...

Models/Reports | Description | User Guide |

|---|---|---|

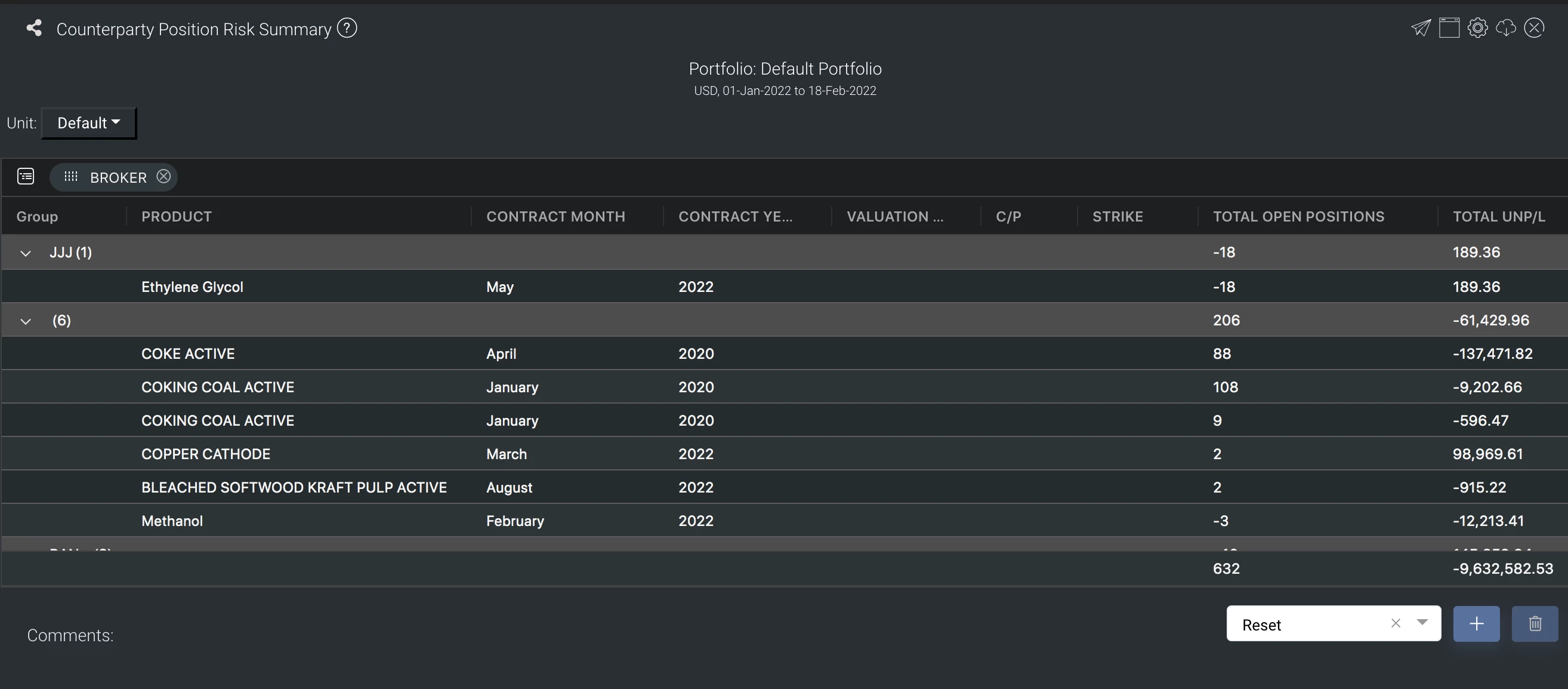

Counterparty Position Risk Summary客户头寸风险汇总 | Provides you with an overview of your risks - outstanding positions and their unrealised P/L from your Counterparty. The app is categorised according to Brokers by default. | |

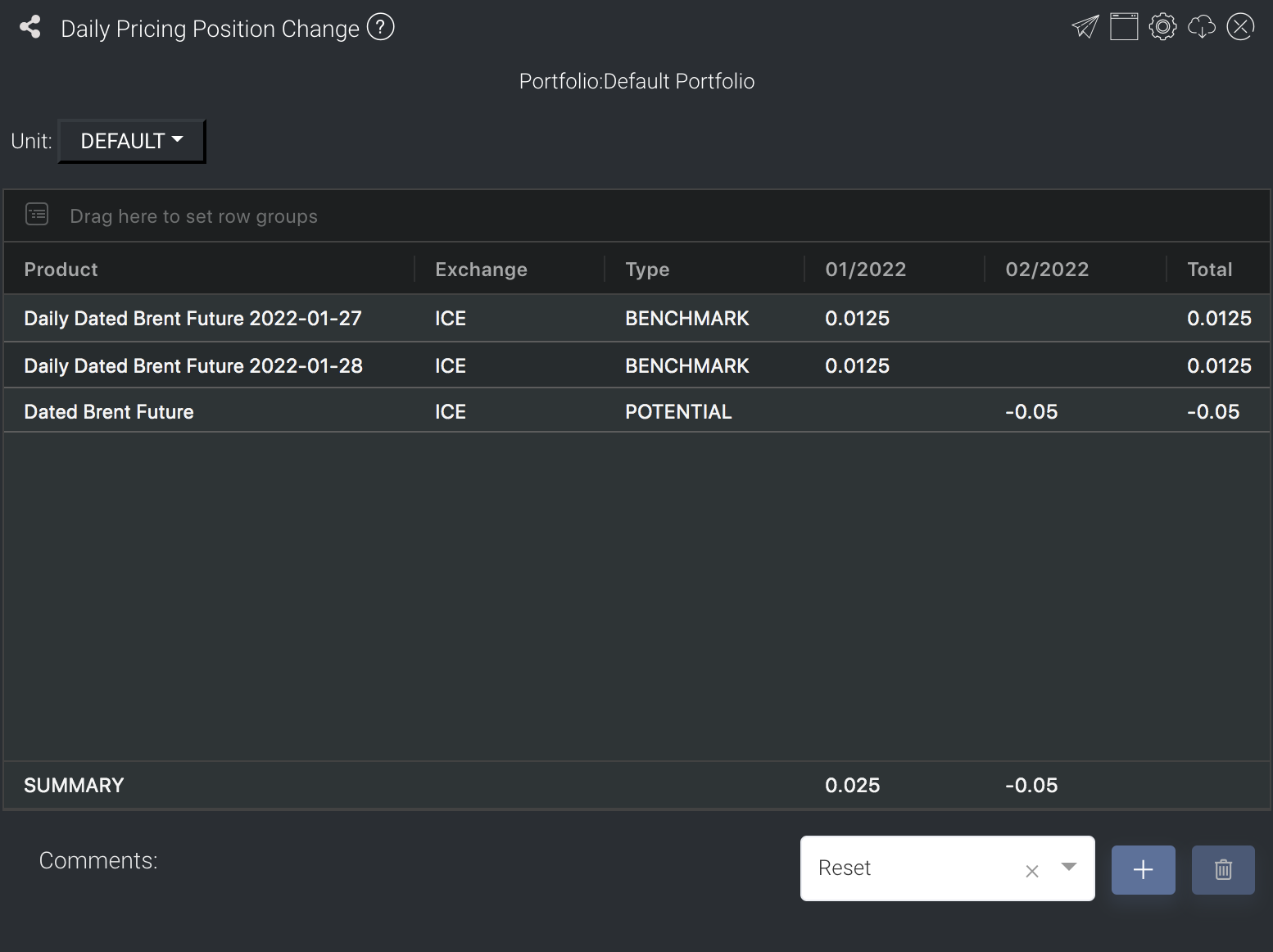

Daily Pricing Position Change | Calculates the changes in the position(s) in a portfolio, due to daily pricing, for that day. A certain number of positions in the portfolio will be priced by Platts each day, hence fixing their prices (and the position is changed from "open" to "closed"). | |

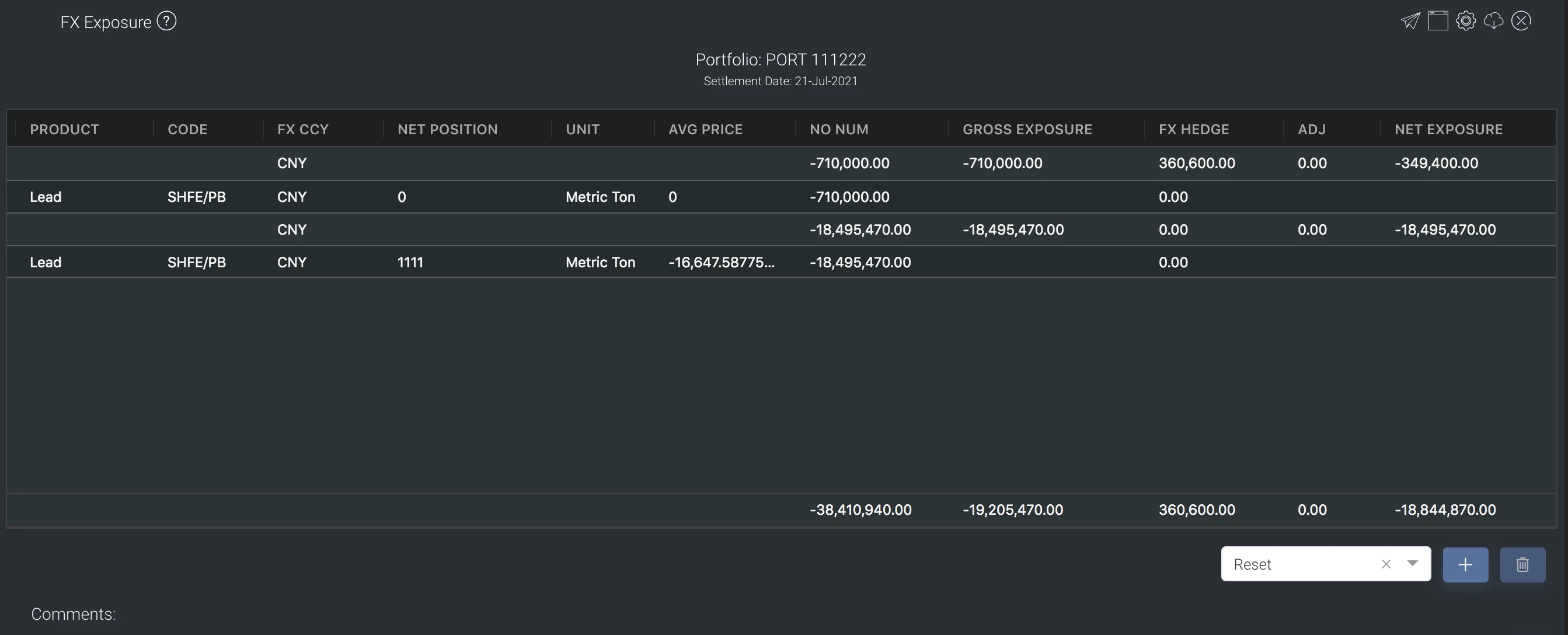

FX Exposure外汇敞口 | Allows you to monitor your hedging strategies and how much hedging is required for the FX exposure.国际贸易的外汇套保 根据货值数据来锁定 净敞口应该为0 | |

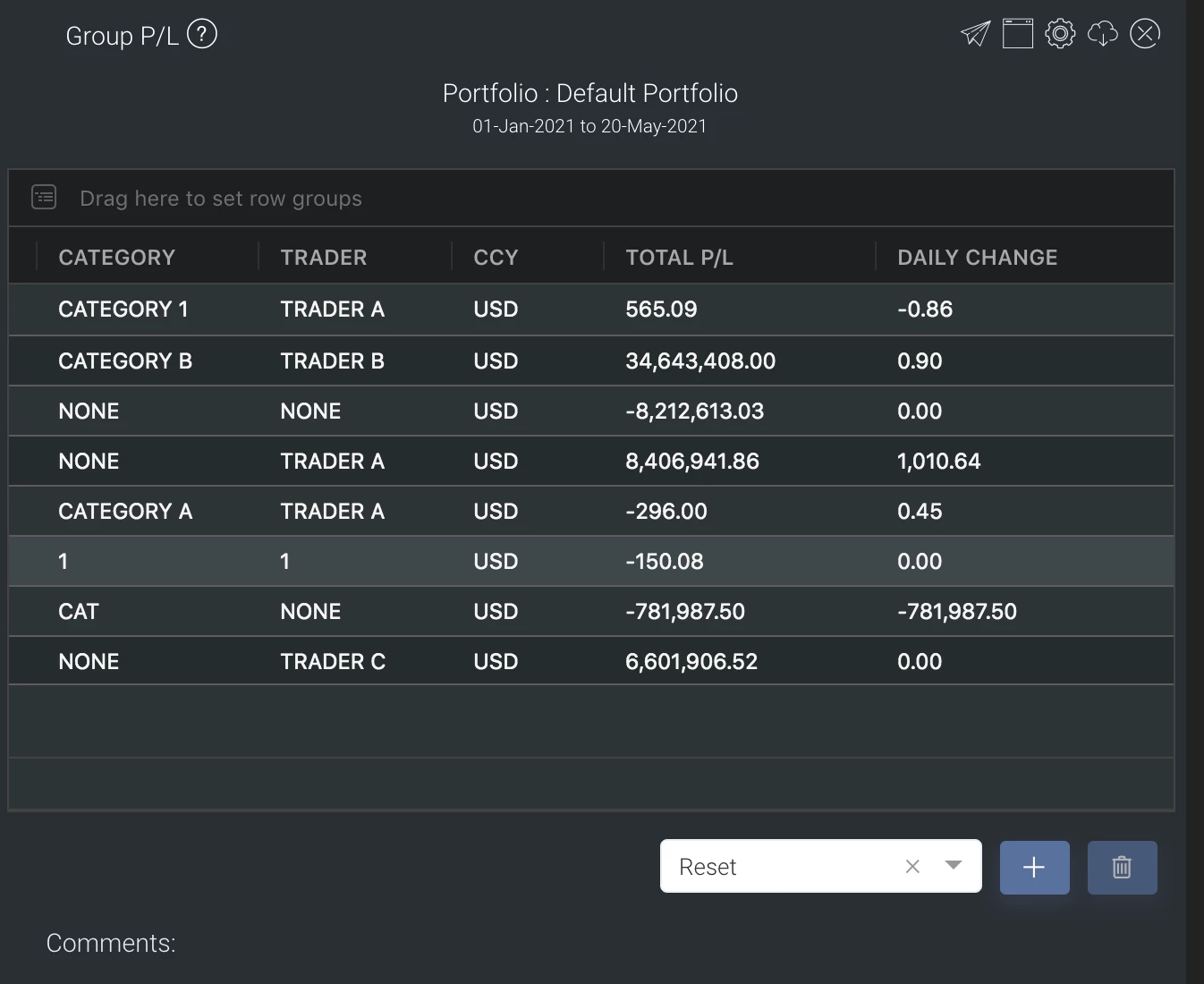

Group P/L组别盈亏 | Provides an overview of all trades and their total P/L, as well as daily change in P/L, commission and expenses/income details. This can be used together with Historical Group P/L. 可以看到品种、交易策略、公司、 交易员的不同维度来查看盈亏,以及总盈亏。也可以查看历史组别盈亏 | |

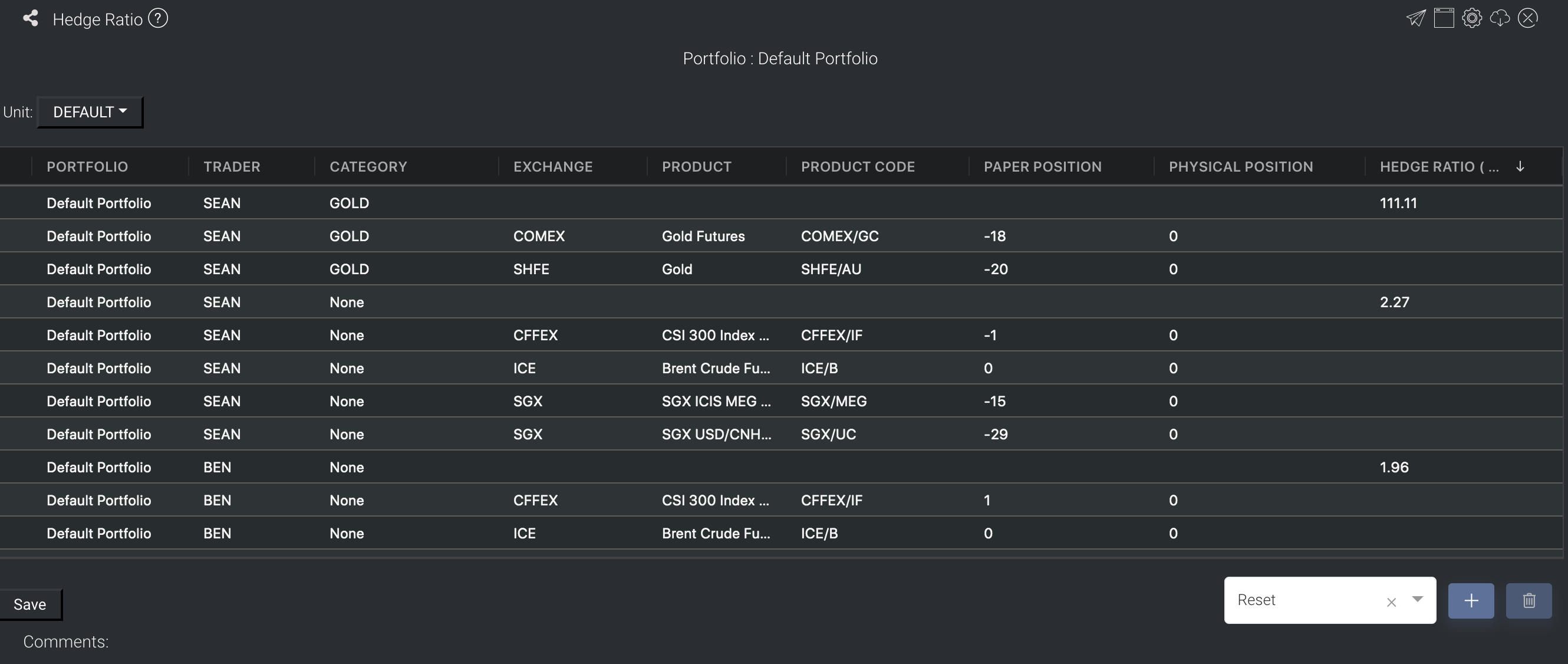

Hedge Ratio套保比率 | Provides an overview of all paper and physical trades positions and their hedge ratio, categorised according to portfolio, trader and category by default. 非标,内外盘,可以根据公司的保值比率情况来设置 | |

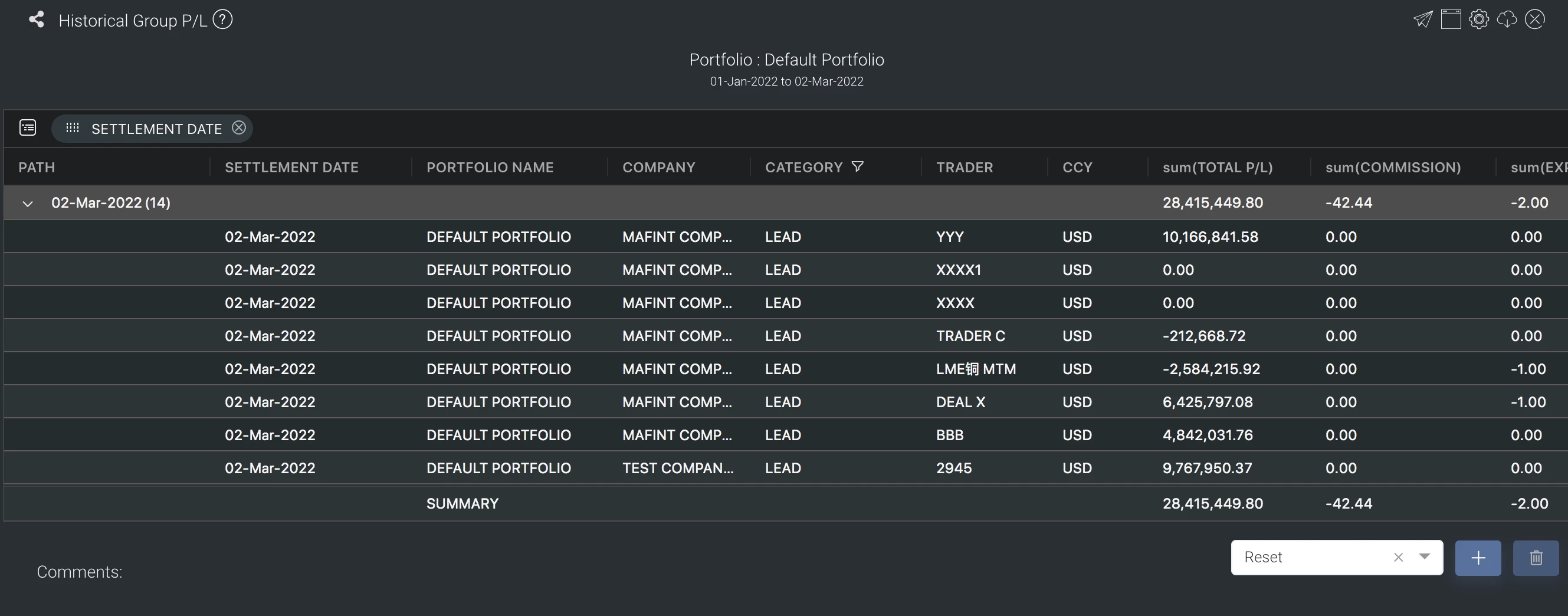

Historical Group P/L | Provides an overview of all historical trades and their total P/L, as well as daily change in P/L, commission and expenses/income details. This can be used together with Group P/L. | |

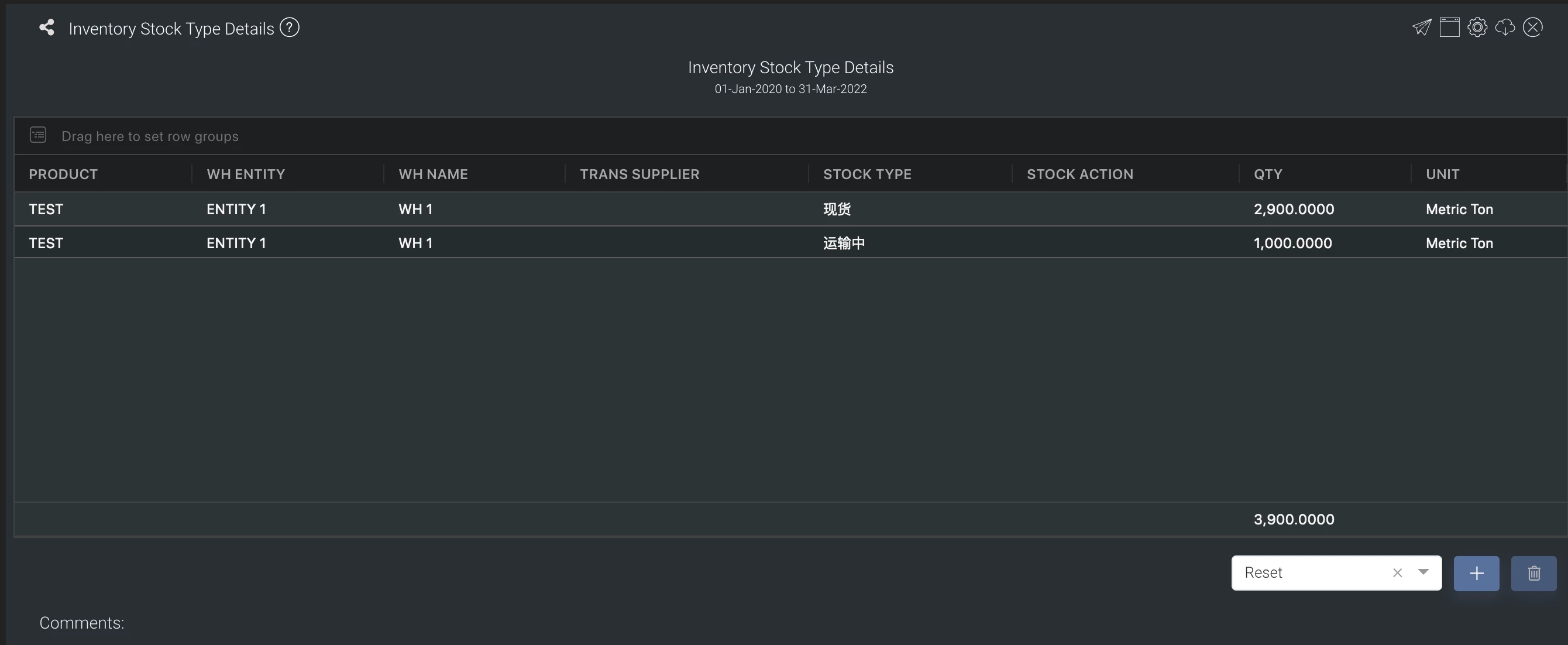

Inventory Stock Type Details | Provides an overview of the details of your inventory, categorised according to its stock type, warehouse and transportation supplier details. It displays the quantity for different types of inventory, warehouse distribution, and inventory details of the transportation logistics. | |

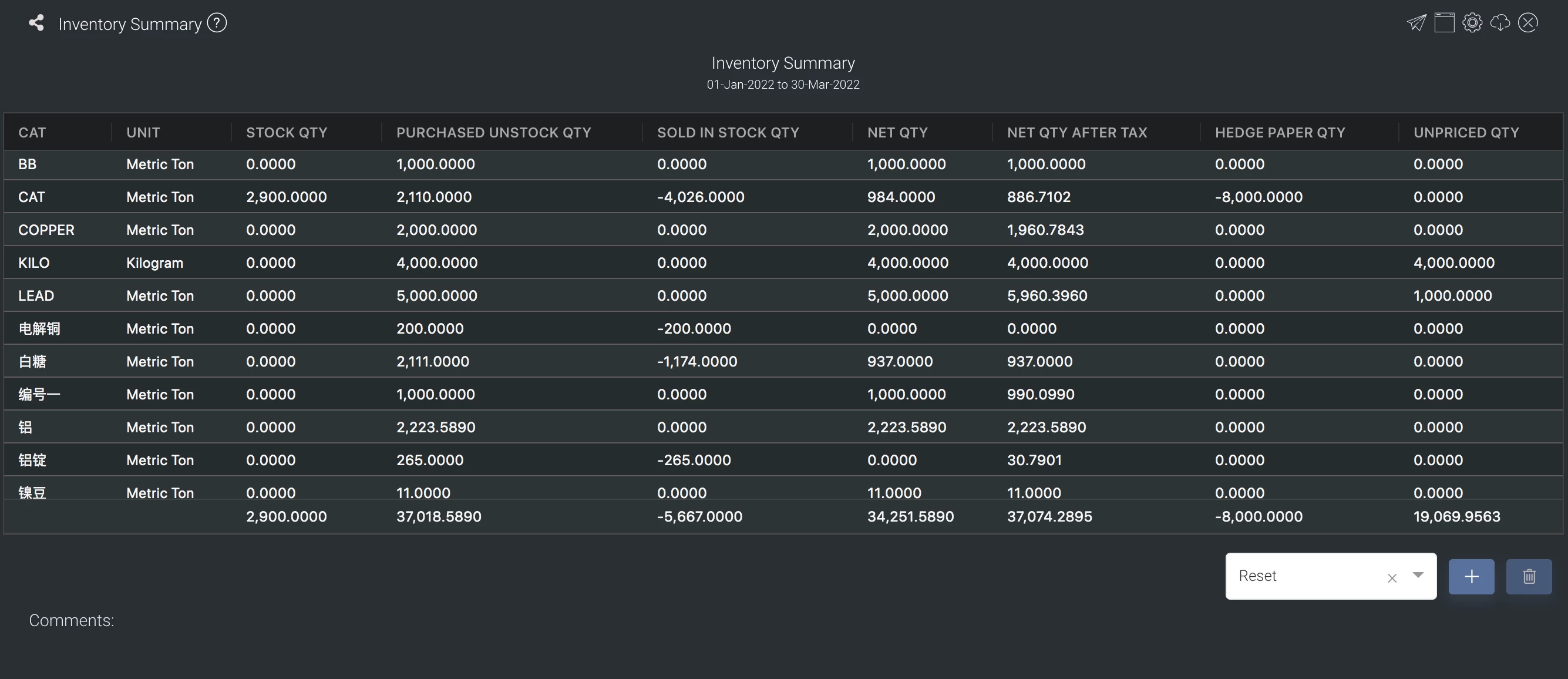

Inventory Summary | Provides an overview of the outstanding stock in and stock out inventory of all of your physical trades based on the contract and actual quantity of your stock, as well as futures positions. | |

Open Position Details | Allows you to view all the portfolio’s open positions and their details directly. This app is obtained directly from the Open Positions Table in View Portfolio page. | |

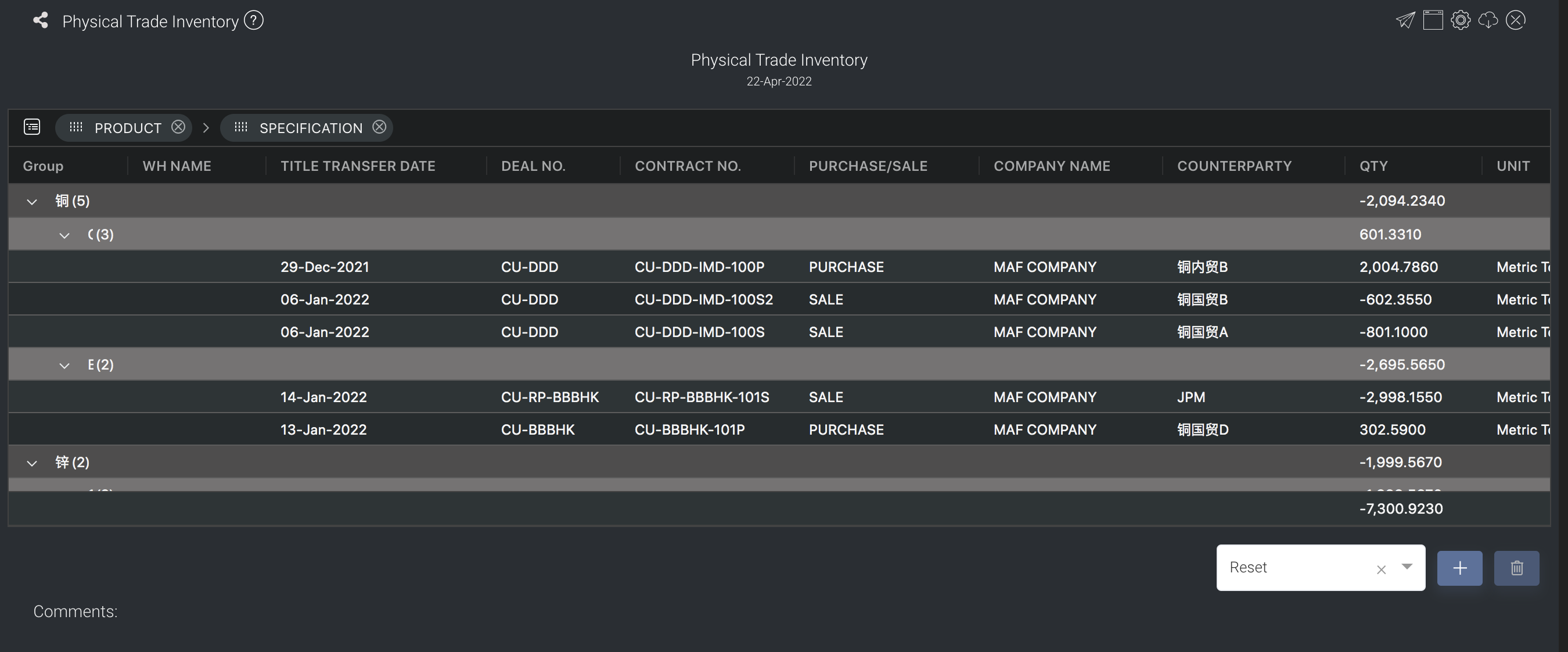

Physical Trade Inventory | Provides you with an overview of the spot contract inventory according to the actual transfer date of the goods and accurately grasp the actual situation of the transfer of goods in each contract. I | |

Physical Trade Status | Provides an overview of the spot contract status with stock delivery, payment and invoice quantity and amount. If the undelivered/open quantity and amount are displayed in red, it means that the inventory is not settled yet/has not been completed yet, allowing you to monitor and manage your outstanding contracts more efficiently. | |

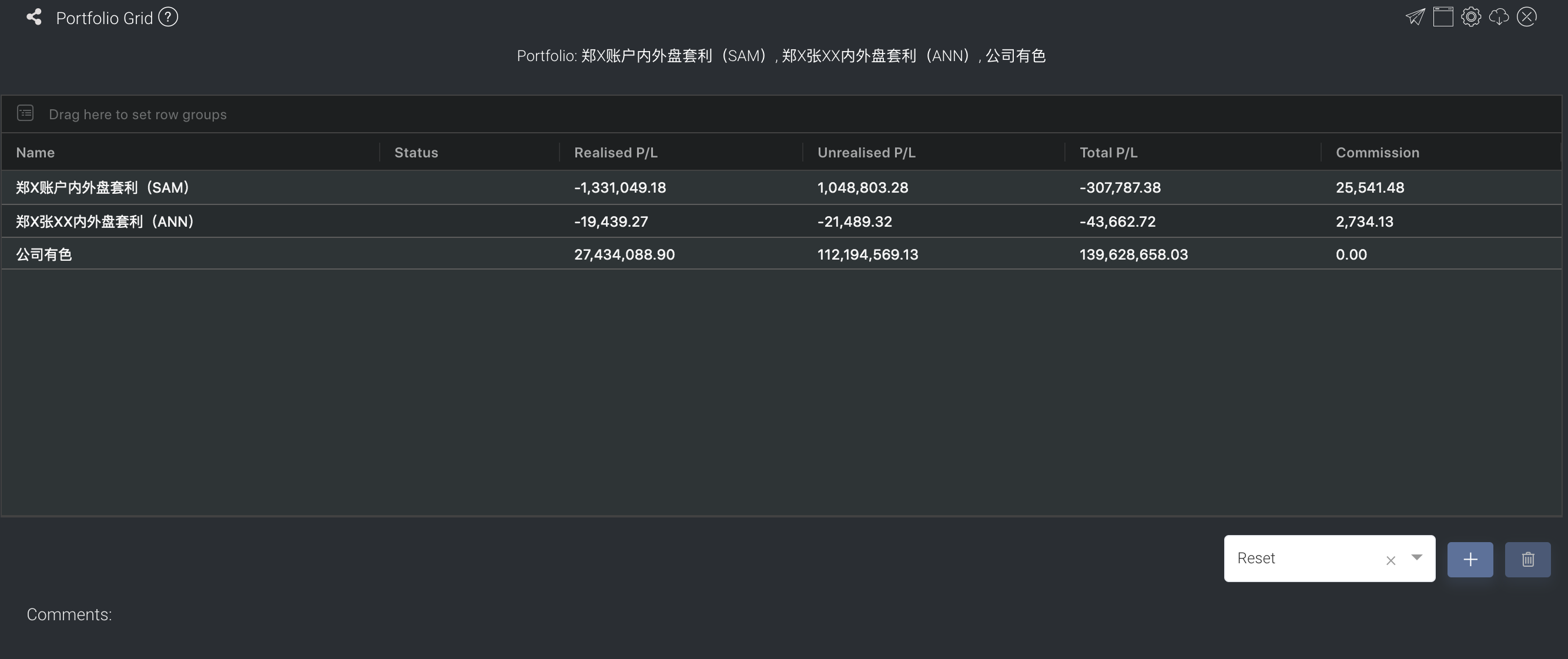

Portfolio Grid | Displays the selected portfolio's profit or loss (P/L) information, including realised P/L, unrealised P/L as well as its total P/L. | |

Position Matrix头寸表 | Displays the composition of assets within a portfolio and their open net positions. 头寸分布情况 | |

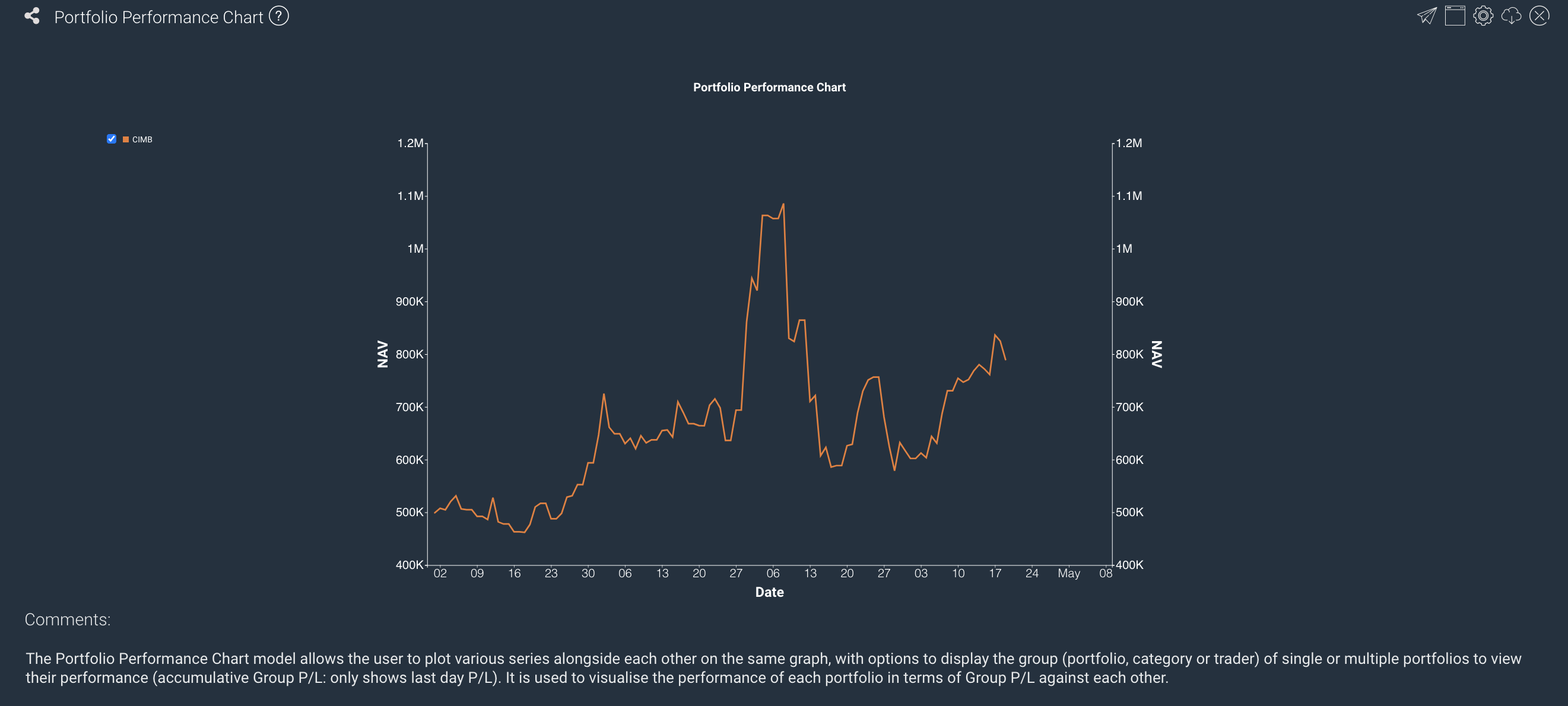

Portfolio Performance Chart交易组合业绩图标 | Allows the user to plot each portfolio’s series alongside each other on the same graph to visualise the performance of their P/L against each other.收益曲线图 | |

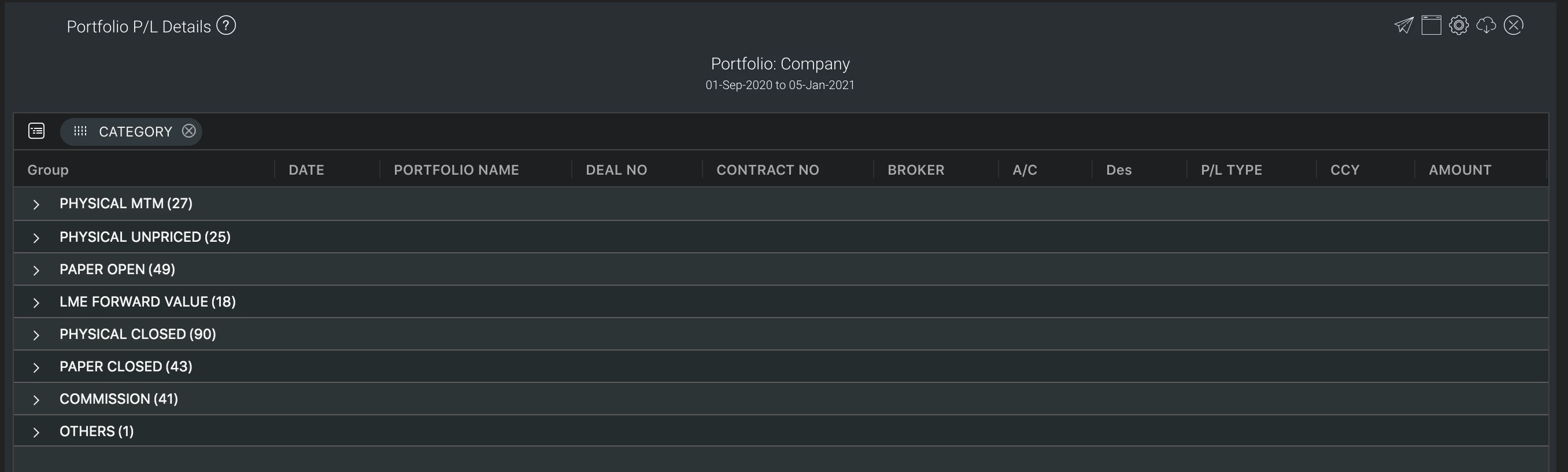

Portfolio P/L Details | Provides an overview of all paper and physical trades categorised according to their group (eg. Physical Closed, Paper Open), and their unrealised or realised P/L. You can select the cut-off date ('End Date') to determine your P/L for that period and the close/settlement date of each trade is crucial as it will determine which month/year's P/L it will belong to. | |

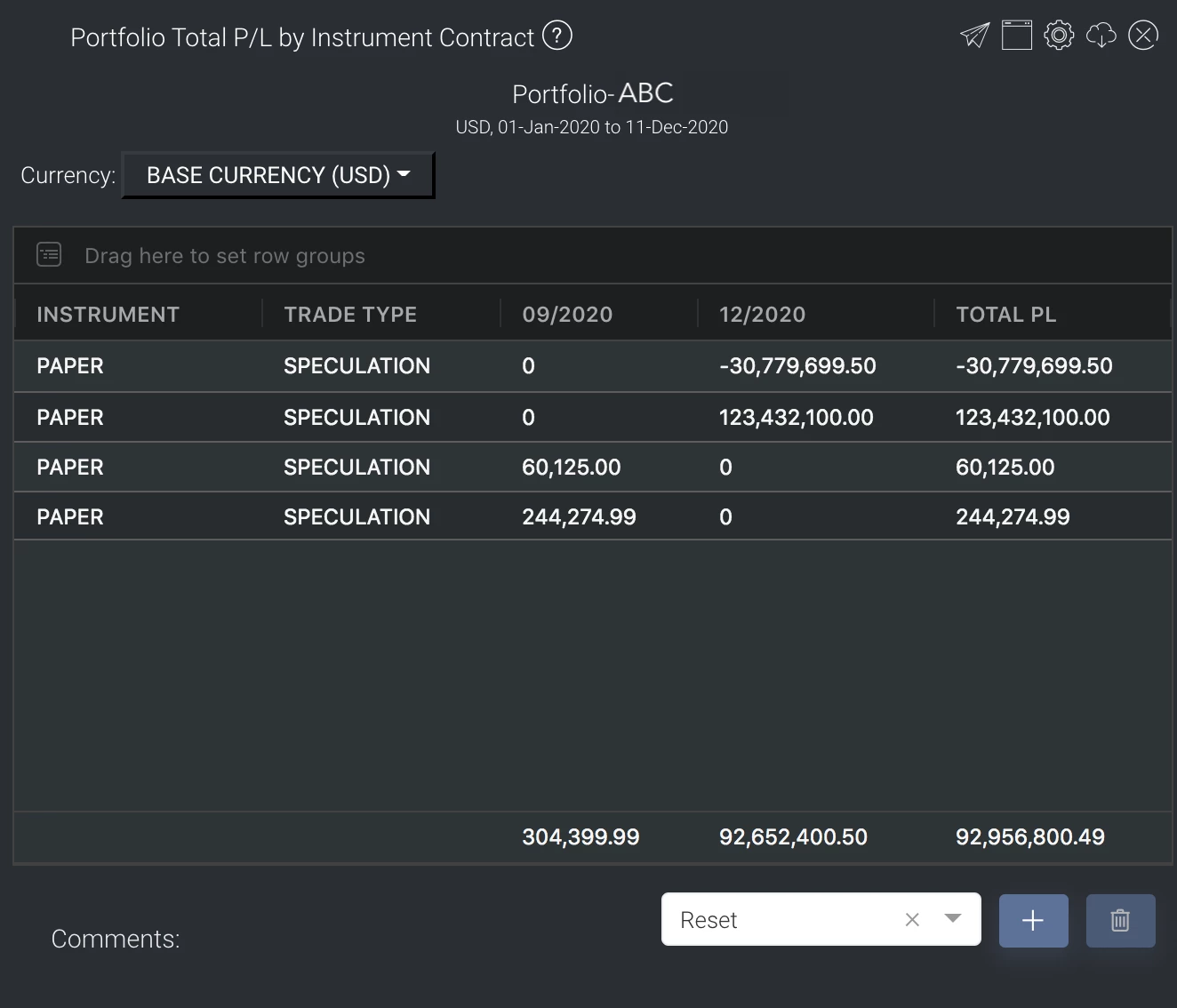

Portfolio Total P/L by Instrument Contract | Allows you to view, at a glance, the composition of assets within a portfolio and their financial positions (total P/L), according to their contract month and year - this includes both open and closed positions. | |

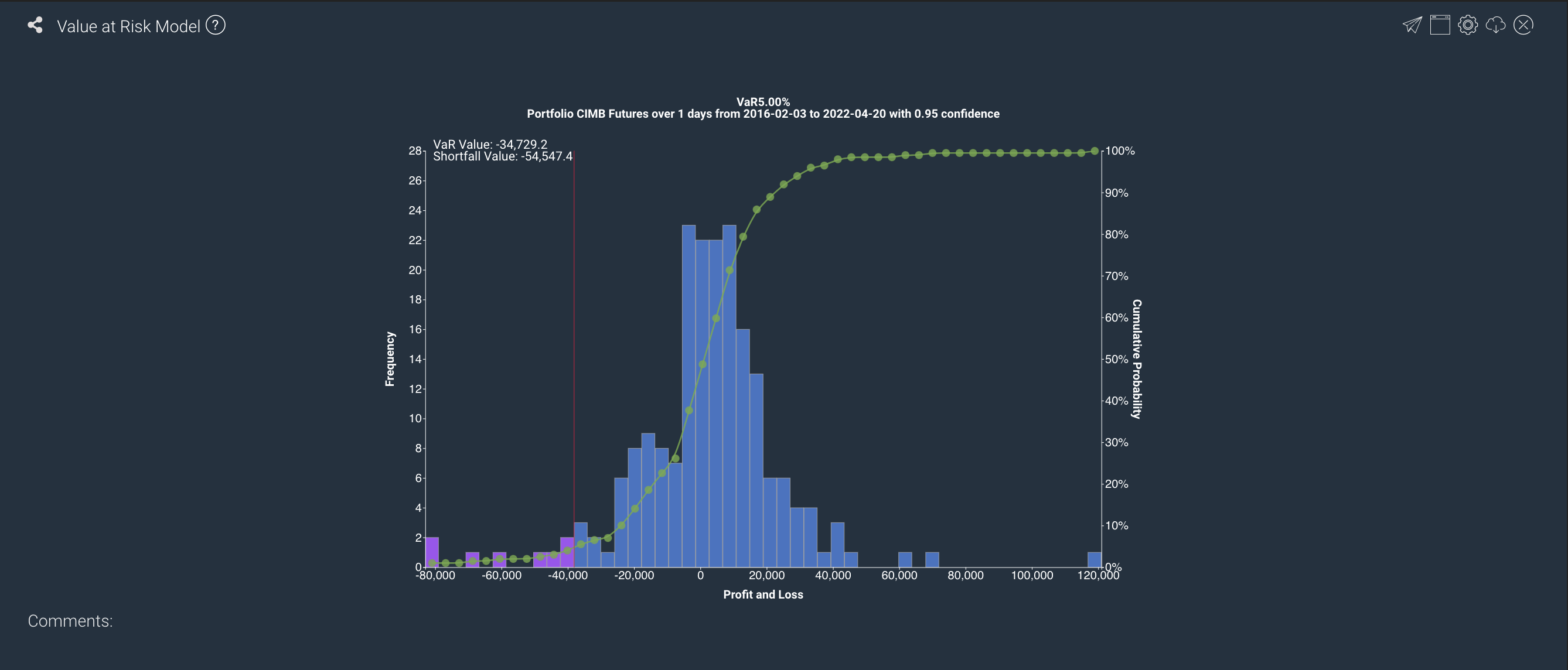

Value-at-Risk Model | Allows you to determine the measure of the degree of risk a portfolio is exposed to, by calculating how much an investor might lose with his/her portfolio, given a certain probability, within a certain time period. |

...