Return to Overview

...

The Portfolio P/L Details Matrix provides an overview of all paper and physical trades categorised according to their group (eg. Physical Closed, Paper Open), and their unrealised or realised P/L. You can select the cut-off date ('End Date') to determine your P/L for that period and the close/settlement date of each trade is crucial as it will determine which month/year's P/L it will belong to.

The rows are the various categories of assets in the portfolio while the columns indicate product information such as contract date, portfolio name, deal number and unrealised or realised P/L. The table acts like a pivot table and can be categorised and organised by groups according to your needs. You can click here to learn how to customise the table by arranging and filtering the columns based on your preference, and saving the table layout(s) as a template. Also see Futures Contracts Codes for more information on exchange and month codes, if required.

Note: You can key in your own exchange rate in 'EX RATE' column and the 'BASE AMOUNT' will be calculated automatically based on your exchange rate . Please note that the exchange rate you keyed in is for your reference and will not be saved.

Exchange Rate for today will be updated at 8am daily.

...

Navigation

To access the quantitative model/report, click on 'Dashboard' from the navigation sidebar on the left.

...

There will be a case when the user wants to standardise the date when they trade spread trading (e.g., BUY SHANGHAI COPPER and Sell COMEX COPPER in night session). In broker statements, SHANGHAI COPPER is shown in 08 Dec 2021 and COMEX COPPER is shown in 07 Dec 2021. So once you tick "EXCL T PLUS", and End Date is 07 Dec 2021, then COMEX COPPER trade will be filtered out and portfolio P/L and positions will be recalculated.

New columns added:

- Trader before Category

Add VAT column (增值税) after Amount

UC TAX 城建税

after BASE AMOUNT

EE TAX 教育附加税

after UC TAX

STAMP DUTY 印花税

after EE TAX

NET AMOUNT 纯利润

after EE TAX

BASE NET AMOUNT 结算纯利润

after NET AMOUNT

= net_amt * ex_rate

Value should be exactly the same as Net Amount if ex rate is 1

all enable group sum and in summary row.

EE TAX, UC TAX, STAMP DUTY TAX calculation logic:

There are only two types of data that may have EE TAX, UC TAX, STAMP DUTY TAX:

Physical trade rows (MTM, priced in, closed, open…)

as long as physical trade has tax rate, then it must have EE TAX, UC TAX

only positive amount and tax rate will have STAMP DUTY TAX

Others (from General Ledger table only, we do not support exp/inc table from now on)

as long as GL row has tax rate, then it must have EE TAX, UC TAX

Only positive amount and tax rate and row with contract no. will have STAMP DUTY TAX

...

To revert the exchange rate back to default, you can delete the row by clicking on the red 'bin' button. Click 'Save' to save the changes. Your exchange rate in the model will be adjusted accordingly.

To save the exchange rate or price for the trades, you can input your own Exchange Rate in the trade execution page page, and it will replace the system’s exchange rate and provide calculations accordingly in Portfolio P/L Details model and other related functions eg portfolio.

Settlement Price

Click on the blue '+' button to add a new row. Select the product from the drop-down list and key in the settlement price. You may add multiple rows to adjust multiple settlement price.

...

Name | Images/Description |

|---|---|

Portfolio | Select a portfolio of interest. Tick "UN PL SETTLEMENT" if you want to bring over the unrealised P/L from the previous period. For example, if the previous unrealised P/L is "40,000", if you bring it over to the current period, PREVIOUS SETTLED UNPL will be reflected as "-40,000". |

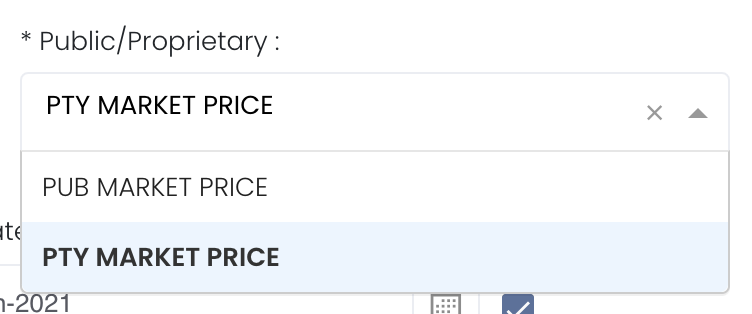

Select public market data or proprietary market data to determine the market data prices used to calculate the P/L or positions accordingly. Please note that if the proprietary (private) market data for certain dates are not input here eg 1 May to 10 May price is input but not 9 May, when you select private data when viewing the portfolio and using the models in Dashboard (eg for trades with trade date on 9 May but private data is not available), the system will use the latest date's settlement price (10 May) to perform the calculations. Please note that if public market data is not available, system will display as PROP instead, even if PROP data is not available. | |

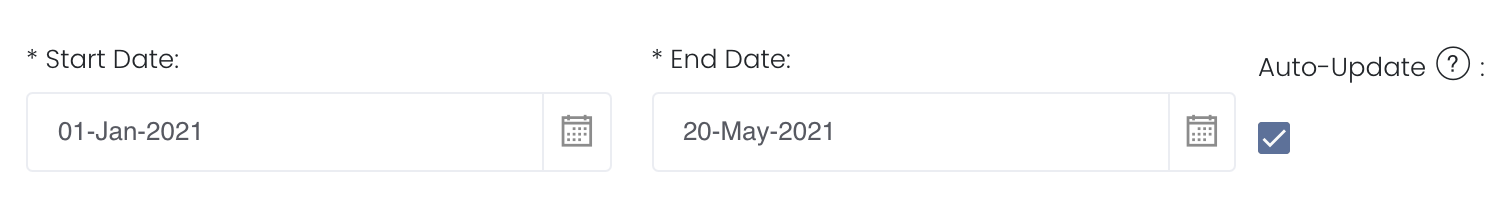

Duration | Select the start and end date to determine the range of period and cut-off date for the calculations of P/L. Start Date will be the start of the year (eg 1 Jan 2020) by default. End Date will be today's date by default. You are fill free to edit the dates as necessary. Auto-Update Tick: Resets the dates to default once you leave the ‘Dashboard’ page. Untick: Dates according to your settings remain unchanged once you leave the ‘Dashboard’ page. |

| Excl T Plus | Tick: Exclude all trades with "T PLUS" (eg T+1) and portfolio P/L and positions will be recalculated Untick: Include all trades with "T PLUS" (eg T+1) and portfolio P/L and positions will be recalculated |

Comments | The inserted comments will be displayed at the bottom of the application. This can be useful for documentation purposes or for settings description. |

...