19 - M19) = 10

(Meanwhile, the positions used in forming the strategy, 10* K19 - 10* M19 , are deducted from the original positions.)

Functionality

Please refer to Table Settings for table functionalities.

Definition

Please refer to List of Definitions: Product Data for more details.

Click to access: