Commodity trading by default requires constant settlements between parties and the process of recording all the payment details may be tedious and complex. With MAF Cloud, transacting with counterparties are make more convenient and effective as information from the transactions can be easily recorded and with much clarity. From providing an overview of the payment records to settling outstanding payments, it creates a structured system for you to track and be notified of your company's finances (inflows and outflows). This allows you and your team to have better visibility of your company's position which is crucial in planning for the optimal trading strategies and improving the profitability of your business.

Main features and benefits:

...

To delete a bank details record, tick the checkbox of the row and click on the 'Delete Row' button located above the table. You may also select multiple rows to delete.

Please refer to Accounting List of Definitions for the definitions of the fields.

...

2. PAYMENT RECORDS

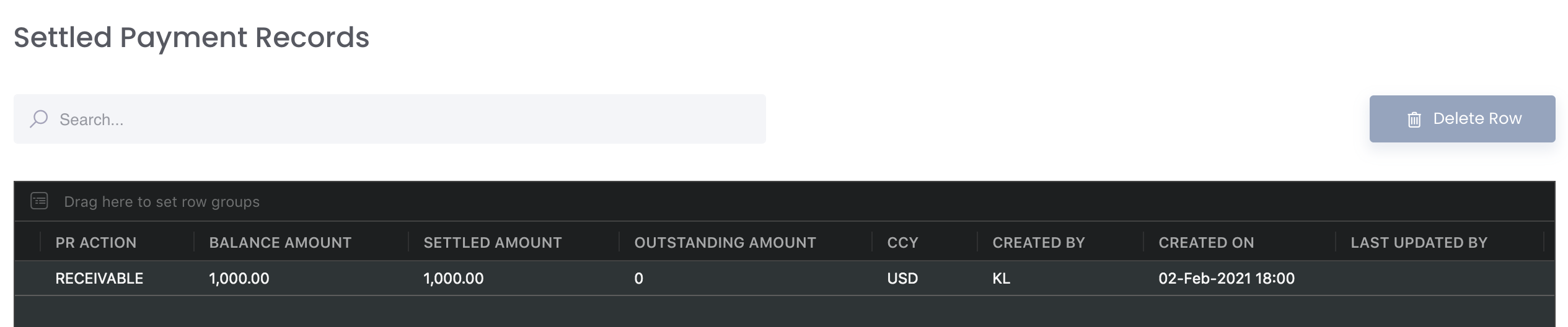

This section is exactly the same as the Payment Records tab in Physical Trades. This tab is included in the Accounting page to allow the Accounts/Finance team to access the outstanding and settled payment records directly in the form of stored invoices, which can be generated in the EXPENSES & INCOMES TAB. Newly created payment records will be displayed in either the Outstanding Payment Records or Settled Payment Records table.

...

To edit the payment record, click on the 'Edit' button (represented by a 'pen and paper' icon) located on the left of each row. To delete a payment record, tick the checkbox of the row and click on the 'Delete Row' button located above the table. You may also select multiple rows to delete.

...

For the 'SETTLED AMOUNT' to be filled, the Accounts/Finance team can input the received/paid amount in 'Bank Transaction' table under the 'Accounting' section and allocate to the invoice. Click here to learn more.

Please refer to Accounting List of Definitions for the definitions of the fields.

...

3. BANK TRANSACTION

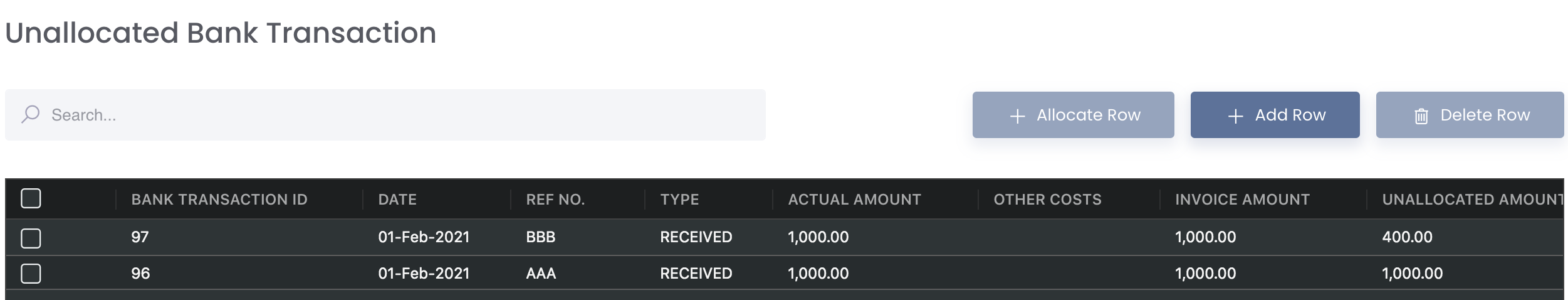

This section allows you to allocate received/paid bank transaction amount (actual amount received or paid by/from your company's bank accounts) directly to settle each invoice for the closure of the deal. This function allows your management and team to know which deals have been fully settled in payment, otherwise, necessary actions can be undertaken.

...

You will be redirected to this table once you click 'Allocate Row' for a bank transaction in the 'Unallocated Table' section.

In this table, double click the field under 'ALLOCATE TO' column (highlighted in red) and select the invoice that you want to allocate your bank transaction into. Scroll to the right of the table to view the 'ALLOCATED AMOUNT' as well as the details of the invoice that you have selected, which will be reflected automatically.

...

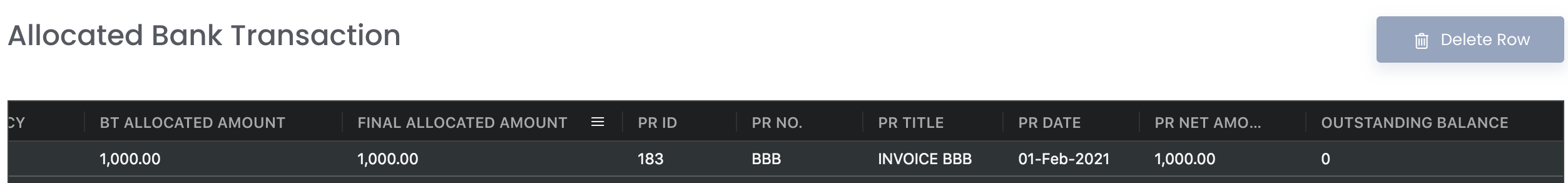

Selecting the invoice from the drop-down list will automatically input the 'BT ALLOCATED AMOUNT' column with the paid/received bank transaction amount that you want to allocate to the invoice (from the Unallocated Bank Transaction Table).

There are 3 scenarios to consider:

1. If the bank transaction amount (to be allocated to the invoice) eg USD 1,000 is exactly the same as the invoice amount eg USD 1,000, the 'ALLOCATED AMOUNT' column will be USD 1,000, as this reflects the invoice amount that has yet to be settled, so USD 1,000 from the bank transaction amount will be allocated to settle the invoice of USD 600. You can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column of the invoice becomes 0, indicating that the invoice will be settled once this bank transaction amount has been allocated successfully.

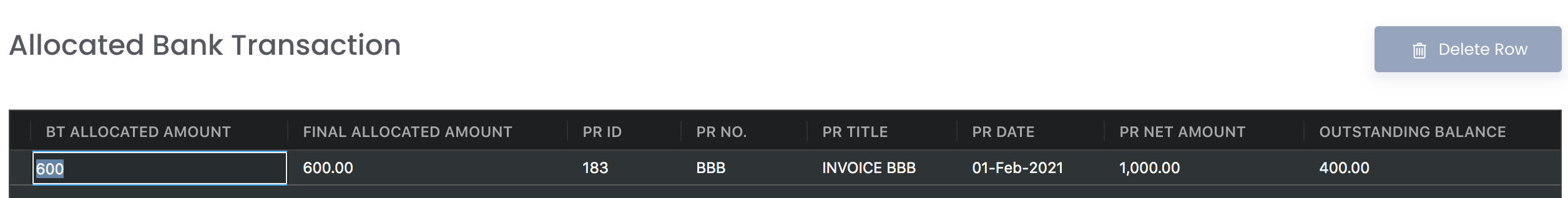

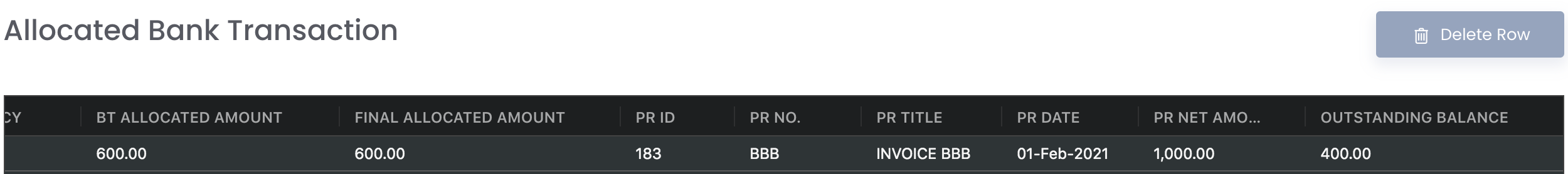

- Note: Although all the fields are auto-filled, you are free to edit the 'BT ALLOCATED AMOUNT' column to indicate any amount to allocate to the invoice (allocate partial amount) eg allocate 600 instead of the full 1,000. In this case, you can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column eg 1000 (invoice amount) - 600 (allocated partial amount) = 400 (outstanding amount), indicating that the invoice still has an outstanding balance of 400 and is not settled as only a partial amount of this bank transaction amount (600) has been allocated successfully. On the other hand, the remaining unallocated partial amount (400) after you have edited the 'BT ALLOCATED AMOUNT' column (allocate partial amount of 600 instead of 1,000) will remain in the 'UNALLOCATED AMOUNT' column in the Unallocated Bank Transaction Table, which will reflect the unallocated bank transaction amount available to be allocated to other invoice to settle the payment fully.

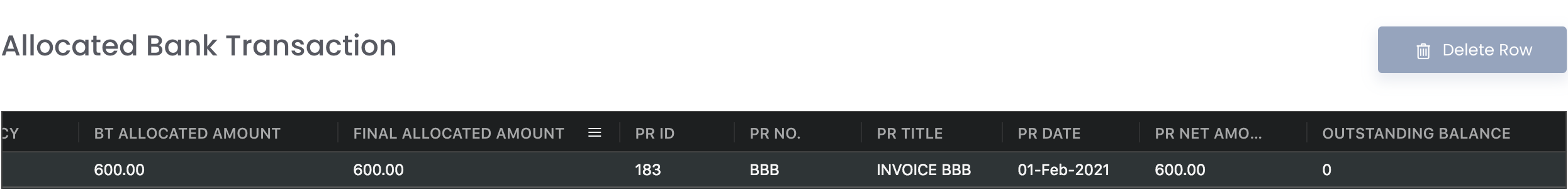

2. If the bank transaction amount (to be allocated to the invoice) eg USD 1,000 is more than the invoice amount eg USD 600, the 'ALLOCATED AMOUNT' column will be USD 600, as this reflects the invoice amount that has yet to be settled, so only USD 600 from the bank transaction amount will be required to settle the invoice of USD 600. You can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column of the invoice becomes 0, indicating that the invoice will be settled once this bank transaction amount has been allocated successfully.

- Note: Although all the fields are auto-filled, you are free to edit the 'BT ALLOCATED AMOUNT' column to indicate any amount to allocate to the invoice (allocate partial amount) eg allocate 600 instead of the full 1,000. In this case, you can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column eg 1000 (invoice amount) - 600 (allocated partial amount) = 400 (outstanding amount), indicating that the invoice still has an outstanding balance of 400 and is not settled as only a partial amount of this bank transaction amount (600) has been allocated successfully. On the other hand, the remaining unallocated partial amount (400) after you have edited the 'BT ALLOCATED AMOUNT' column (allocate partial amount of 600 instead of 1,000) will remain in the 'UNALLOCATED AMOUNT' column in the Unallocated Bank Transaction Table, which will reflect the unallocated bank transaction amount available to be allocated to other invoice to settle the payment fully.

3. If the bank transaction amount (to be allocated to the invoice) eg USD 600 is less than the invoice amount eg USD 1000, the 'ALLOCATED AMOUNT' column will be USD 600, as this reflects the maximum bank transaction amount that can be used to settle the invoice amount. You can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column of the invoice become USD 400, indicating that the invoice has not been settled yet and will require another bank transaction amount to be allocated to settle it fully.

...

The 'FT ALLOCATED AMOUNT' will automatically be filled according to the 'BT ALLOCATED AMOUNT' value.

To settle an outstanding payment record, the respective row in the 'Unallocated Bank Transaction' table has to be allocated to the respective invoices. The payment details in the 'Payment Records' tab will appear settled once Outstanding Amount=0 , i.e. Balanced amount = Settled amount.

Note: To unallocate/delete the allocated bank transaction row, tick the checkbox of the row and click on the 'Delete Row' button located above the table. You may also select multiple rows to delete. Once the bank transaction rows have been deleted in the 'Allocated Bank Transaction' table, they will return back to the 'Unallocated Bank Transaction' table for reallocation. On the other hand, deleting the rows in the 'Unallocated Bank Transaction' table will delete the transactions permanently.

There are 4 scenarios to consider:

1. If the bank transaction amount (to be allocated to the invoice) eg USD 1,000 is exactly the same as the invoice amount eg USD 1,000, the 'ALLOCATED AMOUNT' column will be USD 1,000, as this reflects the invoice amount that has yet to be settled, so USD 1,000 from the bank transaction amount will be allocated to settle the invoice of USD 600. You can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column of the invoice becomes 0, indicating that the invoice will be settled once this bank transaction amount has been allocated successfully.

- Note: Although all the fields are auto-filled, you are free to edit the 'BT ALLOCATED AMOUNT' column to indicate any amount to allocate to the invoice (allocate partial amount) eg allocate 600 instead of the full 1,000. In this case, you can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column eg 1000 (invoice amount) - 600 (allocated partial amount) = 400 (outstanding amount), indicating that the invoice still has an outstanding balance of 400 and is not settled as only a partial amount of this bank transaction amount (600) has been allocated successfully. On the other hand, the remaining unallocated partial amount (400) after you have edited the 'BT ALLOCATED AMOUNT' column (allocate partial amount of 600 instead of 1,000) will remain in the 'UNALLOCATED AMOUNT' column in the Unallocated Bank Transaction Table, which will reflect the unallocated bank transaction amount available to be allocated to other invoice to settle the payment fully.

2. If the bank transaction amount (to be allocated to the invoice) eg USD 1,000 is more than the invoice amount eg USD 600, the 'ALLOCATED AMOUNT' column will be USD 600, as this reflects the invoice amount that has yet to be settled, so only USD 600 from the bank transaction amount will be required to settle the invoice of USD 600. You can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column of the invoice becomes 0, indicating that the invoice will be settled once this bank transaction amount has been allocated successfully.

- Note: Although all the fields are auto-filled, you are free to edit the 'BT ALLOCATED AMOUNT' column to indicate any amount to allocate to the invoice (allocate partial amount) eg allocate 600 instead of the full 1,000. In this case, you can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column eg 1000 (invoice amount) - 600 (allocated partial amount) = 400 (outstanding amount), indicating that the invoice still has an outstanding balance of 400 and is not settled as only a partial amount of this bank transaction amount (600) has been allocated successfully. On the other hand, the remaining unallocated partial amount (400) after you have edited the 'BT ALLOCATED AMOUNT' column (allocate partial amount of 600 instead of 1,000) will remain in the 'UNALLOCATED AMOUNT' column in the Unallocated Bank Transaction Table, which will reflect the unallocated bank transaction amount available to be allocated to other invoice to settle the payment fully.

can only allocate 1 bank txn to 1 invoice even if partial

settled

To allocate a row, select the relevant transaction by checking its box on the left and clicking the '+ Allocate Row' button followed by selecting the specific payment details under the 'Allocate To' column (highlighted in red). The transaction will be reflected as an allocated bank transaction on the 'Allocated Bank Transaction' table.

To settle an outstanding payment record, the respective row in the 'Unallocated Bank Transaction' table has to be allocated to the respective payment details. The payment details in the 'Payment Records' tab will appear settled once Outstanding Amount=0, i.e. Balanced amount = Settled amount.

To delete a row, tick the checkbox of the row and click on the 'Delete Row' button located above the table. You may also select multiple rows to delete. 3. If the bank transaction amount (to be allocated to the invoice) eg USD 600 is less than the invoice amount eg USD 1000, the 'ALLOCATED AMOUNT' column will be USD 600, as this reflects the maximum bank transaction amount that can be used to settle the invoice amount. You can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column of the invoice become USD 400, indicating that the invoice has not been settled yet and will require another bank transaction amount to be allocated to settle it fully.

- Note: Although all the fields are auto-filled, you are free to edit the 'BT ALLOCATED AMOUNT' column to indicate any amount to allocate to the invoice (allocate partial amount) eg allocate 600 instead of the full 1,000. In this case, you can scroll right to the end of the table to view the 'OUTSTANDING BALANCE' column eg 1000 (invoice amount) - 600 (allocated partial amount) = 400 (outstanding amount), indicating that the invoice still has outstanding balance of 400 and is not settled as only a partial amount of this bank transaction amount (600) has been allocated successfully. On the other hand, the remaining unallocated partial amount (400) after you have edited the 'BT ALLOCATED AMOUNT' column (allocate partial amount of 600 instead of 1,000) will remain in the 'UNALLOCATED AMOUNT' column in the Unallocated Bank Transaction Table, which will reflect the unallocated bank transaction amount available to be allocated to other invoice to settle the payment fully.

4. When you want to allocate net bank transaction amount (received/paid net amount after offsetting 2 invoices eg 1 received and 1 paid) into the invoices, you can allocate the rows as per normal and select the payable/receivable invoice accordingly. You will be required to adjust the 'BT ALLOCATED AMOUNT' accordingly so the 'OUTSTANDING BALANCE' will be reflected as 0.

Please refer to Accounting List of Definitions for the definitions of the fields.

...

Click to access:

| Page Tree |

|---|