| Table of Contents |

|---|

Options contract can now be automatically captured when you upload your daily statements! They can be allocated into various portfolios and generated in customisable reports/models (along with other paper and physical trades) to analyse and calculate their performance automatically according to your requirements.

All options products contract can be found in Product Data>View Product Data from the navigation sidebar on the left.

Step 1: How to Create New Paper Trade to Link to Own Options

...

Contract

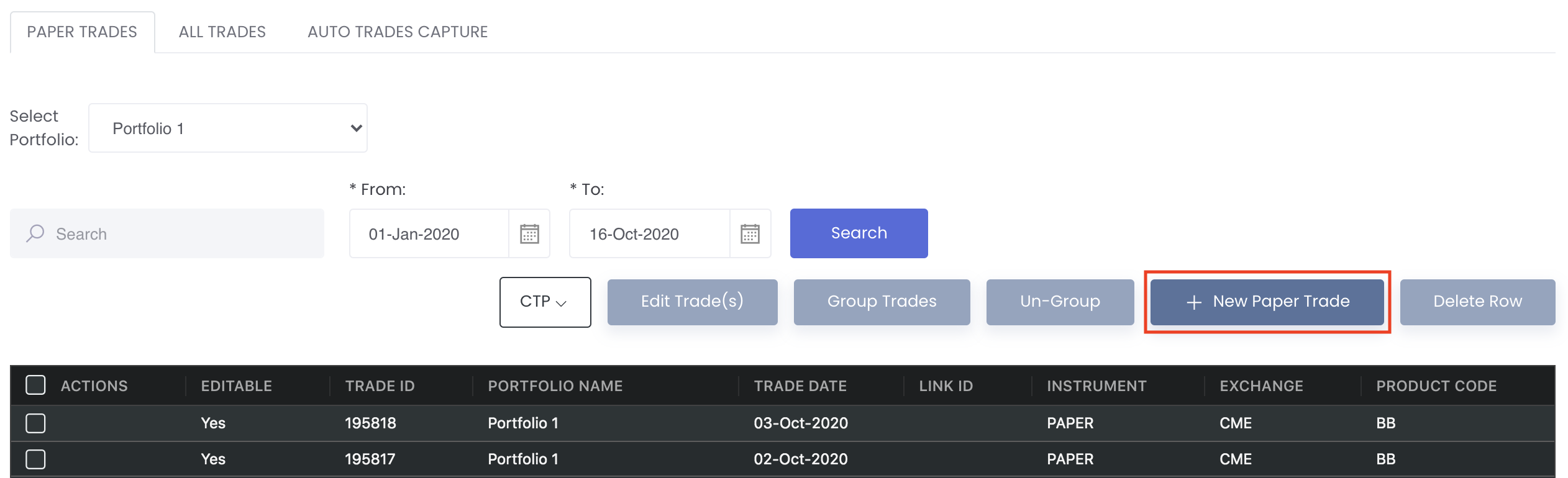

Click on “Trade” from the navigation sidebar on the left, followed by “Paper Trade”.

...

2. Click on “+ Paper Trade” to create a new paper trade to add options contract.

3. Fill in the paper trade details and select your options product contract under “MAF PRODUCT ID”. Alternatively, you may hover over the “…” button on the top right corner and click on “CTP Position” to upload your file.

...

Click on “Submit” at the bottom left corner of the page to save your paper trade.

...

Step 2: How to Add Proprietary Market Data Price to Options Contract

1. If you do not want to use public settlement price (obtained from various Exchange sources) to calculate the P/L for your option tradescontract, you may choose to add your own settlement price to your options productcontract.

Click on “Market Data” from the navigation sidebar on the left, followed by “Proprietary Market Data”.

...

2. Click “Add Row” to add proprietary market data price to your own options productcontract. You can also click “Download Template” to download an Excel template to pre-fill the data before uploading into the table.

You can select/input your own options product contract under “Code” (created in Step 2) and other details such as Settlement Price (under “SETTLEMENT”).

...

1. In the “View Paper Trades” page, you may allocate your trades option contracts to your desired portfolio(s) by ticking the checkbox of the trades and clicking on “Allocate Portfolio”.

...

Select the portfolio to allocate the trades options contract into and click on “Save Portfolio” once done.

...

These reports/models support options products contracts and will include “C/P” and “Strike” columns:

...